Real Blogger Outreach – Powerful Links. Zero Spam.

Real Blogger Outreach – Powerful Links. Zero Spam.

Metal Silicon Prices | Trend | Chart | News | Graph | Analysis | IMARC Group

Written by Beckett » Updated on: June 17th, 2025

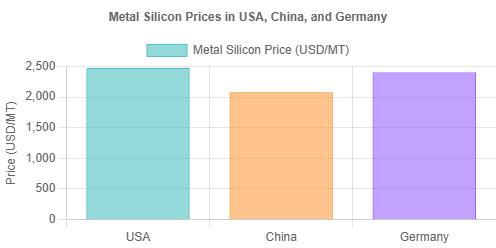

North America Metal Silicon Prices Movement Q2:

Metal Silicon Prices in United States:

In the second quarter of 2024, metal silicon prices in the United States climbed to 2,474 USD/MT by June, influenced by consistent industrial demand and balanced supply dynamics. Key sectors, including solar energy and automotive manufacturing, drove robust demand for metal silicon, particularly for applications in photovoltaic cells and lightweight materials. Advancements in technology and economic developments further strengthened market conditions, contributing to year-on-year growth. Additionally, stable supply chains and efficient production capacities ensured minimal price fluctuations, reflecting a well-balanced market environment. This synergy of factors underscored the steady pricing trend for metal silicon in the U.S. market during the quarter.

APAC Metal Silicon Prices Movement Q2:

Metal Silicon Prices in China:

In Q2 2024, China's metal silicon market experienced significant price drops, with values reaching 2,078 USD/MT by June. This decline was primarily driven by an oversupply in the market, as production ramped up during the monsoon season. Simultaneously, demand from key sectors like aluminum and photovoltaics remained subdued, further exacerbating the downward pressure on prices. The market faced persistent challenges, including lackluster consumption and weak buyer sentiment, which contributed to a bearish outlook throughout the quarter. These factors combined to create a challenging environment for the metal silicon industry, reflecting ongoing supply-demand imbalances and reduced market activity.

Europe Metal Silicon Price Movement Q2:

Metal Silicon Prices in Germany:

Germany's metal silicon market in Q2 2024 demonstrated remarkable stability, with prices settling at 2,399 USD/MT by the end of the quarter. This steadiness was driven by consistent demand from the construction and traditional automotive industries, which offset the impact of declining electric vehicle (EV) sales. The balanced supply chain and steady industrial consumption played a crucial role in maintaining market equilibrium, minimizing price fluctuations. Despite challenges in the EV segment and broader economic pressures, the robust performance of other sectors ensured a positive outlook for metal silicon demand, reinforcing Germany's position as a key player in the European market.

How IMARC Pricing Database Can Help

The latest IMARC Group study, “Metal Silicon Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2024 Edition,” presents a detailed analysis of Metal Silicon price trend, offering key insights into global Metal Silicon market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Metal Silicon demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

Request to Get the Sample Report: https://www.imarcgroup.com/metal-silicon-pricing-report/requestsample

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.