Key Challenges and Opportunities for LCD Display Suppliers in 2025

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

India's electronics market is undergoing a steady transformation, and the demand for LCD displays is at the heart of this shift. With the rise in consumer electronics, automotive displays, and smart technologies, the role of an LCD Display Supplier in India has become more crucial than ever. As we move into 2025, the journey presents both hurdles and avenues for growth.

Growing Demand for LCD Displays

The Indian LCD display market is projected to grow by 10% annually, reaching an estimated valuation of ₹20,000 crore by 2025. A surge in smart TVs, smartphones, and automotive displays is fueling this expansion. The introduction of affordable LCD TVs, priced under ₹15,000, has particularly driven sales in tier-2 and tier-3 cities.

In the automotive sector, the push toward electric vehicles has led to a higher demand for digital dashboards and infotainment systems, which use high-quality LCD panels. The consumer electronics sector alone is expected to contribute ₹8,000 crore to this market by the end of 2025.

Challenges Faced by Indian Suppliers

Dependence on Imports

India imports over 75% of its LCD panels, primarily from China, Taiwan, and South Korea. Currency fluctuations, geopolitical tensions, and international supply chain disruptions often make sourcing challenging and costly.

High Production Costs

Setting up advanced manufacturing facilities for LCD production requires significant investment. Indian suppliers face stiff competition from established international players offering economies of scale.

Technological Advancements

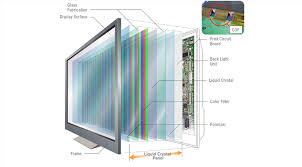

As the market shifts toward high-resolution displays and thinner panels, suppliers need to constantly upgrade their manufacturing capabilities. Limited access to the latest technology puts local suppliers at a disadvantage.

Raw Material Shortages

Key components like liquid crystal compounds and polarizing films are largely imported, creating bottlenecks in the production process. Any delay in material procurement directly impacts delivery timelines.

Consumer Preferences

Indian buyers often prioritize affordability, making it challenging to balance quality and cost. Suppliers must innovate to stay competitive in a price-sensitive market.

Opportunities on the Horizon

‘Make in India’ Initiative

Government initiatives such as PLI (Production Linked Incentive) schemes are encouraging local manufacturing. A ₹7,000 crore allocation for electronics manufacturing, announced in 2024, is expected to benefit LCD manufacturers directly.

Emerging Sectors

The rise of digital healthcare devices, wearables, and home automation systems is creating new demand for LCD displays. These niche markets are expected to grow at a CAGR of 15% by 2025.

Shift to Localized Production

With increasing support for indigenous manufacturing, more suppliers are exploring joint ventures and collaborations to establish assembly plants in India. Karnataka and Tamil Nadu have emerged as preferred states due to their industrial policies.

Sustainability Trends

Eco-friendly manufacturing is gaining traction. Suppliers who adopt energy-efficient production methods and recyclable components can tap into the growing segment of environmentally conscious buyers.

Customizable Displays

The market is moving toward specialized LCDs for sectors like automotive, medical, and industrial automation. Customization, from size to functionality, offers a significant competitive advantage for suppliers willing to invest in R&D.

Estimating Future Potential

The Indian electronics market is projected to hit ₹15 lakh crore by 2025, with LCD displays contributing nearly 1.3% of this value. If Indian suppliers capture just 30% of this share, it translates to a potential revenue of ₹5,200 crore.

By optimizing local supply chains and leveraging government incentives, suppliers can reduce dependency on imports by 20% within the next two years. This shift could save the industry ₹1,500 crore annually.

Upcoming Trends in 2025

Integration of AI and IoT

Smart devices powered by AI and IoT require advanced LCD displays. Suppliers focusing on high-definition panels and touch-enabled technology will find themselves in high demand.

Growth of 8K Displays

With the introduction of 8K televisions in India, suppliers must prepare for a gradual shift toward ultra-high-resolution panels. Though currently niche, this market is expected to grow by 25% annually.

Flexible and Foldable Displays

The popularity of foldable smartphones and tablets will drive innovation in flexible LCDs. Indian suppliers can capitalize on this trend by forming partnerships with technology firms.

Energy-Efficient Panels

With rising electricity costs, consumers are looking for energy-efficient products. LCD displays with lower power consumption will be a strong selling point in the coming years.

Increased Automation in Manufacturing

Automation in production processes can significantly reduce costs and improve quality. Suppliers investing in smart manufacturing technologies will see long-term benefits.

Practical Strategies for Success

Focus on Collaboration

Partnering with global firms for technology transfer can help bridge the technology gap. Joint ventures in India can also attract foreign investment.

Enhance R&D Investments

Developing proprietary technologies for cost-efficient manufacturing and new applications can give Indian suppliers a competitive edge.

Adopt Lean Manufacturing

Streamlining operations to reduce waste and improve efficiency will make products more affordable and increase profit margins.

Diversify Product Lines

Expanding into high-growth areas like medical displays or industrial automation can stabilize revenue streams.

Expand Reach in Rural Markets

Affordable LCD TVs and monitors for rural education and entertainment offer untapped potential. Government programs promoting digital literacy could serve as a catalyst for this demand.

The Road Ahead for LCD Display Suppliers

The role of an LCD Display Supplier in India is set to grow significantly by 2025, driven by domestic demand, policy support, and emerging technologies. While challenges like import dependence and high production costs persist, the opportunities for growth far outweigh these hurdles.

By adapting to changing market needs and leveraging available resources, Indian suppliers have the potential to not only meet local demand but also make a mark in the global electronics industry. The journey to 2025 is an exciting one, filled with possibilities for those ready to take bold steps forward.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.