Mexico Dairy Alternatives Market Size, Demand & Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

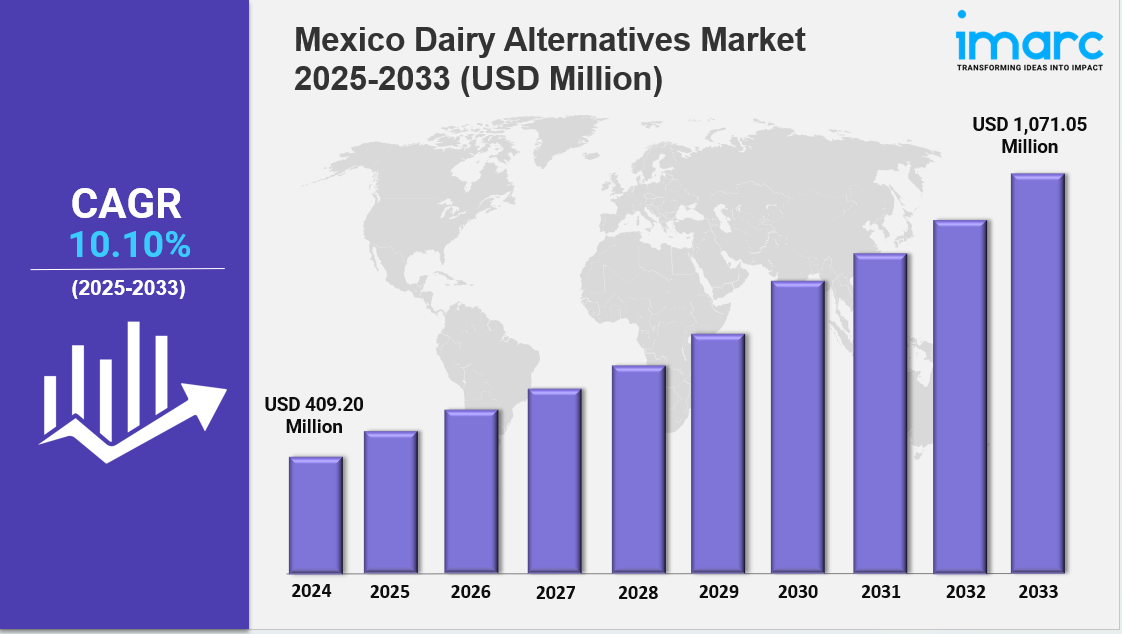

The Mexico dairy alternatives market size reached USD 409.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,071.05 Million by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The market is expanding due to growing health and environmental awareness, rising lactose intolerance, and demand for plant-based dairy products. Growth is driven by almond and soy segments, retail expansion, and sustainability trends, making it dynamic and competitive.

Key Market Highlights:

✔️ Strong market growth fueled by rising lactose intolerance and growing health-conscious consumer base

✔️ Increasing demand for plant-based milk, yogurt, and cheese made from soy, almond, oats, and coconut

✔️ Expanding product innovation and retail presence across supermarkets, health stores, and online platforms

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-dairy-alternatives-market/requestsample

Mexico Dairy Alternatives Market Trends and Drivers:

The Mexico dairy alternatives market is undergoing major changes as health awareness, urban lifestyles, and evolving regulations reshape consumer habits. By 2024, more than 83% of Mexico’s population lived in urban areas, where demand for dairy-free products continues to grow. Health issues such as lactose intolerance, diabetes, and obesity are prompting many to cut back on traditional dairy—according to ENSANUT 2024, 42% of consumers reported reducing dairy intake. This shift is driving significant momentum in the Mexico dairy alternatives market trends, with oat milk sales alone jumping by 300% year-over-year.

Brands like NotCo and Jüsto are leading the charge, introducing fortified plant-based drinks packed with calcium and prebiotics. These new offerings have gained nearly 28% of shelf space in major retail outlets, highlighting how innovation is driving competition and changing the face of the Mexico dairy alternatives market outlook. Regulatory moves have also played a big role. In 2024, COFEPRIS began requiring front-of-pack warning labels for high-sugar dairy products, prompting reformulations across the industry. Starbucks Mexico responded by replacing 74% of its dairy offerings with almond milk.

Local innovation is another key driver. BioMilk launched yogurt made from amaranth, a native crop, cutting import reliance by over 60% and boosting local sourcing within the Mexico dairy alternatives market size. Major players are also investing in research to incorporate traditional ingredients like agave, chia, and nopal. In fact, more than $120 million was invested in 2024 to support this R&D push. Danone’s agave-based cheese reached a 19% market share within six months, while Nestlé debuted desserts using chia and nopal—both of which use significantly less water than traditional almond products.

Programs like Tatahuate have helped train over 4,000 people in chia fermentation, contributing to locally sourced product lines in stores like Walmart. Research teams from UNAM and CINVESTAV even developed a cactus-based alternative to casein, now licensed to Sigma Alimentos. Infrastructure upgrades have helped bring down production costs, achieving price parity between plant-based and conventional dairy in some areas. Alpro’s facility in Jalisco, for example, reduced pea protein processing costs by 73%, allowing them to price almond milk at just $1.20 per liter. Retailers such as Soriana and Oxxo have responded by bundling plant-based milks with everyday essentials—reaching around 12 million households.

Supportive government policies are also playing a part. Tax exemptions and federal grants have helped more than 200 small and mid-sized businesses scale up operations, directly boosting the Mexico dairy alternatives market outlook. Still, challenges remain. A 2024 Profeco report found that monopolistic practices in rural distribution networks are limiting access outside major cities. Even so, momentum is building. Based on current trends, the Mexico dairy alternatives market forecast suggests the sector could reach $1.4 billion by 2028.

Big brands are taking notice. Kraft Heinz launched a plant-based queso fresco made from potato and cassava that’s already gained strong traction in foodservice, hitting 31% market penetration. Online sales are also growing fast—Gen Z now accounts for 67% of all digital purchases. Northern Mexico saw 89% sales growth in 2024 alone, partly due to supply chain issues affecting conventional dairy.

New labeling rules introduced under the 2024 NOM-051 revisions now allow plant-based drinks to be marketed as “milk,” following major court decisions. Market consolidation is accelerating as well—PepsiCo recently acquired Nada Moo and expanded distribution through its existing logistics network. Looking ahead, the Mexico dairy alternatives market trends point toward continued growth fueled by advances in precision fermentation, eco-friendly packaging innovations, and tighter environmental regulations from SEMARNAT. With inflation in the dairy sector hitting 23% in 2024, the demand for plant-based options is only expected to rise.

Mexico Dairy Alternatives Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

Breakup by Product Type:

- Cheese

- Creamers

- Yogurt

- Ice Creams

- Milk

- Others

Breakup by Source:

- Almond

- Soy

- Oats

- Hemp

- Coconut

- Rice

- Others

Breakup by Formulation:

- Plain

- Sweetened

- Unsweetened

- Flavored

- Sweetened

- Unsweetened

Breakup by Nutrient:

- Protein

- Starch

- Vitamin

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.