Multi-State GST Compliance in India: Are Virtual Principal Places of Business (VPOB) Legal for E-Commerce Sellers?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Under India's Goods and Services Tax (GST) system, businesses must register for GST in every state where they plan to sell goods or services that are subject to tax. This makes it necessary for e-commerce sellers who do business all over India to have more than one GST registration. For small and medium-sized businesses (SMEs), setting up a physical office in every state is often not possible because of the cost. Because of this operational gap, more and more people are using Virtual Principal Place of Business (VPOB) services. This article looks at the legal validity of using a VPOB for GST registration and compliance in a critical way, focusing on the legal framework, procedural requirements, regulatory scrutiny, and best practices for making sure the law is followed.

The Law That Requires Registration in More Than One State

Section 22 of the Central Goods and Services Tax Act, 2017 says that suppliers must register if their total sales exceed a certain amount. According to Section 25(1) and Rule 8 of the CGST Rules, it is very important that each state or union territory that makes taxable supplies has its own registration.

The law doesn't say what a "Principal Place of Business" is in terms of geography or physical space, but it does say that it has to be listed in the registration application and that proof of it has to be given to the GST officer in charge of the area.

How to Figure Out the Principal Place of Business Under GST Law

Rules 8 and 18 of the CGST Rules say that the Principal Place of Business should be the main place where the top management keeps the books and does business.

To comply, applicants must send in one of the following:

• Proof of ownership (sale deed, municipal record);

• A lease or rental agreement with proof of the lessor's ownership; or

• A consent letter with a NOC from the owner, along with proof of ownership.

So, if you use a virtual address, it must meet these document standards and not be made up.

The rise of Virtual Principal Places of Business (VPOB)

A VPOB is basically a legally binding address given by a service provider, with the property owner's permission and agreement. It may also include mail handling, signage, and optional access to the property when needed.

Startups, D2C brands, and sellers on big e-commerce sites like Amazon and Flipkart often do this to follow state registration rules without having to pay a lot of extra costs.

The Court and the Government's View on VPOBs

The Supreme Court has not directly ruled that VPOBs are not a valid idea. However, because fly-by-night operators have been abusing the system, tax authorities have stepped up physical verification under Rule 25 of the CGST Rules.

In a lot of states, GST officers want to see:

• The actual site;

• The business signs;

• The furniture or minimal operational setup.

Section 29 says that if officers find the premises locked or not working and there is no good reason for it, they can either reject or cancel registrations.

For example, different High Courts have upheld cancellation orders when the declared place of business was not there or could not be reached during the inspection.

CBIC Circulars and Explanations

The Central Board of Indirect Taxes and Customs (CBIC) has said again that just filling out forms is not enough; there has to be some real-world activity as well.

On September 20, 2017, Circular No. 20/20/2017-GST said that strict physical verification is required whenever the applicant chooses an address that makes them doubt its authenticity.

Risks of not following the law and legal consequences

If you misuse a VPOB, you could lose your GSTIN, get demand notices for past tax debts, lose your Input Tax Credit (ITC) for vendors who work with that supplier, or be fined under Section 122 for giving false information.

Because of this, sellers need to make sure that the virtual office provider is trustworthy, the lease or consent is real, and the minimum verifiable infrastructure is kept up.

Best Ways to Make Sure VPOBs Are Legally Valid

To stay within the law, e-commerce sellers should take the following steps:

1. Do your homework: Only work with well-known virtual office providers who have real, accessible locations.

2. Make sure the rent or lease agreement is properly stamped and that the landlord has valid proof of ownership.

3. Signs and Getting In: Put up signs with the name of your business that are easy to see, and let officers inspect without any problems.

4. Keep Records: As required, the VPOB must keep basic books of accounts, invoices, and letters.

5. Regular Checks: Go to the location or ask for photos or videos to make sure there is no misuse.

6. What makes a VPOB different from an Additional Place of Business (APOB)

It is important to know the difference between a Principal Place of Business (the main office for state registration) and an Additional Place of Business (warehouses, godowns, and branch offices). Form GST REG-01 must accurately declare both. Misclassifying things can cause problems with compliance.

To sum up

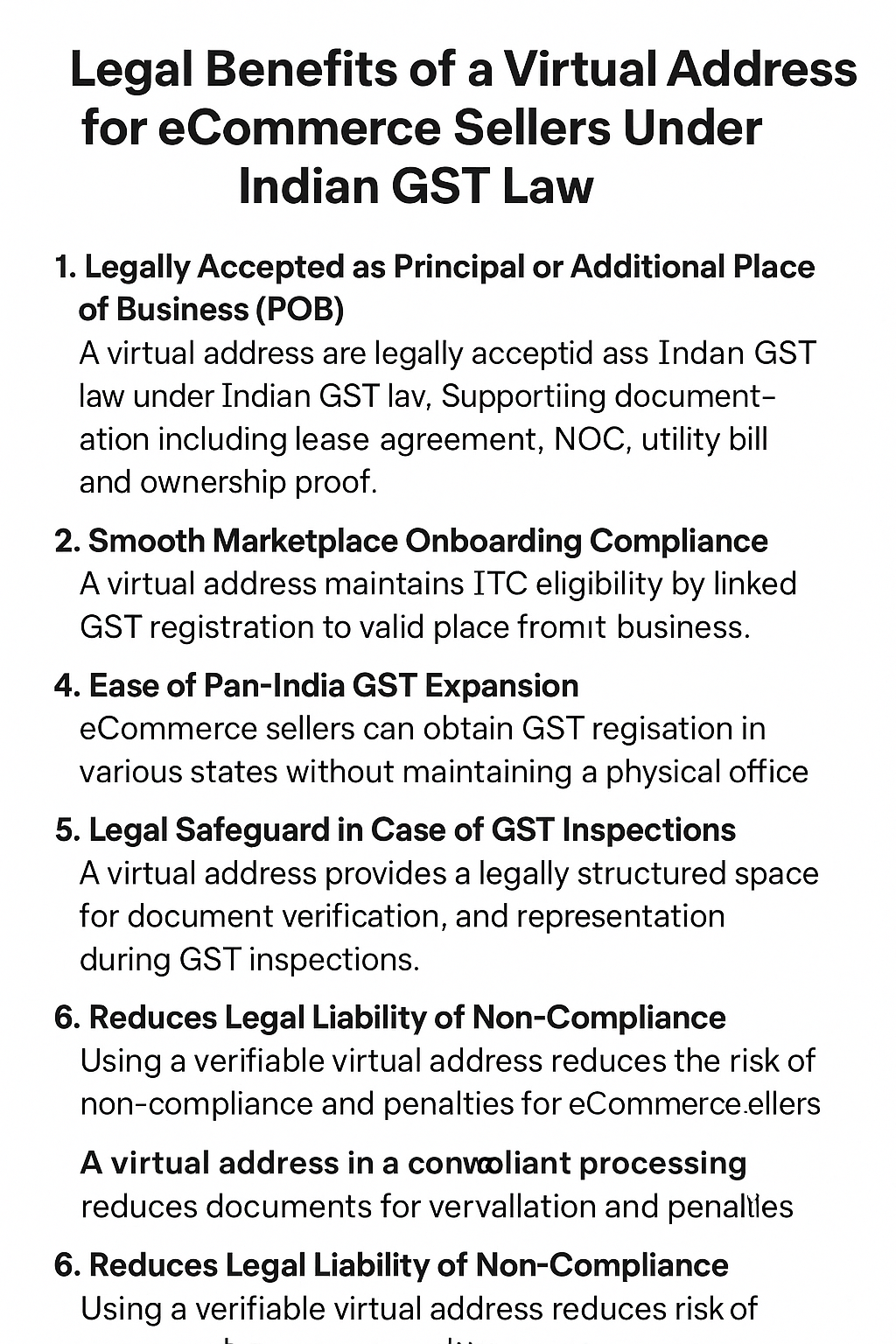

For India's e-commerce sector, Virtual Principal Places of Business have become a useful way to make sure that businesses follow the rules in more than one state. The legal validity of a VPOB, on the other hand, depends entirely on whether it is actually working and following the GST law's documentary requirements.

E-commerce sellers must strictly follow the rules and keep a close eye on things to avoid punishment. Because there is more scrutiny, it is best to think of VPOB arrangements as more than just a way to save money; they should also be seen as a real operational footprint that follows the letter and spirit of the GST framework.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.