Online Trading Platform Market Trends, Analysis, Growth, Size, Share, Forecast 2025-2033

The latest report by IMARC Group, titled “Online Trading Platform Market Report by Component (Platform, Services), Type (Commissions, Transaction Fees), Deployment Mode (On-premises, Cloud), Application (Institutional Investors, Retail Investors), and Region 2025-2033,” offers a comprehensive analysis of the online trading platform market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry.

The global online trading platform market size reached USD 10.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.39% during 2025-2033.

Online Trading Platform Market Dynamics:

- Emerging Trends in Technology Integration

The e-platforms for trading are in a phase of substantial changes owing to the use of advanced technologies such as Artificial Intelligence (AI). Machine Learning (ML) and the Blockchain technology. These developments are improving the capacity of the platforms through bespoke investment advice and automation of optimal trading strategies for the consumers. AI equipped analytics are giving the traders smart tools to work with and using block chains helps in guaranteeing safe and accurate transactions. The combination and use of these technologies will result in trouble free trading which fulfills the growing need for sophisticated tools among retail and institutional investors. Therefore, it is clear that firms with an inclination towards technological advancement will have a strategic advantage as well as a favorable position.

- Growth through Increased Accessibility and Global Reach

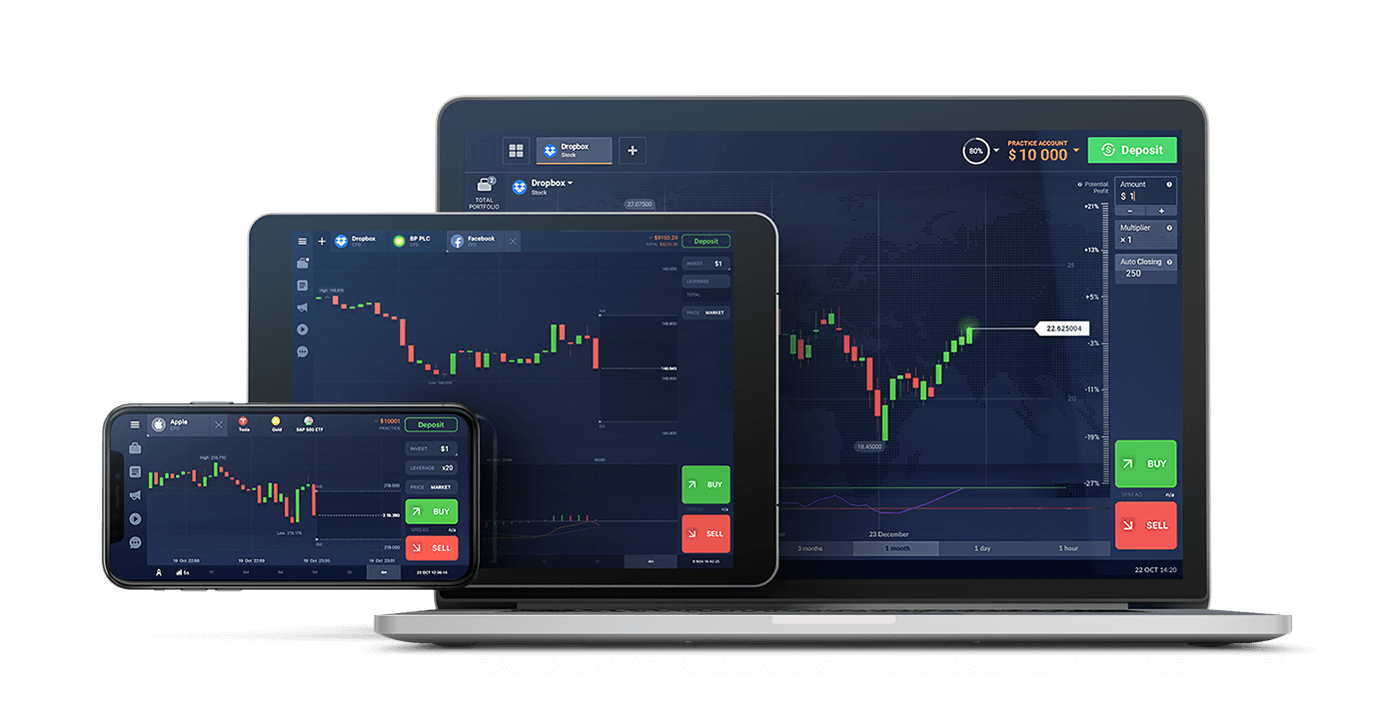

An important trend in the online trading platform market is the increase in the number of internet connections and the number of users of smartphones. This increased reach has made trading more inclusive as customers from various backgrounds can trade in financial markets. Platforms are incorporating intuitive designs and mobile-first strategies, making trading possible to the clients with little or no financial knowledge. And, the customers have also increased their engagement on a global scale since platforms enable cross trading with dividable currencies, use of real-time global market information and other features of local adaptation. There is tremendous room for growth that is apparent in all markets and all regions, with emerging markets becoming one of the areas of greater concern for platform providers.

- Future Demand Shaped by Regulatory Developments and User Preferences

Policymaking increasingly dominates the future of demand transformation, with respect to online trading platforms. Regulators and governments are focusing more and more on the protection of the investors, increasing the level of openness and compliance. All this is making the platforms put strict security requirements to themselves and follow the rules. At the same time, users are more inclined towards ethical and sustainable trading practices, making platforms look to provide options for ESG (Environmental, Social, and Governance) investments. The aforementioned trends appear to enhance the focus on trust and responsibility, which means that the projection for platforms satisfying the legal requirements and moralth standards is quite promising.

Online Trading Platform Market Trends:

The online trading platform industry is at an inflection point as there are changes brought about by technology, greater customer focus innovations and a changing regulatory environment. The increasing use of AI and Blockchain technology changed the nature of the platform and the services it offers to traders, providing better analytics, better transparency and security. At an equally all expansion of platforms on a global scope is happening as they adopt mobile-first approaches and localization for an expanding and varied audience.

ESG investments and ethical investing are also emerging as key trends as they correspond to the changing values of the investing community. Compliance to regulations is also providing design requirements such as security and transparency which will provide a better trading experience. As a whole, all of these trends and others will create an active and strong market that will be able to meet the needs of a global market that is tehnologically oriented.

Online Trading Platform Market Segmentation:

Breakup by Component:

- Platform

- Services

Platform accounts for the majority of the market share.

Breakup by Type:

- Commissions

- Transaction Fees

Commissions holds the largest share of the industry.

Breakup by Deployment Mode:

- On-Premises

- Cloud

Cloud represents the leading market segment.

Breakup by Application:

- Institutional Investors

- Retail Investors

Institutional investors exhibits a clear dominance in the market.

Breakup by Region:

- North America (USA, Canada)

- Europe (Germany, France, UK, Italy, Spain, Russia, others)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, others)

- Middle East/Africa

- Latin America (Brazil, Mexico, others)

North America leads the market, accounting for the largest online trading platform market share.

Top Online Trading Platform Market Leaders:

- Ally Financial Inc.

- Cboe Global Markets Inc.

- Charles Schwab & Co. Inc.

- Chetu Inc.

- Devexperts LLC

- E-Trade Financial Corporation (Morgan Stanley)

- FMR LLC

- Interactive Brokers LLC

- MarketAxess Holdings Inc.

- Plus500 Ltd

- Tradestation Group Inc. (Monex Group Inc.)

About US:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.