Polyamide Market Outlook 2025: Trends, Drivers, and Future Growth

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The Polyamide Market Outlook presents a promising growth trajectory for this versatile polymer, which is essential in the manufacturing of a wide range of materials used across industries such as automotive, textiles, electronics, and consumer goods. As of 2023, the global polyamide production capacity stood at 15,300 KT, with projections indicating it will rise to 17,800 KT by 2032. This growth is underpinned by increased demand from emerging markets and technological advancements in polyamide applications. The Asia Pacific region dominates the global polyamide market, accounting for over 50% of global production capacity. Among key global producers, China is the leading manufacturer of PA 66, while North America remains a prominent player in PA 6 production. Despite these robust production levels, the plant capacity utilization of polyamides stood at 55% in 2023, signaling potential for capacity optimization and further market expansion.

This article provides an expert-level analysis of the current polyamide market dynamics, highlighting supply and demand trends, regional disparities, key drivers of growth, and the future outlook for polyamide production across various applications.

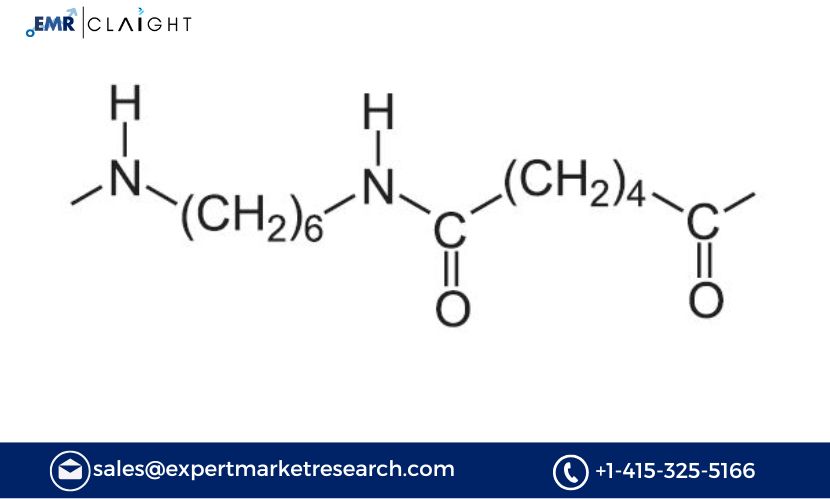

What Are Polyamides?

Polyamides are synthetic polymers characterized by the presence of amide linkages in their molecular structure. Commonly known by the trade name Nylons, polyamides are used in a broad spectrum of applications, thanks to their excellent mechanical properties, durability, heat resistance, and chemical resistance. The most commonly used types of polyamides are PA 6 (Polyamide 6) and PA 66 (Polyamide 66), both of which are used extensively in the production of fibers, films, automotive parts, electrical components, and consumer goods.

Polyamide 6, which is derived from caprolactam, is primarily used in fibers for textiles, industrial applications, and consumer goods. Polyamide 66, produced from hexamethylenediamine and adipic acid, is known for its superior strength and heat resistance and is frequently used in engineering plastics, automotive applications, and high-performance components.

Global Supply and Demand Trends

Global Production Capacity and Expansion

As mentioned, the global production capacity for polyamides reached approximately 15,300 KT in 2023, and it is forecasted to grow to 17,800 KT by 2032. This increase in production capacity is reflective of several key trends within the market:

Technological Advancements: Ongoing innovations in the processing technologies for polyamide production are leading to improved efficiency, better product quality, and increased capacity. These technological advances allow producers to meet the growing demand for high-performance polyamides across industries.

Growth in End-Use Applications: Polyamides are witnessing increasing demand in sectors such as automotive, construction, electronics, and textiles. The growth of the electric vehicle (EV) market, where polyamide components are used for lightweight, durable parts, is also contributing to the demand for higher production capacities.

Sustainability: The push for sustainable materials and the increasing interest in bio-based polyamides are helping to stimulate further investments in production facilities that can handle the demand for environmentally friendly products.

Regional Dynamics and Key Market Players

Asia Pacific: The Leading Region

The Asia Pacific region dominates the global polyamide market, representing more than 50% of the global production capacity. Among the key players in this region, China stands out as the largest producer of PA 66, while countries like Japan, South Korea, and India also play significant roles in polyamide production.

China’s dominance in PA 66 production is driven by its significant chemical manufacturing base, availability of raw materials, and established infrastructure for large-scale production. In addition, the rapid growth of end-use industries such as automotive, electronics, and consumer goods in China has fueled demand for polyamides, particularly PA 66, which is required for high-strength, heat-resistant applications in these sectors.

North America and Europe

In North America, the United States stands as the leader in PA 6 production. The region’s polyamide production is supported by its robust automotive, electronics, and industrial manufacturing sectors, where polyamide components are used extensively. Furthermore, the renewable energy sector in North America, especially wind turbines, uses polyamide-based composites, providing an additional growth avenue for the market.

Europe is another key market for polyamides, with countries like Germany and France being significant contributors to production and consumption. The automotive industry in Europe, with its emphasis on lightweight materials and fuel efficiency, is a major consumer of polyamides, particularly in engineered plastics and automotive parts.

Emerging Markets and Growth Drivers

The Middle East and Africa regions are seeing a growing demand for polyamides due to expanding industrial sectors, particularly in the oil and gas, construction, and manufacturing industries. The Latin American market is also emerging as a potential growth area, with increasing infrastructure development and a growing demand for lightweight, durable materials in the automotive and consumer goods sectors.

Key Drivers of Polyamide Market Growth

1. Automotive Industry Expansion

The automotive industry is one of the primary drivers of the polyamide market, with PA 6 and PA 66 being integral to the production of automotive parts such as bumpers, radiator tanks, fuel lines, airbags, and gear systems. The increasing demand for lightweight materials to improve fuel efficiency and reduce emissions in vehicles is pushing the automotive industry to adopt more polyamide-based components. Furthermore, with the rise of electric vehicles (EVs), polyamides are being used to make lightweight, high-performance components that help to reduce the overall weight of the vehicles and improve battery efficiency.

2. Textile Industry Demand

Polyamides, particularly PA 6, are widely used in the textile industry for manufacturing fibers and yarn for applications such as clothing, industrial fabrics, and carpets. The growth in the global fashion industry and rising consumer demand for high-performance fabrics continue to drive the demand for polyamide fibers, which offer durability, strength, and resistance to abrasion.

3. Electronics and Electrical Industry

The use of polyamides in the electronics industry is another growth driver. Polyamides are increasingly used in the production of electrical insulation, connectors, switchgear, and electrical components, where their heat resistance and electrical insulating properties are critical. With the growing demand for consumer electronics, such as smartphones, computers, and wearable devices, the market for polyamide-based materials in electronics is expected to expand further.

4. Aerospace Industry

The aerospace industry, which requires lightweight, durable, and heat-resistant materials for aircraft parts and components, is another significant consumer of polyamides. As the global demand for air travel grows and the need for fuel-efficient aircraft increases, the use of polyamide-based composites and components in aerospace applications will continue to rise.

5. Bio-based Polyamides

The rising focus on sustainability has prompted manufacturers to invest in bio-based polyamides, derived from renewable resources such as castor oil. These polyamides offer similar performance to traditional petroleum-based polyamides, but with a reduced environmental impact. As consumers and industries increasingly demand more eco-friendly materials, bio-based polyamides are expected to become a significant segment within the overall polyamide market.

Challenges

1. Volatility in Raw Material Prices

Polyamide production relies on key raw materials like caprolactam for PA 6 and hexamethylenediamine and adipic acid for PA 66. The price volatility of these raw materials, especially when derived from petrochemical feedstocks, can impact the cost structure of polyamide manufacturers. This volatility is driven by factors such as crude oil price fluctuations, geopolitical tensions, and natural disasters.

2. Environmental Concerns

While polyamides offer excellent performance, their environmental impact, particularly in terms of non-biodegradability and waste disposal, remains a challenge. The focus on sustainability is prompting manufacturers to explore biodegradable and recyclable alternatives to traditional polyamides, although this is still a work in progress.

3. Overcapacity Risks

As polyamide production capacities expand to meet growing demand, there is a risk of overcapacity in certain regions, particularly if production exceeds market requirements. This overcapacity could lead to price reductions and profit margin pressures, especially if manufacturers cannot diversify into new markets or applications.

Future Outlook: Opportunities and Growth Areas

The Polyamide Market Outlook remains positive, with substantial growth anticipated across key end-use industries. As the demand for lightweight materials, high-performance polymers, and sustainable solutions continues to rise, polyamides are poised to play an even more significant role in shaping the future of manufacturing.

By 2032, global polyamide production capacity is expected to reach 17,800 KT, reflecting the market's ongoing expansion. The primary growth drivers will include the automotive, textile, electronics, and aerospace industries, as well as innovations in bio-based polyamides.

Media Contact

Company Name: Claight Corporation

Contact Person: Lewis Fernandas, Corporate Sales Specialist — U.S.A.

Email: [email protected]

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.