Middle East Fintech Market Size, Industry Growth, and Research Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Middle East Fintech Market Overview

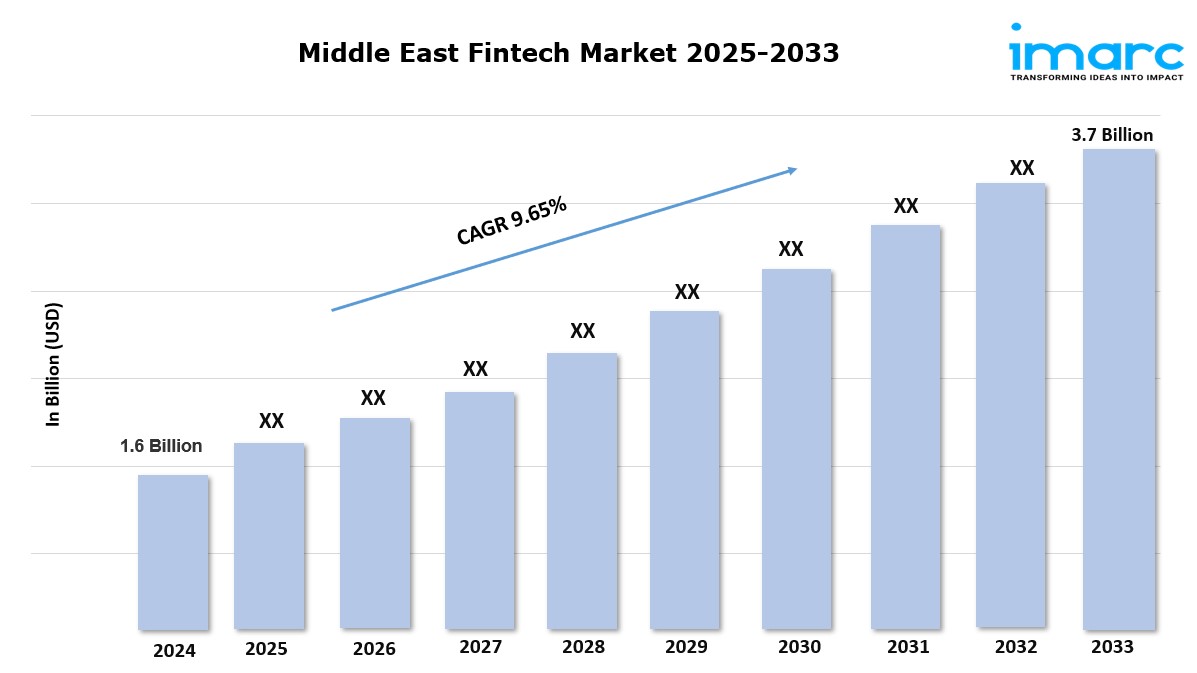

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.7 Billion

Market Growth Rate: 9.65% (2025-2033)

The Middle East fintech market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 9.65% during 2025-2033.

Request for a sample copy of this report: https://www.imarcgroup.com/middle-east-fintech-market/requestsample

Middle East Fintech Market Trends:

The Middle East market is primarily driven by the increasing adoption of digital payment solutions as governments and businesses push for cashless economies. In line with this, the rising penetration of smartphones and high-speed internet, particularly among the younger population, is propelling the market expansion. Furthermore, the rapid growth of e-commerce platforms fueling demand for innovative payment gateways and financial solutions, is fostering market growth.

Similarly, favorable government initiatives and regulatory frameworks, including fintech sandboxes, are fostering innovation and attracting investments, thereby providing an impetus to the market. Moreover, the increasing adoption of blockchain technology in remittances and trade finance is reshaping financial transactions, while heightened investor interest and funding for startups are accelerating the introduction of advanced fintech products, thereby strengthening the market demand. Besides this, strategic collaborations between traditional financial institutions and fintech firms creating hybrid solutions are bolstering market appeal.

Middle East Fintech Market Scope & Growth Analysis:

The scope of the market spans diverse segments, including payments, digital lending, wealth management, and insurance technology. With a heightened focus on financial inclusion, fintech solutions are addressing the needs of unbanked and underbanked populations across the region. Similarly, the growing adoption of artificial intelligence (AI) and machine learning (ML) in risk management, fraud detection, and personalized financial services is enhancing operational efficiency and customer experience.

As per market analysis, the region's strategic position as a global financial hub is attracting international fintech companies to establish operations. Moreover, the rise of government-backed initiatives, such as Saudi Vision 2030 and the UAE's Fintech Hive, is creating a conducive environment for growth. In addition to this, the ongoing integration of fintech into sectors such as healthcare and education is opening new opportunities, ensuring robust market expansion as digital transformation and consumer demand for seamless financial services shift.

Middle East Fintech Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Middle East fintech market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Country Insights:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.