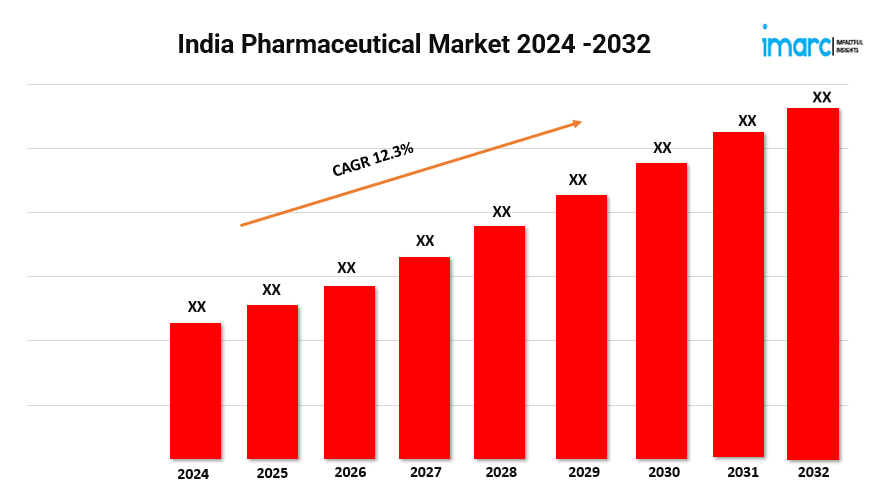

India Pharmaceutical Market Size, Trends, Share, Demand & Outlook 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

India Pharmaceutical Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 12.3% (2024-2032)

The rising number of initiatives aimed at improving healthcare infrastructure, increasing access to affordable medicines, and promoting domestic manufacturing by the governing body are supporting the market growth of pharmaceutical industry in India. According to the latest report by IMARC Group, The India pharmaceutical market size reached US$ 54.6 Billion in 2023. Looking forward, the market to reach US$ 163.1 Billion by 2032, exhibiting a growth rate (CAGR) of 12.3% during 2024-2032.

India Pharmaceutical Industry Trends and Drivers:

The India pharmaceutical market is expanding rapidly, owing to the growing focus on enhancing health infrastructure as well as the need for more affordable healthcare. Besides this, the market is also supported by several initiatives by government authorities, like "Make in India," which promotes domestic pharmaceutical manufacturing. Additionally, the surge in lifestyle diseases such as diabetes, hypertension, and cardiovascular disorders is boosting demand for a wide range of pharmaceutical products. In line with these factors, the India pharmaceutical market has also benefited from the increased healthcare awareness following the COVID-19 pandemic, leading to a stronger focus on preventive medicine and vaccines. Moreover, the growing population, coupled with expanding access to health insurance, is further stimulating market expansion.

The rapid adoption of cutting-edge technologies like biotechnology and nanotechnology for the development of highly effective therapies is one of the major trends in the India pharmaceutical market. In addition to these factors, pharmaceutical companies are spending more money on research and development (R&D) to produce new treatments, especially for autoimmune disorders and cancer. Meanwhile, generic drug manufacturing remains a significant component, with India being a global leader in this segment. Consequently, the rising demand for online pharmacies and the increasing popularity of telemedicine are also reshaping the pharmaceutical landscape, offering greater convenience to consumers. Meanwhile, efforts to produce sustainable and eco-friendly drugs are emerging as a priority, aligning with global environmental standards. Apart from this, the convergence of these factors is expected to propel the growth of the India pharmaceutical market in the coming years.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-pharmaceutical-market/requestsample

India Pharmaceutical Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

Breakup by Nature:

- Organic

- Conventional

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Abbott India Ltd (Abbott Laboratories)

- Aurobindo Pharma Limited

- Biocon Limited

- Cadila Pharmaceuticals Ltd.

- Cipla Ltd.

- Divi's Laboratories Limited

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline Pharmaceuticals Limited (GSK plc)

- Lupin Limited

- Mankind Pharma

- Merck Life Science Private Limited (Merck KGaA)

- Novartis India Limited (Novartis AG)

- Pfizer Healthcare India Pvt. Ltd. (Pfizer Inc.)

- Procter & Gamble Health Limited (The Procter & Gamble Company)

- Sun Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd. (Torrent Group)

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.