Lipase Market Size, Share, Trends, Analyzing, Growth, 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview

The global lipase market size was USD 572.29 million in 2023. The market is set to rise from USD 606.80 million in 2024 to USD 985.54 million by 2032 at a CAGR of 6.25% during 2024-2032.

Lipase fits in a class of enzymes that accelerate triglycerides into glycerol and fatty acids. This enzyme is crucial in human health in lipid transference and offers different tasks in several tissues, including hepatic lipase in the liver and pancreatic lipase in the small intestine. The rapid expansion of the functional cosmetics industry is propelling market growth.

List of Key Players Profiled in Report:

• Novozymes (Denmark)

• Novonesis (Denmark)

• Amano Enzyme Inc. (U.S.)

• Koninklijke Royal DSM (Switzerland)

• Creative Enzymes (U.S.)

• AB Enzymes (Germany)

• Enzyme Development Corporation (U.S.)

• International Flavors & Fragrances (U.S.)

• Biocatalysts (U.K.)

• Aumgene Biosciences (India)

Segments

Microbial Lipases are Highly Preferred as They Offer Robust Resistance to High Temperatures

By source, the market is bifurcated into microbial and animal. The microbial segment accounted for the highest lipase market share as it is more unwavering and can effortlessly grow in a reasonable medium, resulting in high yields. Microbial lipases are highly preferred as they offer robust resistance to high temperatures and action in different pH ranges.

Food & Beverage Segment Dominated Due to Growing Usage ofLipase in Numerous Food Applications

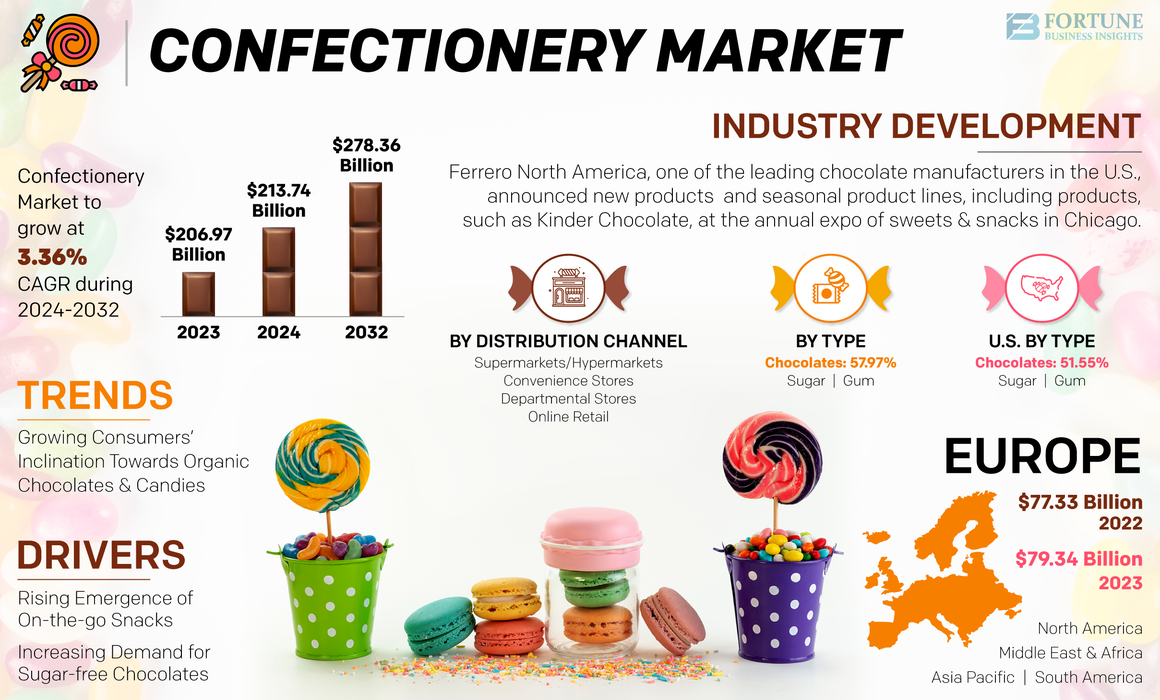

In terms of application, the market is segregated into food & beverage (bakery, dairy, confectionery, beverages, and others), nutraceuticals, animal feed, and others. The food & beverage category commanded the market as the increased preference for lipase enzyme as a sustainable option as it provides high yields in numerous food applications. This enzyme is gaining popularity in the dairy industry, as it is highly preferred as a cheese flavor enhancer and also supports the lipolysis of milk, cream, and fat.

From the regional ground, the market is classified into Europe, South America, North America, Asia Pacific, and the Middle East & Africa.

Source: https://www.fortunebusinessinsights.com/lipase-market-110345

Report Coverage

The market research report presents a complete market examination, highlighting essential elements, including the competitive environment and noticeable product categories. Furthermore, the report provides valuable insights on market trends and significant industry developments. Apart from the factors above, the report includes several aspects that have fostered market expansion in recent times.

Drivers and Restraints

Rising Need for Lipases in Animal Feed Industry to Augment Market Growth

Enzymes are highly demanded in animal feed and intensely contribute by assisting in the absorption and digestion of dietary fats. The rising need for such enzymes for hydrolyzing fats into monoglyceride, free fatty acids, and glycerin is driving market growth. Monogastric animals can secrete lipase, but the secretion is insufficient for absorption. Therefore, the emergence of enzymes is also beneficial in reducing the incidence of ruminant animal diseases and decreasing the overall feed cost. An increase in the launch of lipase-based enzymes by top producers of pet food is fueling the lipase market growth.

Nevertheless, insufficient understanding of this enzyme and regulatory challenges are hindering market growth.

Regional Insights

Rapid Expansion of the Food Processing Industry Boosted Market Growth in North America

The market in North America was valued at USD 227.00 million in 2023 due to renowned research capabilities and robust industrial infrastructure. Increased consumer demand for convenience food products and rapid expansion of the food processing industry is also fueling market expansion in the region.

Europe held the second-leading market share due to the increasing health-conscious population. The growing trend of veganism and the surging usage of natural ingredients for food items are propelling market expansion in the region.

Competitive Landscape

Top Companies Introduce Enzymes That Can Enhance Flavor and Texture

Novozymes, Novonesis, Amano Enzyme Inc., and A.B. Enzymes are some of the leading companies in the market. Key players focus on improving the quality of the product and introducing enzymes that can enhance the flavor and texture.

Key Industry Development

• October 2023: A Denmark-based biotechnology business, Novozymes, launched its newest natural enzyme, Vertera ProBite, which can improve the mouthfeel and texture of plant-based products close to animal meat. It can be used as a processing aid, particularly for plant-centric products.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.