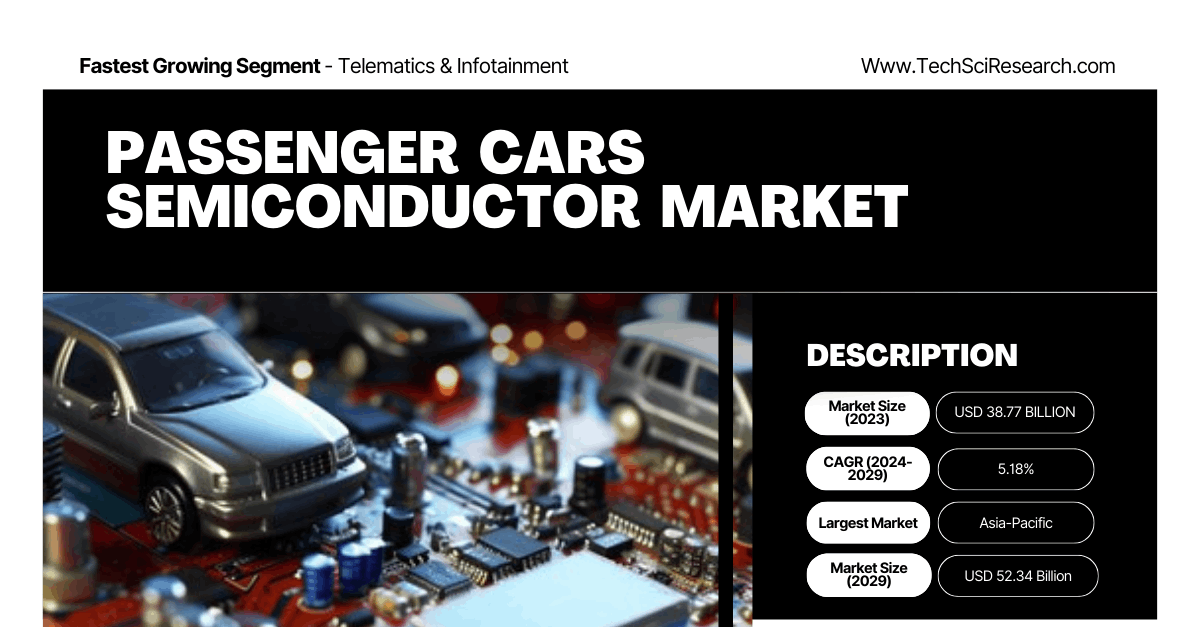

Passenger Cars Semiconductor Market Demand: Analyzing Future Trends and $52.34 Billion Projection

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The global passenger cars semiconductor market, as per the TechSci Research report, is valued at USD 38.77 billion in 2023 and is projected to reach USD 52.34 billion by 2029, with a CAGR of 5.18% from 2023 to 2029. Semiconductors play an essential role in passenger vehicles, powering advanced systems like ADAS, infotainment, and telematics.

The report delves into market growth drivers, challenges, government initiatives, competitive landscape, and trends that shape this dynamic sector.

Introduction

Overview of Semiconductors in Automotive Technology

Semiconductors are critical for automotive electronics, managing functions from vehicle safety to infotainment. They regulate power distribution, enable high-tech safety features, and facilitate electric vehicle (EV) efficiency.

Importance in Passenger Cars

In modern vehicles, semiconductors perform numerous roles including power management, environmental monitoring, and connectivity. As consumer demand for safety and connectivity grows, the semiconductor market is increasingly important for passenger cars.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on the "Passenger Cars Semiconductor Market” @ https://www.techsciresearch.com/report/passenger-cars-semiconductor-market/19310.html

Passenger Cars Semiconductor Market Growth Drivers

- Advancements in Automotive Technology

The rise of advanced driver assistance systems (ADAS), telematics, and vehicle electrification propels semiconductor demand. ADAS requires sensors and processors that interact in real-time, powered by semiconductor technology to ensure safety and responsiveness.

- Surge in Electric Vehicle Adoption

With the global shift towards sustainable energy, electric vehicle adoption is rising. EVs require a higher semiconductor content per vehicle than internal combustion engines, increasing demand for these components, especially for power management and battery efficiency.

- Increased Demand for Safety and Infotainment Features

Consumer interest in safety and infotainment features has also fueled semiconductor demand. Safety technologies, including lane departure warnings, adaptive cruise control, and parking assistance, all rely on semiconductor-driven sensors.

- Regulatory Push and Government Initiatives

Policies worldwide aimed at reducing emissions have encouraged EV adoption through tax incentives and subsidies. This support accelerates the demand for semiconductors, crucial in electric powertrains and battery management systems, alongside investments in charging infrastructure.

Passenger Cars Semiconductor Market Challenges

Operational and Environmental Constraints

Semiconductors in vehicles are subject to extreme conditions, from temperature fluctuations to high vibration levels, which can lead to operational failures. Developing durable, reliable semiconductors is essential to withstand these harsh conditions.

High Costs and Complexity

The initial cost of semiconductor development is high due to the complex manufacturing and precision required. Smaller companies may find it challenging to compete with larger firms that benefit from economies of scale, creating a competitive pricing environment that can impact profitability.

Technological Constraints and Limited Supply Chain Resilience

The semiconductor industry has experienced supply chain bottlenecks, further intensified by high demand. This scarcity increases prices and impacts production timelines for automakers relying on semiconductor supply.

Passenger Cars Semiconductor Market Segmentation

By Component Type

- Sensors: Sensors hold a dominant position, playing a crucial role in vehicle safety and ADAS. These include radar, lidar, and camera sensors that provide real-time data for various functions.

- Microcontrollers and Processors: Used in infotainment and control systems, microcontrollers manage vehicle performance, ensuring smooth operation.

- Memory and Storage: Essential for infotainment and telematics, memory components store and manage data in connected systems.

- Power Semiconductors: Vital in electric vehicles, power semiconductors manage power conversion and efficiency in high-energy systems like battery and powertrain control.

By Application Type

- Safety Systems: As regulatory bodies push for better safety standards, semiconductors are increasingly used in safety-related applications, including collision avoidance, lane assist, and autonomous braking.

- Powertrain Systems: These systems, essential in EVs, leverage semiconductors for efficient energy usage and vehicle performance.

- Infotainment and Connectivity: With growing consumer interest in in-car entertainment and navigation, infotainment systems rely heavily on semiconductor technology for connectivity and user experience enhancement.

By Region

- North America: High EV adoption and strong demand for safety features drive growth in North America.

- Europe: Stringent emission regulations and government incentives make Europe a significant market for automotive semiconductors, especially in EV powertrains.

- Asia-Pacific: As the world’s largest car manufacturing hub, the Asia-Pacific region is witnessing rapid growth in semiconductor demand, spurred by the automotive industry.

-

Rest of the World: Other regions are catching up with EV adoption and advanced automotive features, creating a growing market for passenger car semiconductors.

Government Initiatives Promoting Electric Vehicles

Emission Reduction Goals and Subsidies

Governments globally are setting ambitious emission reduction targets. Subsidies, tax breaks, and rebates are provided to both consumers and automakers to support electric vehicle adoption. These incentives lower the upfront cost of EVs and indirectly drive semiconductor demand for battery management and powertrain systems.

Investment in Charging Infrastructure

To combat "range anxiety," governments are also investing in public EV charging infrastructure. Semiconductor solutions play a key role in these charging stations by enabling efficient power electronics and real-time communication modules.

Competitive Landscape of Passenger Cars Semiconductor Market

Leading Players

The market is highly competitive, with established companies such as Robert Bosch GmbH, Infineon Technologies, NXP Semiconductors, and Texas Instruments leading in production. These companies have a significant advantage due to their large R&D budgets and established market presence.

Market Consolidation Trends

The market is witnessing increased consolidation, with larger players acquiring smaller firms to expand their portfolios and capabilities. This trend allows leading companies to enhance their offerings for ADAS, EV powertrains, and connected technologies.

Pricing Pressure and Profit Margins

High competition results in pricing pressures, impacting profit margins for both semiconductor producers and automotive manufacturers. To remain competitive, companies must balance cost efficiency with innovation, investing in R&D for advanced and affordable solutions.

Technological Trends Shaping the Passenger Cars Semiconductor Market

- Autonomous Driving and the Role of AI

Autonomous driving technology relies on complex networks of sensors and processors. As automakers invest in self-driving capabilities, demand for AI-enabled semiconductors grows. These chips enable the car’s decision-making and response mechanisms in autonomous and semi-autonomous settings.

- 5G Connectivity and Telematics

5G technology is transforming the automotive sector by enabling high-speed data transfer in telematics systems. Real-time connectivity for infotainment, navigation, and fleet management requires advanced semiconductor solutions for seamless integration and enhanced performance.

- Power Efficiency Innovations in EVs

Power efficiency is crucial in EV technology. New semiconductors are engineered for high efficiency, supporting longer battery life and faster charging. Innovations like silicon carbide (SiC) and gallium nitride (GaN) semiconductors are essential for reducing energy losses and improving EV power management.

Future Outlook of Passenger Cars Semiconductor Market

- Opportunities in Emerging Markets

The passenger cars semiconductor market has high growth potential in emerging markets, where automotive technology adoption is still developing. As economies grow, demand for ADAS, EVs, and infotainment systems will increase, driving semiconductor demand in these regions.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=19310

Customers can also request 10% free customization on this report.

- Integration of Advanced Interfaces and User Experience

As vehicles become more user-centric, demand for interactive displays and voice recognition is expected to rise. These interfaces require sophisticated semiconductors for functionality, accuracy, and reliability in user experiences.

- Government Policies Supporting Green Technology

Government regulations on emissions and energy consumption are creating an environment conducive to innovation in green automotive technology. The semiconductor market is set to benefit as governments promote EV production and sustainable energy solutions in the automotive sector.

Key Players in the Passenger Cars Semiconductor Market

Major companies in the global passenger cars semiconductor market include:

- Robert Bosch GmbH

- Infineon Technologies AG

- STMicroelectronics International N.V.

- NXP Semiconductors N.V.

- Toshiba Corporation

- Semiconductor Components Industries, LLC

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Samsung Electronics Co., Ltd.

- Denso Corporation

These companies are actively engaged in R&D to innovate semiconductor technology and address emerging automotive needs.

Conclusion

The global passenger cars semiconductor market is a dynamic and rapidly evolving sector within the automotive industry, driven by technology advancements, regulatory support, and increased consumer demand for electric and autonomous vehicles.

Semiconductors are essential for enabling the transition to safe, efficient, and connected vehicles. Overcoming challenges such as cost and operational reliability remains critical for sustained growth.

With rising EV adoption, autonomous driving advancements, and 5G integration, the semiconductor industry is set to play a pivotal role in shaping the future of the automotive sector.

You may also read:

Passenger Car Green Tire Market Overview: Key Trends and Insights for 2029 [CAGR: 4.59%]

Off-Road Vehicle Market Forecast: Growth from USD 15.52 Billion to USD 19.37 Billion

Automotive Aluminum Market Growth: What the 5.85% CAGR Means for Industry Players

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

![Automotive Plastic Fasteners Market Forecast: [USD 2.74 Billion], [7.74%] Growth Rate Expected by 2028](https://indibloghub.com/public/images/courses/6799ab68c98b19867_1738124136.png)