Mexico Automotive Paints and Coatings Market Size, Growth, Demand & Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

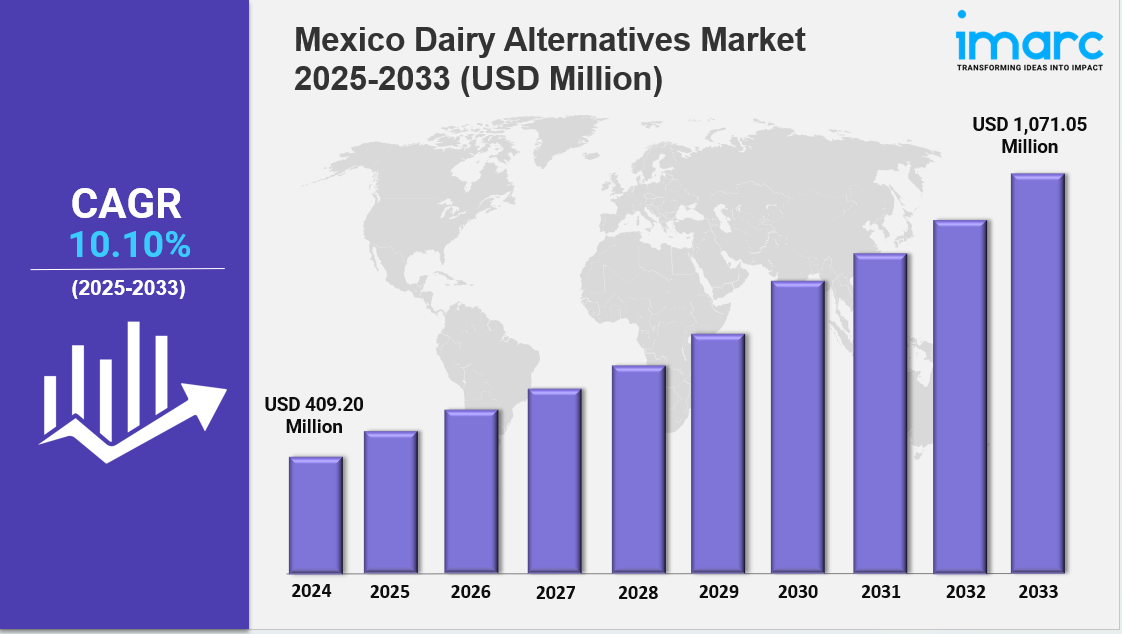

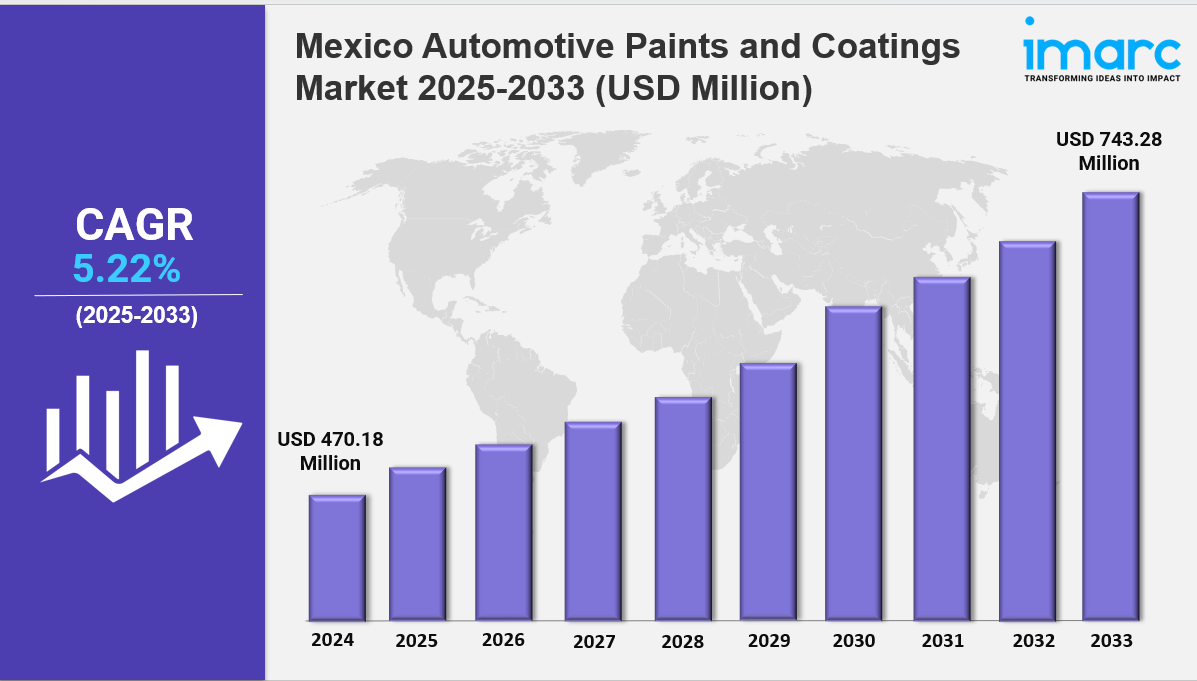

The Mexico automotive paints and coatings market size reached USD 470.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 743.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.22% during 2025-2033. The market is expanding due to increasing demand for high‑speed, accurate visual data processing across industries. Growth is driven by AI‑enhanced algorithms, proliferation of smart cameras, and cloud‑based solutions. With deep learning innovations and surveillance adoption, the sector is becoming more efficient, intelligent, and competitive.

Key Market Highlights:

✔️ Rapid adoption across retail, automotive, and security sectors for real-time analytics

✔️ Advancements in AI and deep learning driving enhanced image processing capabilities

✔️ Growing demand for contactless and automated solutions in post-pandemic environments

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-automotive-paints-coatings-market/requestsample

Mexico Automotive Paints and Coatings Market Trends and Drivers:

The Mexico automotive paints and coatings market is going through a big shift as the industry responds to global environmental goals and stricter standards. More manufacturers are now turning to eco-friendly options like water-based and high-solids coatings. This change is closely tied to new rules on emissions under agreements like the USMCA and regulations from the European Union. Big automakers such as GM and Volkswagen have also committed to carbon-neutral supply chains, speeding up this transition. In 2024, enforcement from Mexico’s environmental agency SEMARNAT led to a 35% jump in the use of bio-based solvents across the industry.

Local companies like Química Mexana are ramping up production of recycled-resin coatings, and nanotechnology is making it possible to apply thinner, more efficient layers—cutting waste without compromising quality. While the upfront costs of these solutions are higher, they’ve proven to save money in the long run—about 22% on average—thanks to lower energy use during application. All of this is helping sustainability become both a smart business move and a competitive edge in the Mexico automotive paints and coatings market.

Mexico’s growing role in electric vehicle (EV) manufacturing is also changing what’s in demand. With Tesla building a massive gigafactory in Monterrey and BMW investing heavily in Puebla, automakers are looking for coatings designed specifically for EVs. These vehicles need lighter materials and heat-resistant paints to help manage battery temperatures. Today, ceramic-based coatings make up around 40% of the premium EV market, while more customers are asking for custom finishes like matte or color-shifting effects—now used in 60% of high-end EV orders. In response, companies such as PPG and Axalta are introducing new solutions like UV-cured coatings, which dry much faster and cut down on energy use.

The surge in EV sales—up 48% in 2024—has made the market more competitive and expanded the Mexico automotive paints and coatings market size. Brands like Comex Auto are investing in smart technology, including AI-powered tools that help match car paint with precision, meeting the growing demand for personalized finishes.

At the same time, Mexico’s older cars—many over 17 years old—are keeping the aftermarket strong. In coastal and desert regions, where weather can be harsh, customers need long-lasting coatings. Products like UV-protective clear coats and monsoon-resistant polyurethanes are becoming popular, driving nearly 30% of recent revenue growth.

With inflation and tighter budgets in 2024, more people turned to do-it-yourself (DIY) auto refinishing. Online stores like Mercado Libre and Amazon México saw a big spike in sales, thanks to digital paint libraries and augmented reality tools that help customers visualize colors before buying. Online sales rose by 65%, though this also led to a rise in fake products. To protect buyers, the consumer agency PROFECO started using blockchain technology to verify authenticity—highlighting the need to balance accessibility with quality control in the Mexico automotive paints and coatings market share.

Technology and regulation continue to drive change. Electrocoat (e-coat) is now used in about 85% of manufacturing plants due to its strong rust protection, especially in Mexico’s humid industrial regions. New materials like graphene-based coatings, which can even "self-heal" small scratches, are also gaining attention. These reduce the need for repeat refinishing by up to 50%. Robotics is another major player—KUKA México recently installed more than 300 precision spray robots to reduce overspray and material waste.

Nearshoring is reshaping the industry too. Paint companies like Nippon Paint are investing hundreds of millions in new facilities, such as a $200 million plant in Aguascalientes focused on fast-drying coatings to support just-in-time production. Still, global supply chain issues—like shortages of titanium dioxide—have led to price hikes of up to 18%. In response, some are turning to alternatives like cellulose-based materials.

Looking ahead, the Mexico automotive paints and coatings market forecast shows steady growth. The companies that succeed will be those who can innovate without sacrificing sustainability. One standout example is BASF, whose recycling program now turns 90% of leftover chemicals into usable coating products—proving that being eco-conscious can also be cost-effective.

Mexico Automotive Paints and Coatings Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

Breakup by Resin Type:

- Polyurethane

- Epoxy

- Acrylic

- Others

Breakup by Technology:

- Solvent-borne

- Water-borne

- Powder

- Others

Breakup by Layer:

- E-coat

- Primer

- Base Coat

- Clear Coat

Breakup by Application:

- Automotive OEM

- Automotive Refinish

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.