Mexico Data Center Colocation Market Size, Share, Trends, Industry Analysis, Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

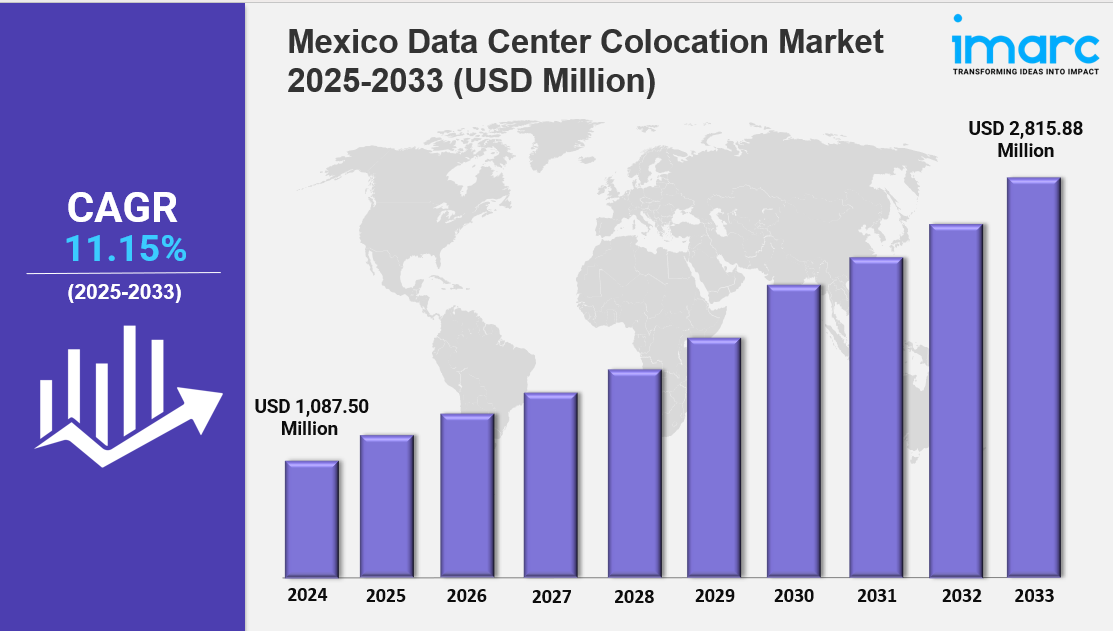

The Mexico data center colocation market size reached USD 1,087.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,815.88 Million by 2033, exhibiting a growth rate (CAGR) of 11.15% during 2025-2033. The market is expanding due to rapid digital transformation, rising cloud adoption, and nearshoring trends. Growth is driven by wholesale and retail colocation demand, 5G integration, and major hyperscaler investments, making the sector more scalable, efficient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising digital transformation and demand for scalable IT infrastructure

✔️ Increasing adoption among enterprises and cloud service providers for cost-effective data management

✔️ Expanding investments in energy-efficient facilities and strategic locations to enhance connectivity and uptime

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-data-center-colocation-market/requestsample

Mexico Data Center Colocation Market Trends and Drivers:

The Mexico Data Center Colocation Market is expanding rapidly as the country becomes a preferred nearshoring destination for global tech and manufacturing companies. With many firms shifting latency-sensitive workloads from Asia, demand for colocation services in Mexico surged by 58% year-over-year. Major cloud players like AWS and Microsoft are investing heavily—over $2.1 billion—to build data centers in border regions that can maintain fast, sub-15ms connections to key U.S. financial markets.

n mid-2024, Oracle set up modular data centers in Tijuana and Ciudad Juárez to support cross-border automotive IoT systems, while KIO Networks scaled its Querétaro campus to 40MW, incorporating direct liquid cooling for AI operations. However, growth isn’t without challenges. A limited 400kV transmission network from CFE in central Mexico is causing delays in nearly 40% of planned builds. At the same time, new data sovereignty laws are requiring foreign companies to store Mexican user data locally—boosting compliance-driven colocation demand by 300%, despite operational costs being 22% higher than comparable facilities in Texas.

Sustainability is becoming essential to staying competitive in the Mexico Data Center Colocation Market. Multinational clients now expect their colocation partners to meet aggressive carbon reduction targets, including Scope 3 emissions. In response, regulators have introduced clean energy requirements: as of 2024, all colocation centers above 10MW must use at least 65% renewable power. This has led to a wave of solar panel installations and new wind energy contracts, especially in Oaxaca. Currently, 73% of Mexico’s colocation capacity includes on-site battery storage and biogas-powered backup systems—an important shift given the national grid’s 14% transmission losses.

Companies like Enel and Engie are even offering custom renewable microgrids to reduce reliance on the public grid. But building in drought-prone areas like Nuevo León presents its own hurdles: water-saving cooling systems can raise capital costs by up to 35%, limiting profit margins even with 82% occupancy rates. Meanwhile, the rollout of América Móvil’s 5G network has sparked major growth in edge computing. More than 1,200 micro colocation nodes have been deployed across 45 smaller cities, reducing latency for smart manufacturing and logistics. In Guanajuato’s Bajío region, for instance, auto manufacturers are leasing modular edge data centers to power real-time analytics, helping boost local providers' revenue by 40%.

A notable collaboration between Equinix and Grupo Carso in 2024 installed compact, AI-ready data sites in nearly 100 Oxxo stores, forming a distributed content network. Yet, challenges remain—many edge facilities still lack Tier III redundancy, and infrastructure sabotage, such as fiber cuts in Michoacán, continue to impact reliability. As private 5G networks gain popularity in factories, there's also a growing shortage of skilled data center technicians, with hiring taking up to 18 months. The broader Mexico Data Center Colocation Market outlook is increasingly shaped by hybrid infrastructure strategies and global trade shifts. As tensions between the U.S. and China escalate, cloud providers like Tencent and Alibaba are choosing Mexico as a neutral gateway for the Americas, investing $800 million in hyperscale data centers near Lázaro Cárdenas.

A growing portion of new colocation space—about 47%—now comes from repurposed industrial buildings, which often already have robust power supplies. Government data now requires more secure handling, leading providers like KIO to offer "Sovereign Cloud Vaults" with advanced biometric access. Technologies like AIOps are also gaining traction, using AI to optimize power use and reduce waste. Looking ahead, Mexico’s role as a testing ground for quantum computing, including IBM’s installations in Monterrey, is setting the stage for highly specialized colocation infrastructure.

With cross-border data regulations tightening, providers with bilingual compliance teams and NAFTA 2.0-aligned frameworks are better positioned to win over U.S. firms looking to move operations south. In short, the Mexico Data Center Colocation Market Growth is being fueled by demand for regional performance, energy efficiency, and regulatory alignment—making Mexico a rising star in the global digital infrastructure landscape.

Mexico Data Center Colocation Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

Breakup by Type:

- Retail Colocation

- Wholesale Colocation

Breakup by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

Breakup by End Use Industry:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.