India Insurance Market Size, Share, Trends, Industry Analysis, Report 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Insurance Market- India

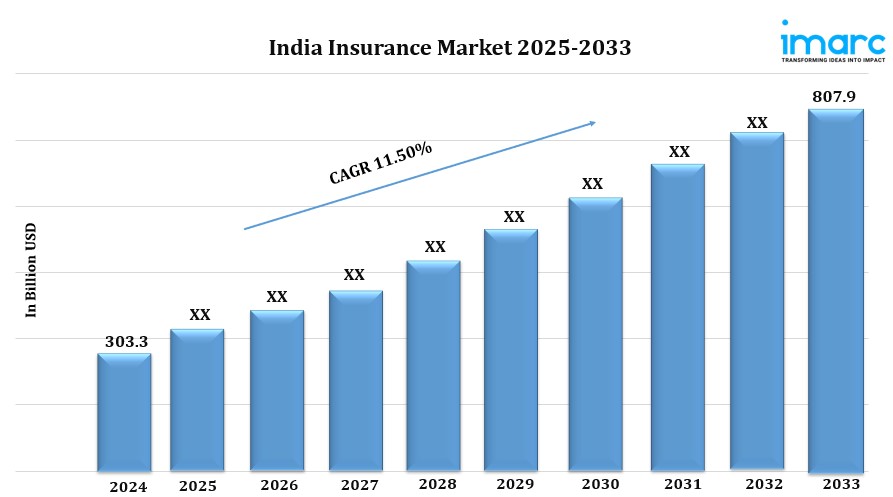

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Growth Rate: 11.50% (2025-2033)

Market Size in 2024: USD 303.3 Billion

Market Size in 2033: USD 807.9 Billion

The India insurance market is expanding with growing demand for life, health, and general insurance products, driven by urbanization. According to the latest report by IMARC Group, the market size reached USD 303.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 807.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033.

India Insurance Market Trends and Drivers:

- Rising Awareness of Financial Security: Increased financial literacy and awareness drive demand for insurance products across sectors.

- Demand for Life and Health Insurance: Growing disposable incomes and a rising middle class fuel demand for life and health coverage.

- Government Initiatives: Programs like Ayushman Bharat and Pradhan Mantri Jeevan Jyoti Bima Yojana promote insurance penetration in rural and urban areas.

- Shift from Traditional Savings to Insurance: More individuals are turning to insurance as a means of risk protection and wealth creation.

- Impact of the Pandemic: The COVID-19 pandemic highlighted the importance of health coverage, leading to a surge in demand for comprehensive health insurance policies.

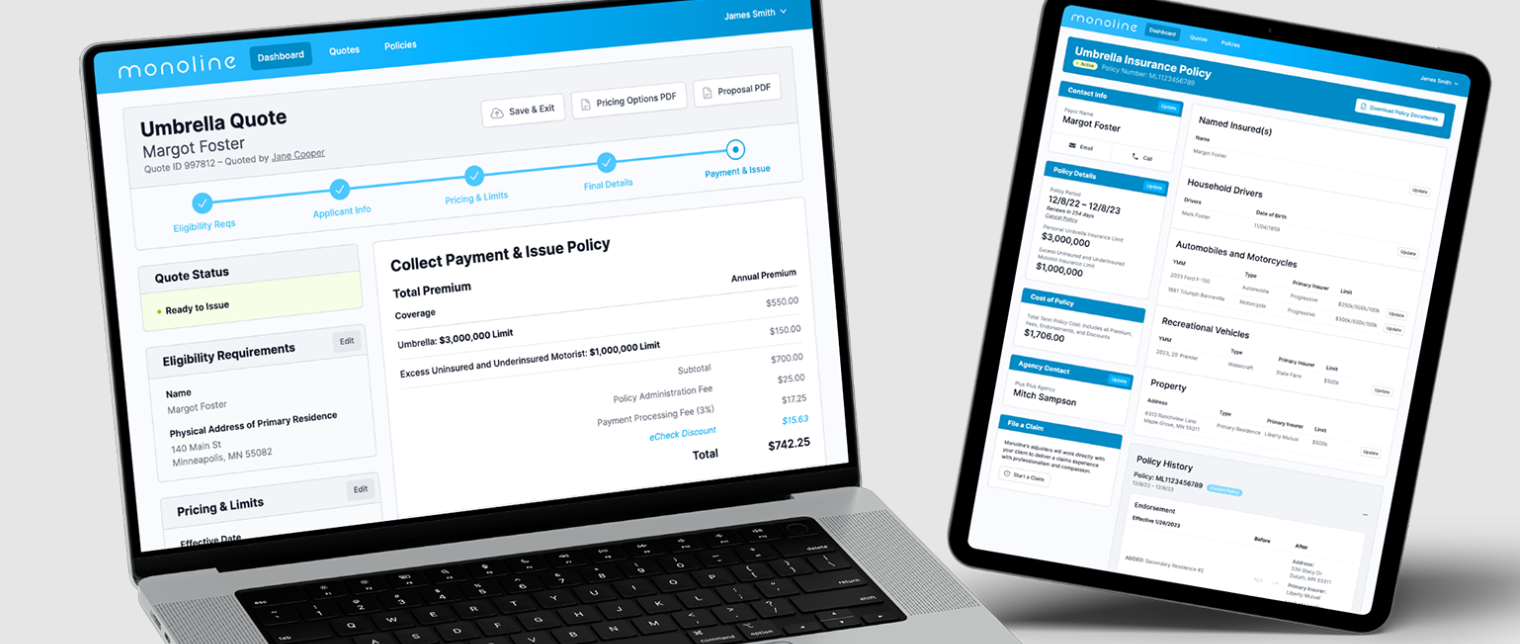

- Digital Transformation: Online policy purchases and digital claims processing improve accessibility, streamline processes, and enhance customer experience.

- Technological Advancements: AI-powered chatbots, data analytics, and blockchain help optimize operations, improve fraud detection, and enable product personalization.

- Growth of Micro and Usage-based Insurance: These policies cater to specific needs, offering affordable coverage for low-income groups.

- Expansion in Non-Life Insurance Segments: Increasing vehicle ownership and real estate development drive growth in motor and property insurance.

- Regulatory Reforms: The Insurance Regulatory and Development Authority of India (IRDAI) promotes competition and innovation, accelerating sector growth.

- Future Prospects: With a digitally savvy population and increased financial awareness, the India insurance market is set to evolve and offer diverse solutions to meet changing consumer needs.

India Insurance Market Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India insurance market size. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Breakup by Type of Product:

- Life Insurance

- General Insurance

- Health Insurance

- Motor Insurance

- Home Insurance

- Liability Insurance

- Others

Breakup by Distribution Channel:

- Online

- Offline

Breakup by End User:

- Corporate

- Individual

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.