(PLR) Top 5 Killer Candle Patterns You Can't Ignore Review: A Practical Guide for Traders

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

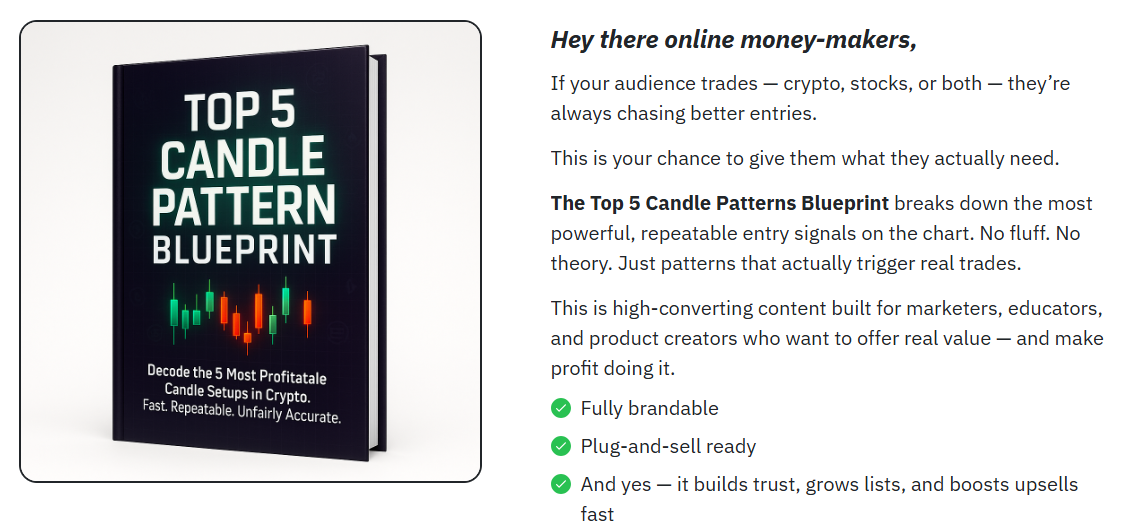

Candlestick patterns are an essential component of technical analysis in trading. They provide critical insights into price action and market sentiment, helping traders make informed decisions. Among the numerous candlestick patterns available, there are a few that stand out due to their accuracy and reliability in predicting market trends. (PLR) Top 5 Killer Candle Patterns You Can't Ignore offers an in-depth look at five of the most powerful candlestick patterns that every trader should know. This review will explore the content of this PLR product, its effectiveness, and whether it can be a valuable resource for traders at different experience levels.

What is the (PLR) Top 5 Killer Candle Patterns You Can't Ignore?

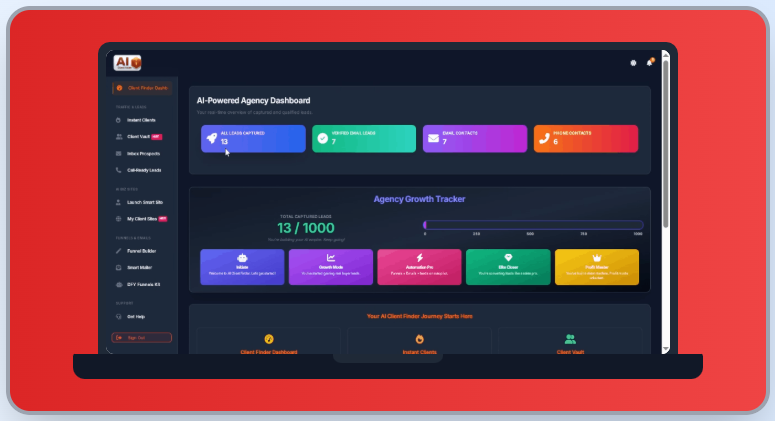

The (PLR) Top 5 Killer Candle Patterns You Can't Ignore is a Private Label Rights (PLR) product designed for individuals in the trading and investment niche. It focuses on five specific candlestick patterns that are considered highly effective in predicting price movements. As a PLR product, it allows users to modify, resell, or repurpose the content, making it a versatile resource for marketers, traders, and educators alike.

This product comes with a comprehensive guide that explains each of the five candlestick patterns in detail. It includes not just the visual representation of the patterns but also the best times and market conditions to apply them, making it practical for traders who are eager to enhance their trading strategies.

The 5 Killer Candle Patterns Covered in the Guide

The guide is structured around five of the most recognized and valuable candlestick patterns. These patterns are widely used in both beginner and advanced trading strategies. Here’s a quick overview of the patterns covered:

1. Engulfing Patterns (Bullish and Bearish):

The Engulfing pattern is a two-candle reversal pattern that can indicate potential trend changes. A Bullish Engulfing pattern appears after a downtrend, signaling a potential reversal to the upside, while the Bearish Engulfing signals a possible reversal to the downside after an uptrend. This pattern is crucial for spotting potential trend shifts.

2. Doji Candlestick:

The Doji candlestick is one of the most important reversal signals, indicating indecision in the market. When a Doji appears after a strong trend, it often signifies that the market is losing momentum, and a reversal could be on the horizon. The pattern is particularly powerful when combined with other indicators.

3. Hammer and Hanging Man:

The Hammer and Hanging Man are single candlestick patterns that occur at the bottom or top of a trend. The Hammer is a bullish reversal pattern that occurs after a downtrend, signaling that buyers might be stepping in. On the other hand, the Hanging Man is a bearish reversal pattern that appears after an uptrend, indicating that selling pressure could be taking control.

4. Morning Star and Evening Star:

The Morning Star is a bullish reversal pattern that occurs after a downtrend, while the Evening Star is the bearish counterpart, occurring after an uptrend. These three-candle patterns are widely recognized for their ability to predict market reversals with a high degree of accuracy.

5. Shooting Star:

The Shooting Star is a bearish reversal candlestick that appears after an uptrend. It has a small body and a long upper wick, signifying that buyers tried to push the price higher but were eventually overpowered by sellers. It’s considered a strong signal of a price reversal.

How Can Traders Benefit from These Patterns?

The Top 5 Killer Candle Patterns guide is designed to help traders better understand market behavior and improve their decision-making process. By mastering these key candlestick patterns, traders can:

• Identify Market Reversals: Many of these patterns are reversal indicators, meaning they signal potential changes in market direction. Recognizing these patterns early can help traders enter trades at more favorable prices.

• Enhance Timing: Candlestick patterns help traders fine-tune their entry and exit points. By using these patterns in conjunction with other indicators, traders can improve the timing of their trades.

• Simplify Market Analysis: Understanding candlestick patterns can simplify market analysis by providing clear visual cues that complement other technical analysis tools. These patterns are easy to spot and can be incorporated into any trading strategy.

Is (PLR) Top 5 Killer Candle Patterns You Can't Ignore Worth It?

The Top 5 Killer Candle Patterns PLR product is a valuable resource for traders who want to integrate candlestick patterns into their strategies. The content is well-organized and provides actionable information that is easy to follow. Whether you are a novice trader looking to understand the basics or an experienced trader seeking to refine your strategy, this guide provides solid insights.

However, as with any trading resource, it’s important to use the information in context. The patterns covered in the guide are effective, but they should not be relied upon exclusively. A balanced approach that includes additional technical analysis tools and proper risk management is essential for success in trading.

For marketers and educators in the trading niche, the PLR nature of the product offers flexibility. You can rebrand and resell the content, or modify it to suit your audience's needs. For traders, it serves as an excellent learning tool to familiarize themselves with key candlestick patterns.

Pros and Cons of the Product

Pros:

• Comprehensive Coverage: The guide covers five essential candlestick patterns in-depth, making it a practical resource for traders.

• Easy to Understand: The content is beginner-friendly while still offering value for experienced traders.

• Flexible: As a PLR product, it can be rebranded and used by marketers or educators in the trading niche.

• Actionable Insights: The guide doesn’t just explain the patterns but also offers practical advice on when and how to use them.

Cons:

• Basic for Advanced Traders: While the guide is perfect for beginners, more advanced traders may find it too simplistic.

• No In-Depth Technical Analysis: The focus is mainly on candlestick patterns, and it doesn’t go into greater detail on integrating these patterns with other tools.

• PLR Restrictions: As with all PLR products, it’s important to make sure that any modifications or rebranding are done thoughtfully to avoid generic content.

Conclusion

The (PLR) Top 5 Killer Candle Patterns You Can't Ignore is a valuable resource for traders looking to improve their technical analysis skills. The guide covers five powerful candlestick patterns that can enhance market analysis and provide key insights for potential trade entries and exits. While the product is geared more towards beginners, it is also helpful for intermediate traders looking to refine their strategies.

As a PLR product, it offers flexibility for marketers and educators who want to use the content in their own courses or resell it. If you're looking for a practical and straightforward guide to candlestick patterns, this product is worth considering.

👉 You can explore more details on the official product page here

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.