Military Sensors Market Size, Demand, Key Players, and Predicted Growth Analysis for 2030

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The global military sensors market, valued at USD 25.94 billion in 2019, is projected to grow from USD 21.66 billion in 2020 to USD 74.91 billion by 2032, with a CAGR of 8.50% from 2020 to 2032.

A key driver of this growth is the adoption of wireless sensor network (WSN) technology in military applications. These advanced sensor networks enable real-time data collection and analysis, enhancing situational awareness, asset tracking, and decision-making capabilities for defense forces. As militaries worldwide prioritize technological advancements and modernization, the demand for sophisticated military sensors is expected to rise steadily throughout the forecast period.

Top Key Players: Military Sensors Market

Honeywell International Inc. (The U.S.)

Thales Group (France)

Curtiss-Wright Corporation (The U.S.)

TE Connectivity Ltd. (The U.S.)

Raytheon Company (The U.S.)

Kongsberg Gruppen ASA (Norway)

BAE Systems PLC (The U.K.)

Lockheed Martin Corporation (The U.S.)

Imperx, Inc. (The U.S.)

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/military-sensors-market-104666

Drivers & Restraints: Military Sensors Market

Drivers

Advancements in Sensor Technology: Continuous innovations in sensor technology, including improvements in sensitivity, miniaturization, and integration with AI and machine learning, are driving the adoption of military sensors. These advancements enhance the capabilities of military sensors in various applications, such as surveillance, reconnaissance, and combat operations.

Increasing Defense Budgets: Growing defense budgets worldwide are enabling significant investments in advanced military technologies, including sensors. Countries are prioritizing the modernization of their armed forces to address emerging security threats, driving demand for sophisticated sensor systems.

Rising Demand for Unmanned Systems: The increasing use of unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned underwater vehicles (UUVs) in military operations is boosting the demand for advanced sensors. These sensors are crucial for navigation, target detection, and situational awareness in unmanned systems.

Enhanced Battlefield Awareness: The need for real-time situational awareness and improved battlefield management is driving the deployment of advanced sensor systems. Military sensors provide critical data for decision-making, helping to enhance operational effectiveness and mission success.

Cybersecurity Threats: The growing sophistication of cyber threats and electronic warfare is prompting the military to adopt advanced sensors for cybersecurity applications. These sensors help in detecting and mitigating cyber threats, ensuring the integrity and security of military networks and communication systems.

Focus on Soldier Modernization Programs: Various nations are investing in soldier modernization programs to enhance the capabilities and survivability of their troops. This includes equipping soldiers with wearable sensors for health monitoring, communication, and situational awareness.

Restraints

High Costs: The development and deployment of advanced military sensors involve significant costs. High initial investments and maintenance expenses can be a barrier for some countries, particularly those with limited defense budgets.

Integration Challenges: Integrating new sensor technologies with existing military systems can be complex and challenging. Compatibility issues and the need for extensive testing and validation can delay the deployment of advanced sensor systems.

Regulatory and Compliance Issues: Stringent regulations and compliance requirements related to the export and use of military technologies can restrict market growth. International arms control agreements and export restrictions can limit the availability of advanced sensor technologies to certain regions.

Technological Limitations: Despite advancements, certain technological limitations such as power consumption, data processing capabilities, and environmental durability can restrain the performance of military sensors in specific applications.

Security Concerns: The risk of sensor systems being compromised or hacked poses a significant challenge. Ensuring the security and integrity of sensor data is critical, and any vulnerabilities can undermine the effectiveness of military operations.

Environmental Factors: Military sensors often need to operate in harsh and challenging environments. Extreme temperatures, humidity, dust, and electromagnetic interference can affect sensor performance and reliability, posing additional challenges for manufacturers.

Segmentation: Military Sensors Market

Airborne Segment to Grow Rapidly Backed by Surging Usage of Military Helicopters & UAVs: The airborne segment, which accounted for 27.03% of the military sensors market share in 2019, is expected to exhibit the highest compound annual growth rate (CAGR) in the coming years. This growth is attributed to the increasing utilization of UAVs, fighter jets, and military helicopters, particularly in countries like India, China, and the U.S.

Regional Insights: Military Sensors Market

Rising Modernization Programs to Boost Growth in North America: North America dominated the military sensors market in 2019, generating USD 9.32 billion in revenue. The region is poised for continued growth, driven by government initiatives aimed at conducting modernization programs and procuring advanced technologies such as 3D expeditionary long-range radar.

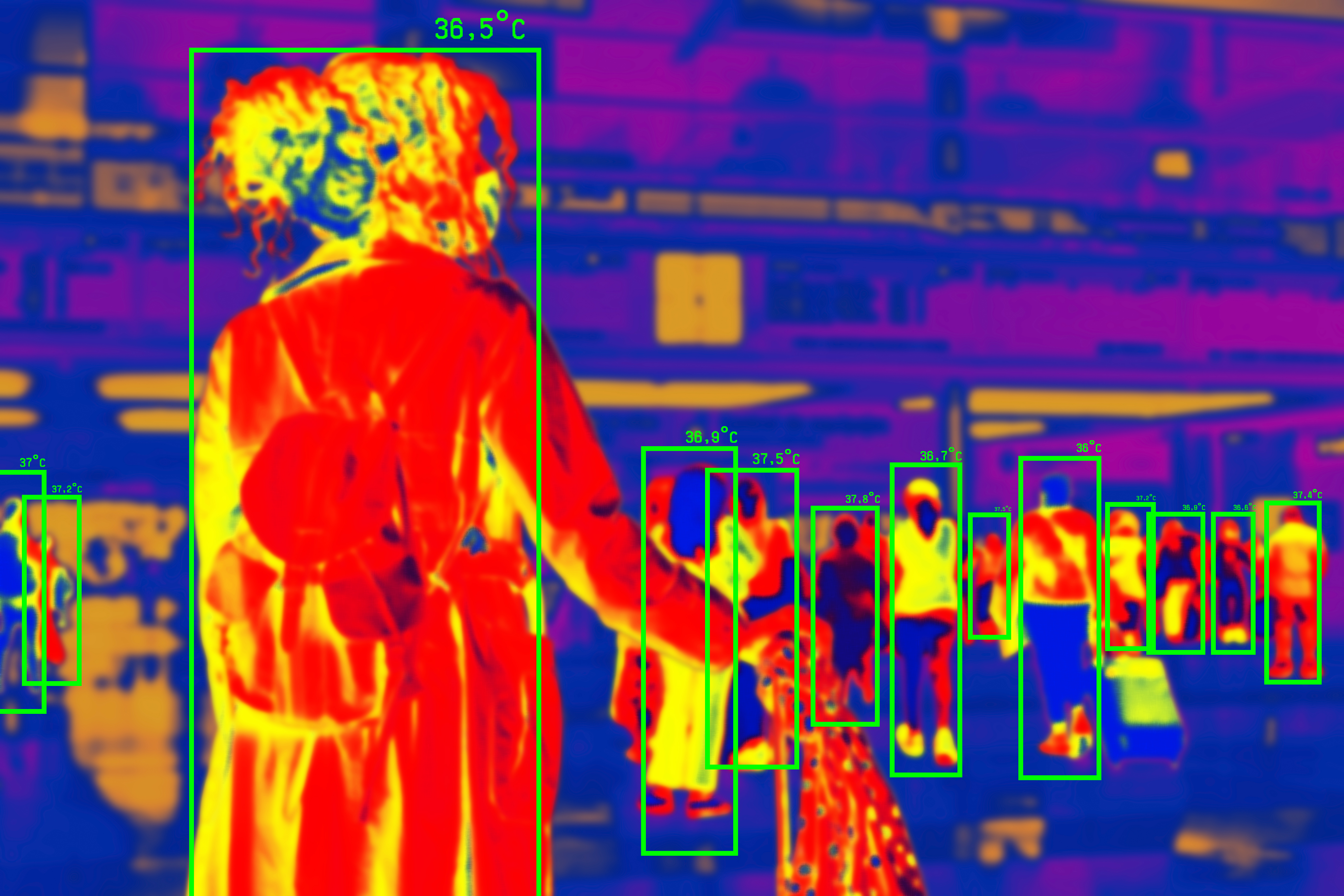

Europe to Grow Substantially Due to Increased Usage of EOIR Military Sensors: Europe is expected to experience significant growth, fueled by the rising adoption of electro-optical infrared (EOIR) military sensors by the U.K. Defense Ministry.

Asia Pacific to Benefit from Geopolitical Tensions and Territorial Disputes: Asia Pacific is projected to witness growth due to escalating territorial disputes between countries such as India and Pakistan, as well as geopolitical tensions between China and India. These factors are driving increased defense spending and the adoption of military sensor technologies in the region.

Competitive Landscape-

Key Players Focus on Gaining New Contracts to Compete with Their Rivals

The market for military sensors contains numerous prominent companies that are persistently striving to gain a competitive edge by procuring new contracts from government agencies. They are doing so to deliver their in-house military sensors. Below are two of the latest industry developments:

November 2020: BAE Systems won a contract worth USD 94 million from the U.S. Navy to deliver the latter with advanced technology. It will be used to develop several unmanned aerial systems.

May 2020: FLIR Systems received a second contract from the Army to provide unmanned aerial systems for the Soldier Borne Sensor program. The program is capable of offering real-time visual sector scanning.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.