Loans for Self Employed: Unlocking Financial Freedom

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today's fast-paced world, the dream of entrepreneurship is stronger than ever. Many individuals are choosing to work for themselves, enjoying the flexibility and satisfaction it brings. However, when it comes to financing major life goals like buying a home or expanding a business, securing loans for self employed individuals can feel like a daunting task.

This comprehensive guide will shed light on everything there is to know about loans for self employed individuals, ensuring readers feel empowered and informed to take the next step with confidence.

Understanding Loans for Self Employed

Loans for self employed are financial products specifically designed for individuals who do not have a traditional employer. Unlike salaried employees, self-employed borrowers often need to provide additional documentation to prove their income and financial stability. This makes the application process slightly different, but certainly achievable with the right guidance.

Self employed loans come in many forms. Some are tailored for purchasing homes, while others serve the needs of business expansion. No matter the type, it is crucial to find a lender who understands the unique financial situation of self-employed individuals.

The Need for Self Employed Home Loans

For self-employed individuals dreaming of homeownership, self employed home loans offer a viable pathway. Traditional mortgage applications may not fit their financial picture, making these specialized loans essential. Lenders offering mortgage loans for self-employed applicants often request two years of tax returns, bank statements, and profit-and-loss statements.

The key is to prepare thoroughly. By maintaining detailed financial records and working with a lender experienced in mortgage self employed applications, the dream of owning a home can become a reality.

Self Employed and Mortgage Loans: Overcoming Challenges

Self employed and mortgage loans come with their own set of challenges. Fluctuating income and complicated tax deductions sometimes make it harder to showcase financial strength. However, borrowers should not be discouraged. Many mortgage self employed lenders offer flexible solutions.

Understanding the options available, such as stated income loans or bank statement programs, can significantly ease the journey. With preparation and the right advice, self-employed individuals can overcome hurdles and secure favorable terms.

Exploring Business Loan for Self Employed

Growth-minded entrepreneurs often seek a business loan for self employed individuals to fund expansion, purchase equipment, or manage cash flow. These loans differ slightly from personal loans, focusing more on business revenues and plans.

When applying, self-employed borrowers should be ready to present comprehensive business plans, financial statements, and tax documents. A strong credit history also greatly improves the chances of approval. In many cases, showing a consistent business income can make all the difference.

Finding the Right Self Employed Mortgage Lenders

The choice of lender plays a significant role in securing loans for self employed individuals. Not all lenders understand the complexities of self-employment income. Therefore, it is critical to work with self employed mortgage lenders who specialize in assessing unique financial situations.

Experienced lenders offer tailored advice and flexible underwriting standards, giving borrowers a greater chance of approval. Additionally, they can guide borrowers through alternative documentation processes, making the experience smoother and less stressful.

Tips for Securing Mortgage Loans for Self-Employed Individuals

Securing mortgage loans for self-employed individuals requires preparation and strategic planning. Here are essential tips to help borrowers succeed:

- Maintain Accurate Financial Records: Clear and organized financial statements are crucial.

- Improve Credit Scores: Higher credit scores lead to better loan terms.

- Save for a Larger Down Payment: A bigger down payment reduces risk for lenders.

- Minimize Debt: Lower debt-to-income ratios increase approval chances.

- Consult Specialized Lenders: Professionals familiar with mortgage self employed loans can offer customized solutions.

By following these tips, self-employed borrowers can significantly improve their prospects.

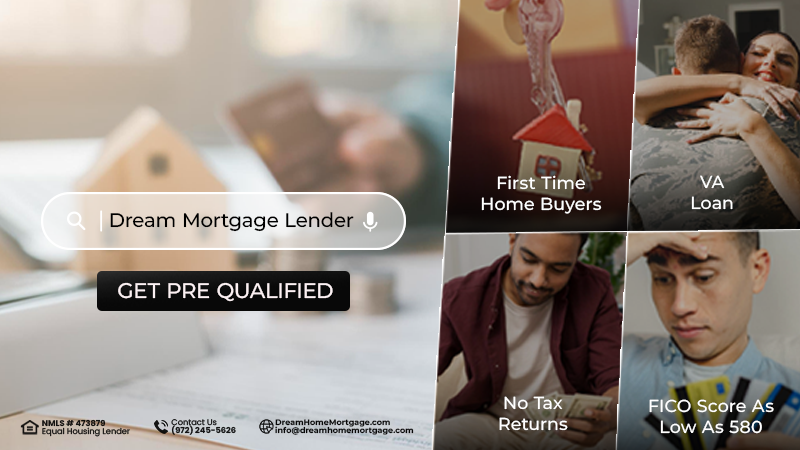

Why Dream Home Mortgage Stands Out

Dream Home Mortgage is a trusted name in the mortgage industry in the USA. They provide comprehensive services covering all aspects of loans for self employed, making the borrowing process smoother and more accessible.

Benefits of Choosing the Right Mortgage Self Employed Loan

Choosing the right mortgage self employed loan opens doors to financial freedom. It allows individuals to invest in their future, secure a home, and grow their businesses with confidence.

Moreover, the right loan structure offers flexibility in payment plans, competitive interest rates, and the ability to leverage financial assets effectively. Working with specialized lenders ensures a smooth journey from application to closing.

Common Myths About Self Employed Loans

Several myths often discourage self-employed individuals from seeking loans. It is important to debunk these misconceptions:

- "Self-employed people can't qualify for loans." Reality: Many lenders specialize in self employed loans.

- "Only high-income individuals get approved." Reality: Consistent, documented income matters more than the amount.

- "The process is too complicated." Reality: With proper guidance, the process is manageable.

By dispelling these myths, potential borrowers can approach the loan process with optimism and clarity.

Conclusion: The Path to Success

Loans for self employed individuals are not just possible; they are within easy reach for those who prepare wisely and seek the right partnerships. Whether looking for self employed home loans, business loan for self employed needs, or mortgage loans for self-employed purposes, the key lies in understanding the process, gathering the necessary documents, and working with expert lenders.

With the right approach, self-employed individuals can achieve their financial goals and enjoy the fruits of their hard work. Embracing the possibilities that self employed and mortgage loans offer is the first step towards a secure and prosperous future.

In this ever-evolving economy, opportunities abound for those who dare to dream and plan wisely. Loans for self employed individuals are not just financial products; they are stepping stones to a brighter tomorrow.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.