Keyword Market Size, Share, Growth, and Trends Report 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

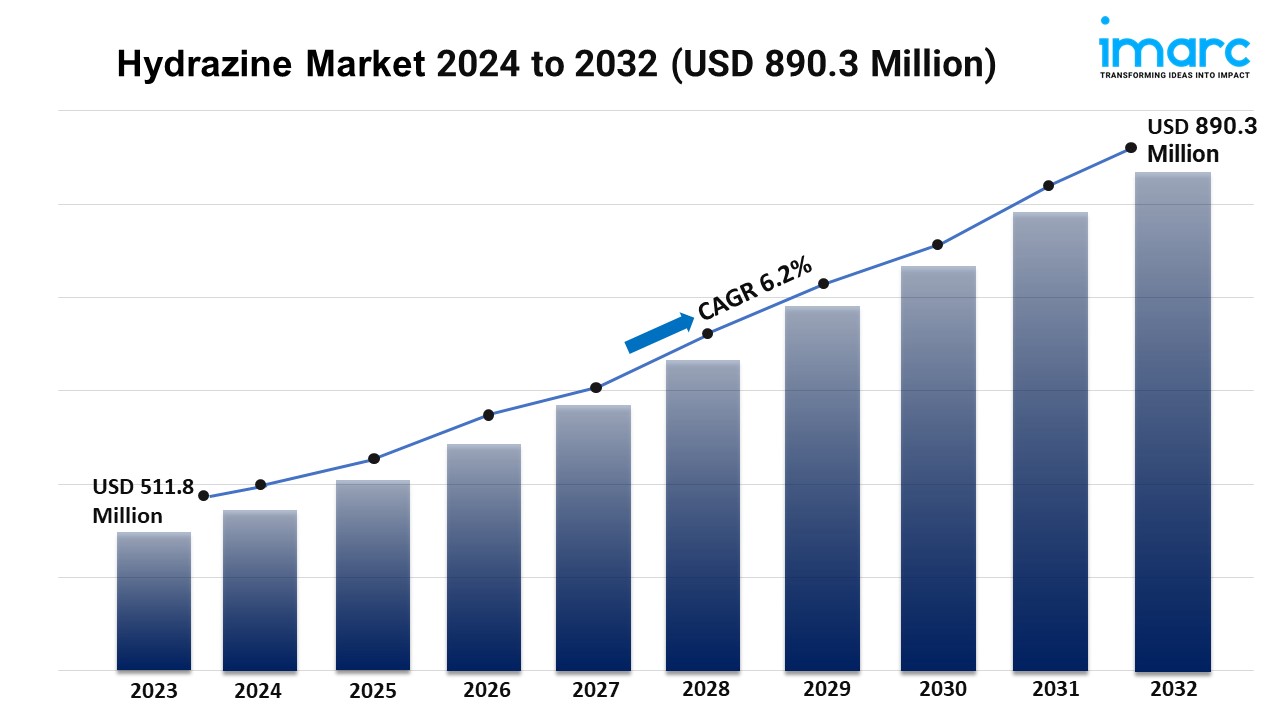

Global Hydrazine Market Statistics: USD 890.3 Million Value by 2032

Hydrazine Industry

Summary:

- The global hydrazine market size reached USD 511.8 Million in 2023.

- The market is expected to reach USD 890.3 Million by 2032, exhibiting a growth rate (CAGR) of 6.2% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest hydrazine market share.

- Hydrazine hydrate accounts for the majority of the market share in the type segment.

- Blowing agents represent the leading application segment.

- Agrochemicals hold the largest share in the hydrazine industry.

- The rise in utilization of hydrazine in the aerospace and defense sector is a primary driver of the hydrazine market.

- Environmental regulations and safety standards are reshaping the hydrazine market.

Industry Trends and Drivers:

- Growing Demand in Aerospace and Defense:

Hydrazine plays a pivotal role in the aerospace and defense industries, primarily serving as a highly effective rocket propellant and a reliable fuel for satellite thrusters. Its high energy density and stability under various conditions make it an ideal choice for both manned and unmanned space missions. The increasing number of satellite launches, driven by the expansion of commercial space enterprises and governmental space programs, significantly drives the demand for hydrazine. Additionally, hydrazine is utilized in the production of various defense applications, including fuel cells and as a precursor in synthesizing polymers and pharmaceuticals essential for defense technologies. The continual advancements in aerospace technology, coupled with heightened defense budgets globally. Moreover, as space exploration missions become more ambitious and frequent, the reliance on hydrazine as a dependable propellant ensures its sustained relevance.

- Expanding Industrial Applications:

Hydrazine is integral to a multitude of industrial processes, serving as a versatile chemical in sectors, such as water treatment, chemical manufacturing, and polymer production. In water treatment, hydrazine acts as an oxygen scavenger, preventing corrosion and maintaining the efficiency of boiler systems in power plants and other industrial facilities. Its role as a reducing agent is crucial in the synthesis of polymers like polyurethanes, which are used in diverse applications ranging from automotive parts to consumer goods. Additionally, hydrazine is employed in the production of pharmaceuticals and agrochemicals, acting as an intermediate in the creation of various active compounds. The global expansion of industrial activities, particularly in emerging economies, drives the demand for hydrazine. Its versatility and effectiveness in enhancing production processes and product quality make it indispensable across multiple industries.

- Environmental Regulations and Safety Concerns:

Environmental regulations and safety standards are shaping both demand and operational practices. Hydrazine is classified as a hazardous substance due to its toxicity and potential environmental impact, necessitating stringent handling, storage, and disposal measures. Regulatory bodies across the globe are implementing more rigorous standards to minimize the environmental footprint and ensure the safety of workers handling hydrazine. Compliance with these regulations often leads to increased operational costs for manufacturers and users as they invest in safer handling technologies and pollution control systems. Additionally, the push for greener and more sustainable alternatives is prompting research into less toxic substitutes for hydrazine, especially in applications like rocket propulsion and water treatment. While these regulations may pose challenges, they also drive innovation in safer production methods and the development of environment friendly alternatives.

Request for a sample copy of this report: https://www.imarcgroup.com/hydrazine-market/requestsample

Hydrazine Market Report Segmentation:

Breakup By Type:

- Hydrazine Hydrate

- Hydrazine Nitrate

- Hydrazine Sulfate

- Others

Hydrazine hydrate exhibits a clear dominance in the market because its aqueous form offers greater stability and safety during storage and transportation compared to anhydrous hydrazine, making it more attractive for a wide range of industrial applications.

Breakup By Application:

- Corrosion Inhibitor

- Medicinal Ingredients

- Precursor to Pesticides

- Blowing Agents

- Others

Blowing agents hold the biggest market share due to their essential role in the production of polyurethane foams, which are widely used in insulation, automotive, and construction industries.

Breakup By End Use Industry:

- Pharmaceuticals

- Agrochemicals

- Others

Agrochemicals account for the majority of the market share as hydrazine derivatives are critical intermediates in the synthesis of various pesticides and herbicides, driving high demand from the agricultural sector.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market owing to its advanced industrial infrastructure, stringent regulatory frameworks that ensure high safety and quality standards, and significant investments in aerospace and automotive industries that heavily utilize hydrazine.

Top Hydrazine Market Leaders:

The hydrazine market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Acuro Organics Limited

- Arkema

- Arrow Fine Chemicals

- Finetech Industry Limited

- Japan Finechem Inc (Mitsubishi Gas Chemical Company Inc.)

- Lanxess AG

- Lonza Group AG

- Merck KGaA

- Nippon Carbide Industries Co. Inc.

- Otsuka-MGC Chemical Company Inc (Otsuka Chemical Co. Ltd.)

- Tokyo Chemical Industry Co. Ltd

- Weifang Yaxing Chemical Co. Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.