Is Dubai Real Estate Really a Safe Haven Asset? Everything You Need to Know

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

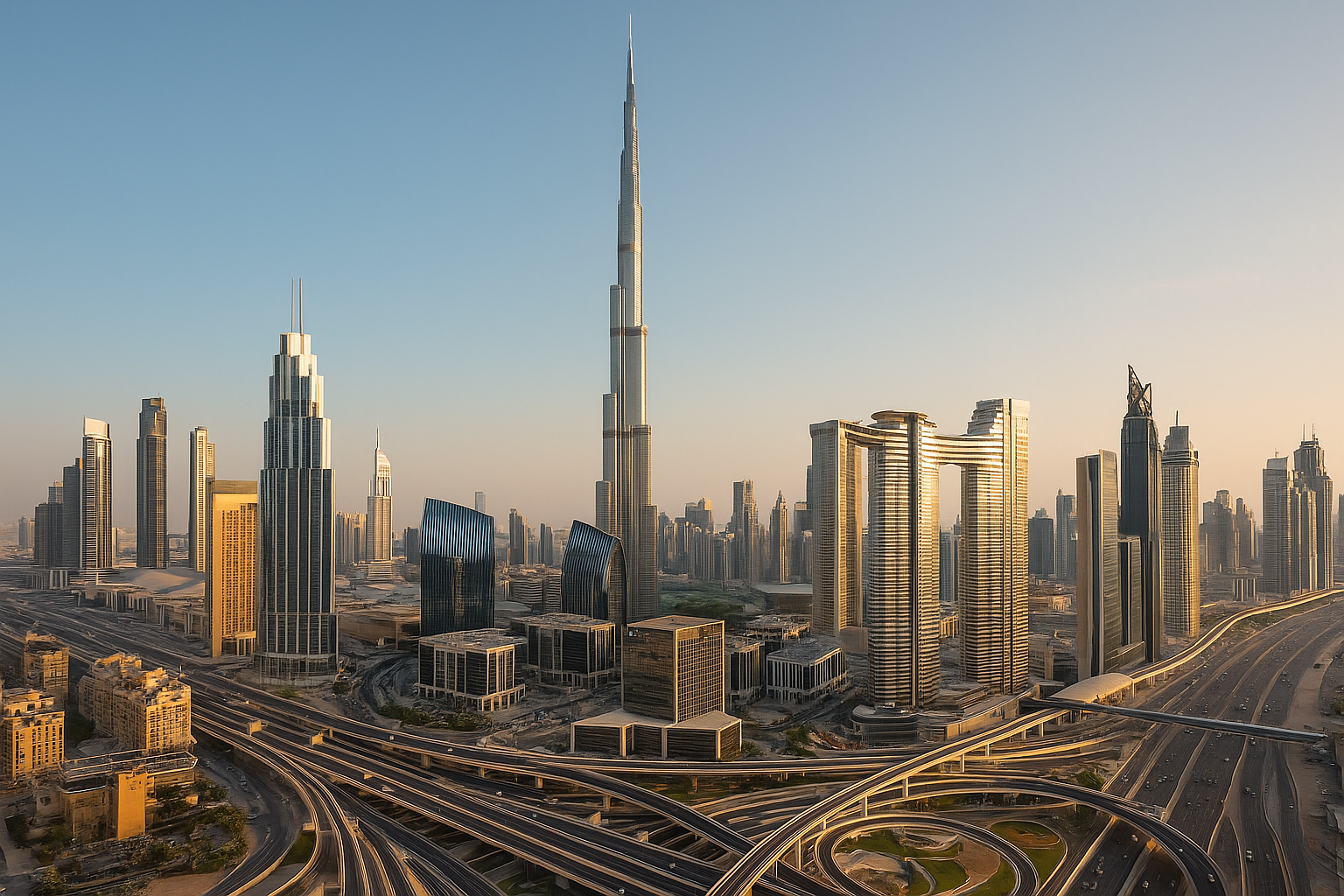

When markets wobble and uncertainty takes over, smart investors don’t just chase profits, they seek safety. Traditionally, that’s meant turning to gold, government bonds, or stable currencies. But a surprising new player is turning heads: Dubai real estate. Could this fast-growing market actually offer the kind of stability once reserved for the old guard of safe haven assets? Let’s break it down in simple terms.

What Makes an Asset a Safe Haven?

Before we dive into Dubai, let’s understand what we mean by a safe haven asset:

- Preserves value during economic downturns

- Offers long-term stability and predictable growth

- Backed by strong regulations and legal protection

- Remains in demand, even when global markets shake

Investors typically move their money into safe havens when traditional investments like stocks or crypto become too volatile.

How Dubai Measures Up as a Safe Haven

Let’s explore whether Dubai real estate checks the boxes above—and spoiler alert—it often does.

1. Strong Government and Political Stability

The UAE consistently ranks as one of the most politically stable countries in the Middle East. Dubai, in particular, is known for:

- Pro-investor policies

- Business-friendly tax structures

- A reliable legal system, This kind of environment builds investor confidence.

2. No Property Taxes, No Capital Gains Tax

Dubai offers zero tax on rental income and capital gains for individuals. For global investors, that’s a huge advantage compared to markets like the UK, U.S., or Europe where tax burdens can eat into profits.

3. Regulated Market with Investor Protection

Dubai’s Real Estate Regulatory Agency (RERA) ensures:

- Transparency in developer practices

- Protection of buyer funds through escrow accounts

- Strict project timelines and approvals

These legal safeguards reduce investment risks and fraud, something not all international markets can offer.

Real-World Performance: How Dubai Property Responds to Global Crises

Let’s look at how Dubai real estate has behaved during global challenges:

During COVID-19:

While most countries saw property markets collapse, Dubai bounced back quickly in 2021 and 2022. Luxury segments boomed, and demand from foreign investors surged.

During Global Inflation:

While inflation drove prices up globally, Dubai’s strong AED-USD peg protected investors from currency fluctuations. That’s a key reason many see it as a hedge against inflation.

In 2023-2024:

Rental yields hit 6–9% in prime areas, and prices continued to rise in hotspots like Dubai Marina, Downtown Dubai, and Palm Jumeirah.

Global Shifts Driving More Investors to Dubai

Here’s why investors from around the world are turning to Dubai as a safe haven:

- High Net Worth migration: Wealthy individuals from Europe, China, and India are relocating

- Golden Visa program: Buy a property and get long-term residency

- No inheritance tax: Makes Dubai attractive for estate planning

- Smart infrastructure and safety: Clean, secure, and modern

Is Dubai the “Switzerland of Real Estate”?

That might sound like a big claim, but it’s not far off.

Like Switzerland, Dubai is:

- Neutral, globally connected, and geopolitically safe

- A hub for private wealth, banking, and family offices

- Focused on long-term growth and real estate innovation

In fact, Dubai now has one of the highest concentrations of millionaires in the world.

Future-Proofing: Why Dubai’s Real Estate Still Has Room to Grow

Several factors make Dubai more than just a short-term play:

- Dubai 2040 Urban Master Plan: Focus on sustainable development, wellness, and green spaces

- Upcoming infrastructure: New airports, cultural hubs, and transit lines

- Climate-resilient buildings: Dubai is pushing for energy-efficient and smart properties

All of these point toward a real estate market that’s positioned for long-term resilience and appreciation.

Final Thoughts: Should You See Dubai as a Safe Haven?

If you’re looking for a place to park your money safely, generate passive income, and potentially benefit from capital growth, Dubai real estate makes a strong case.

It combines the benefits of a global city with:

- Transparent laws

- High rental demand

- Tax advantages

- Long-term urban planning

Now that you’ve seen the bigger picture, it’s easy to understand why invest in Dubai real estate? it’s not just a trend, it’s a smart move backed by real, long-term value.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.