Managing ADHD: Practical Approaches to Financial Planning and Budgeting

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

First of all,

✍️ Adults living with ADHD face unique challenges in work and relationships. Visit our ADHD resource to explore management strategies, productivity hacks, and treatment options that make daily life easier and more balanced.

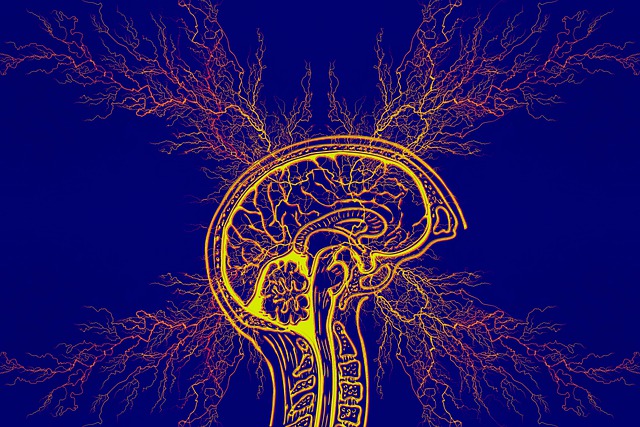

ADHD is a neurodevelopmental condition that impairs an individual's capacity for effective task management, organization, and concentration. ADHD is frequently linked to difficulties in the workplace and in the classroom, but its effects on money management are frequently disregarded. Due to issues with impulse control, time management, and attention regulation, people with ADHD may find it difficult to save money, budget, and make wise financial decisions.

This article will examine the relationship between attention deficit hyperactivity disorder (ADHD) and money management. It will cover the particular difficulties faced by people with ADHD and offer doable solutions to enhance budgeting abilities and general financial health.

Recognizing the Obstacles:

Impulse Control: Those who suffer from ADHD frequently have trouble controlling their impulses, which makes it challenging for them to avoid impulsive purchases and instant pleasure. Financial instability, debt buildup, and excessive spending might result from this.

Time management:

Ineffective time management techniques can make budgeting and financial planning difficult. Financial chores may be difficult for people with ADHD to prioritize, which can result in missing payments, late fees, and disorganized financial records.

Attention Regulation:

It might be difficult to concentrate on financial duties like budgeting, keeping track of spending, and examining financial accounts if one has trouble maintaining their focus. Important financial information might thus be missed, which could result in expensive errors.

Organization:

ADHD can have an impact on one's ability to be organized, which can make it difficult to keep track of spending, keep organized financial records, and remember deadlines.

Techniques for Budgeting While Having ADHD:

Automate and Simplify:

Automate bill payments, establish automated transfers to savings accounts, and use budgeting applications with visual cues and reminders to streamline financial duties. Automation lessens the mental strain that comes with handling money and lowers the possibility of forgetting things or missing payments.

Make a Budget for Visual Aids:

People with ADHD may find visual aids very beneficial. Using color-coded spreadsheets, graphs, or charts, create a visual budget that tracks your income, expenses, and savings objectives. It is simpler to comprehend financial information quickly and maintain motivation to stay within the budget when it is presented visually.

Prioritize and Set Clear Goals:

Make sure you have well-defined financial objectives, such as debt repayment, emergency fund building, or purchase targeted savings. Divide more ambitious objectives into more doable, smaller tasks, and rank them according to significance and urgency. Establishing measurable goals gives you direction and incentive to stick to your budgetary goals.

Employ Timers and Reminders:

Use technology to schedule timers and reminders for your financial tasks. Remind yourself of important dates such as savings contributions, budget review meetings, and bill due dates by setting up alarms, calendar notifications, or smartphone apps. Reminders that are set on a regular basis promote consistency and help people avoid putting off tasks.

Practice introspection and mindfulness:

Develop mindfulness techniques to become more conscious of your emotional triggers and impulsive spending habits. Consider whether a purchase fits with your priorities and financial goals before purchasing it. Deep breathing exercises and meditation are examples of mindfulness practices that might assist control emotions and lessen the tendency toward impulsive spending.

Seek Professional Assistance:

Take into consideration consulting with financial experts, therapists, or support groups that focus on money management and ADHD. A financial advisor may assist you in creating long-term financial plans and offer customized strategies made to meet your unique circumstances. Support groups and therapy provide a secure environment for talking about issues, exchanging stories, and picking up tips from others going through a similar situation.

In summary:

For those with ADHD, handling money can be difficult, but with the correct tools and assistance, budgeting abilities can be strengthened and financial stability can be attained. Through comprehension of the distinct obstacles linked to ADHD and application of useful strategies like automation, goal-setting, visual budgeting, and mindfulness, people can assume responsibility for their finances and establish a stable financial future. Recall that although results may come gradually, persistence and consistency are essential for long-term success in money management for people with ADHD.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.