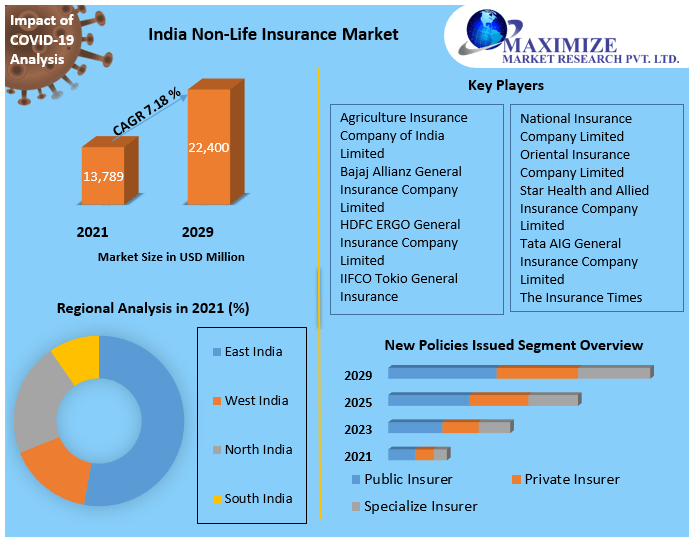

India Non-Life Insurance Market Growth: Expanding at a 7.18% CAGR

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Detailed and insightful market overview for the India NonLife Insurance Market focusing on the market size, growth trends, significant drivers and challenges, emerging opportunities, and key players:

✍️ If you’re unsure whether to buy online or offline, our post on buying life insurance online highlights the advantages of digital policies, instant approvals, and lower costs.

The India NonLife Insurance Market report provides insights into a certain market segment by combining data from primary and secondary research. It covers the years 2024–2030 and combines quantitative and qualitative analysis to provide a thorough understanding of the sector. Market segmentation makes it possible to thoroughly analyze the India NonLife Insurance sector from a variety of angles. The India NonLife Insurance market research paper provides stakeholders with important insights into the market landscape and prospects through the careful consideration of detailed forecasts, advancements, and revenue forecasts.

The Explosive Growth Trajectory of the India NonLife Insurance Market:

India Non-Life Insurance Market was valued at US$ 13, 7889 Mn. in 2021 and is expected to grow at US$ 22,400 Mn. in 2029. India Non-Life Insurance Market size is expected to grow at a CAGR of 7.18 % through the forecast period.

Grab Your Exclusive Sample Copy of the Report Now: https://www.maximizemarketresearch.com/request-sample/42091/

In-depth analysis of the market scope and research methodology for the emerging sector of India NonLife Insurance Market:

A vibrant and expanding segment of the food and cosmetics industries is the India NonLife Insurance market. The evaluation of the India NonLife Insurance Market was conducted using a diverse research methodology. India NonLife Insurance Market research specialists collect information from both primary and secondary sources. To learn more about market trends, customer preferences, and product demand, primary research involves speaking with manufacturers, suppliers, consumers, and industry experts directly. Interviews, focus groups, and surveys are typical primary research methods. Analyzing data that has already been collected from reliable sources, like government organizations, industry publications, market studies, and scholarly journals, is known as secondary research. This aids in comprehending competitive analysis, regulatory frameworks, and past India NonLife Insurance market patterns. The collected data is interpreted using statistical modeling and other data analysis techniques.

India NonLife Insurance Geographical segmentation is also taken into account by the market research approach, which looks at regional differences in customer preferences and market dynamics. It considers variables that affect India NonLife Insurance consumption, including the climate, cultural influences, and economic circumstances. By integrating primary and secondary research, data analysis, and geographical evaluation, a maximized market research methodology guarantees a thorough and trustworthy understanding of the India NonLife Insurance Market and offers useful insights for companies, stakeholders, and decision-makers in these sectors.

Key Regional Trends and Opportunities in the India NonLife Insurance Market:

The India NonLife Insurance market report provides comprehensive coverage of regions including North America, Europe, Asia Pacific, South America, and the Middle East&Africa. It offers insights into the market trends prevalent in these regions, allowing stakeholders to understand the dynamics shaping the India NonLife Insurance industry landscape. Moreover, the report conducts a detailed analysis of India NonLife Insurance market size and share within the India NonLife Insurance industry, offering valuable data and statistics for informed decision-making. Analysis helps businesses and investors gauge the competitive landscape and identify growth opportunities.

Unlock In-Depth Insights! Explore the Full Research with Just One Click: https://www.maximizemarketresearch.com/request-sample/42091/

Unlocking Growth: Exploring the Dynamic Segmentation of the India NonLife Insurance Market:

by Product

• Motor insurance

• Health insurance

• Fire insurance

• Marine insurance

• Others

by New Policies Issued

• Public insurer

• Private insurer

• Specialize insurer

by Distribution Channel

• Individual agents

• Corporate agents - banks

• Corporate agents - others

• Brokers

• Direct business

• Others

Based on products, Motor insurance has the highest market share in 2021. Significant increase in automotive demand and the requirement of motor insurance across India. The report conducts an in-depth segment analysis of India's non-life insurance market, giving important insights at both macro and local levels. It provides coverage for listed damage and destruction to the vehicle caused by floods, earthquakes, typhoons, and other natural disasters. It also covers vehicle damage and destruction caused by theft, burglary, strikes, or riots. The cover protects the car's owner/driver and co-passengers as they travel. The coverage also applies to damage and destruction caused while mounting or dismounting from the car.

Table of Content: India NonLife Insurance Market

Part 01: Executive Summary

Part 02: Scope of the India NonLife Insurance Market Report

Part 03: Global India NonLife Insurance Market Landscape

Part 04: Global India NonLife Insurance Market Sizing

Part 05: Global India NonLife Insurance Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Dive Deeper into the Data! Explore the Full Study on Our Webpage Now: https://www.maximizemarketresearch.com/request-sample/42091/

Industry Leaders in Focus:

• Agriculture Insurance Company of India Limited

• Bajaj Allianz General Insurance Company Limited

• HDFC ERGO General Insurance Company Limited

• ICICI Lombard General Insurance Company Limited

• IIFCO Tokio General Insurance

• National Insurance Company Limited

• Oriental Insurance Company Limited

• Star Health and Allied Insurance Company Limited

• Tata AIG General Insurance Company Limited

• The New India Assurance Company Limited

• The Insurance Times

• ICICI Bank

• Mahindra Insurance Brokers Limited

• Royal Sundaram General Insurance Co. Limited

• Universal Sompo General Insurance Co. Ltd.

Got Questions? Reach Out Now for Expert Insights and Market Scope Exploration: https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/

Your Ultimate Guide: Key Questions Answered in the Latest Market Report:

What is India NonLife Insurance?

What is the India NonLife Insurance Market's forecast period?

How is the India NonLife Insurance market's competitive situation?

What are the main forces behind the India NonLife Insurance market's expansion?

What is the largest market share in the India NonLife Insurance region?

In the India NonLife Insurance market, which segment became the dominant one?

During the forecast period, which major trends are most likely to emerge in the India NonLife Insurance market?

What prospects does the India NonLife Insurance Market have?

Which companies dominate the India NonLife Insurance market?

Which are the India NonLife Insurance industry players' primary growth strategies?

Discover the Game-Changers:

Market Share, Size & Forecast by Revenue | 2024−2030

Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

PESTLE Analysis and PORTER’s Five Forces Analysis

Market Segmentation – A detailed analysis of segments and sub-segments

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Key Findings and Analyst Recommendations

Elevate your knowledge base with the most recent research trends curated by Maximize Market Research:

Configuration Management Market https://www.maximizemarketresearch.com/market-report/global-configuration-management-market/62980/

Petroleum Jelly Market https://www.maximizemarketresearch.com/market-report/petroleum-jelly-market/71870/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 9607195908, +91 9607365656

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.