Looking for Stable Stocks? These Have Strong Fundamentals

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Investing in the stock market requires patience, foresight, and a keen understanding of a company’s financial health. For investors aiming to identify fundamentally strong stocks, it's crucial to delve deep into a company's core financial indicators and business model. Fundamentally strong stocks are characterized by robust financial health, consistent performance, and promising future prospects, making them attractive options for investors looking to minimize risk in their portfolios.

Understanding Fundamentals

Fundamentally strong stocks typically exhibit a solid balance sheet, stable cash flow, strong earnings, and competitive advantages in their sectors. Evaluating these parameters requires analyzing key financial ratios and trends within the industry and the overall market.

Crucial Financial Ratios to Identify Fundamentally Strong Stocks

1. Earnings Per Share (EPS): EPS is a key indicator of a company's profitability. It informs investors about how much profit the company is generating per share of its stock. EPS can be calculated as follows:

[ text{EPS} = \frac{\text{Net Profit}}{\text{Number of Outstanding Shares}}]

For instance, if a company has a net profit of INR 500 million and 50 million outstanding shares, the EPS would be INR 10.

2. Price-to-Earnings Ratio (P/E Ratio): This is a critical measure to assess whether a stock is overvalued or undervalued compared to its earnings. A lower P/E may indicate that the stock is undervalued, while a higher P/E suggests potential overvaluation.

[text{P/E Ratio} = \frac{\text{Market Price Per Share}}{\text{Earnings Per Share}}]

3. Debt-to-Equity Ratio: A measure of a company's financial leverage, this ratio compares a company's total liabilities to its shareholder equity, indicating the proportion of equity used to finance assets.

[ text{Debt-to-Equity Ratio} = \frac{\text{Total Liabilities}}{\text{Shareholder Equity}}]

A lower ratio suggests a company is using less debt, potentially signifying lower financial risk.

4. Current Ratio: This ratio measures a company's ability to pay short-term obligations, providing insight into liquidity.

[text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}}]

A ratio over one indicates the company can cover its short-term liabilities.

Popular Fundamentally Strong Stocks in the Indian Market:

Here are some of the popular stocks often cited for their strong fundamentals:

1. Reliance Industries Limited (RIL): Known for diversification and innovation, RIL has maintained a strong presence across multiple sectors such as petrochemicals, telecommunications, and retail. Despite its large-scale operations, the company consistently reports stable earnings and strong balance sheet metrics.

2. Tata Consultancy Services (TCS): As a leading global IT services firm, TCS has shown resilient growth backed by strong cash flows and zero debt, making its stock appealing to those focused on fundamentally sound investments.

3. HDFC Bank: One of India's premier banks, HDFC maintains a high quality of assets and consistent growth in dividends and profitability. A look at its P/E ratio often showcases its favorable valuation relative to the industry.

4. Infosys Limited: Another IT giant, Infosys, similar to TCS, reports robust earnings, minimal debt, and a strong return on equity (ROE), making it a popular choice among investors looking for stable, fundamentally strong stocks.

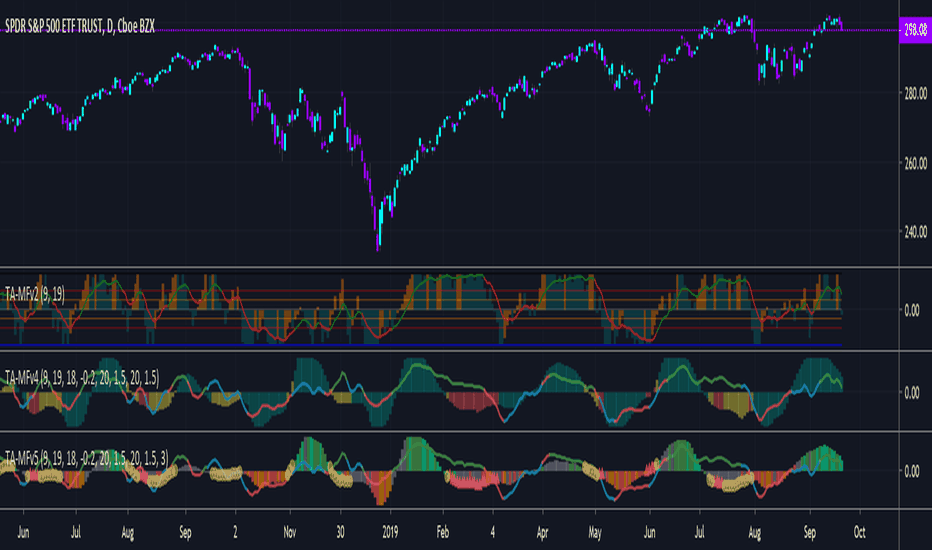

Trend Analysis and Market Positioning

When evaluating fundamentally strong stocks, investors should consider both quantitative assessments and qualitative factors such as management efficiency, competitive advantages, and sector positioning. For instance, stocks like Infosys and TCS often capitalise on the growing demand for digitalisation and IT services globally, presenting sound investment opportunities.

Risk Assessment and Diversification

Investors seeking stability through fundamentally strong stocks must gauge sector risks, economic factors, and geopolitical developments impacting market conditions. Diversification minimizes exposure to sector-specific risks and mitigates the impact of any unforeseen economic downturns.

Conclusion

Understanding fundamentally strong stocks involves an in-depth analysis of financial health, market trends, and sector positioning. While popular stocks like RIL, TCS, Infosys, and HDFC Bank represent the consistent performance in the Indian stock market, investors should leverage financial ratios and trends to assess potential investment avenues.

Disclaimer: This article does not provide financial advice or stock recommendations. Investing in the stock market carries inherent risks. Potential investors must conduct thorough research, considering all pros and cons, and consult financial advisors if necessary before engaging in trading or investing activities in the Indian stock market.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.