Polyvinyl Chloride Prices: Latest Trend, Chart and Demand

Polyvinyl Chloride Prices End of The Last Quarter:

- United States: 875 USD/Ton

- China: 755 USD/Ton

- India: 965 USD/Ton

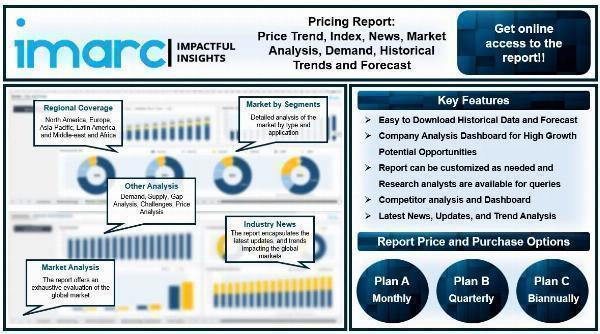

The latest report by IMARC Group, titled " Polyvinyl Chloride Pricing Report 2024: Price Trend, Chart, Industry Analysis, News, Demand, Historical and Forecast Data," provides a thorough examination of the price trend. This report delves into the Price of Polyvinyl Chloride globally, presenting a detailed analysis, along with an informative Price Chart. Through comprehensive price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the demand, analyzing how it impacts industry dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this Price report an invaluable resource for industry stakeholders.

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

Request For a Sample Copy of the Report: https://www.imarcgroup.com/polyvinyl-chloride-pricing-report/requestsample

Polyvinyl Chloride Price Trend

The polyvinyl chloride (PVC) prcies has been undergoing notable shifts due to a range of global factors. PVC, a critical material for construction and manufacturing, sees its demand closely linked to the performance of these industries. Increased infrastructure projects and construction activities have fueled higher demand recently. Economic indicators, such as inflation rates and labor market conditions, also shape PVC market dynamics. For instance, strong employment reports indicate a robust economy, which could lead to greater consumption of PVC products. Meanwhile, supply constraints—caused by events like the Baltimore bridge collapse and unfavorable weather—have tightened the market, pushing prices upward. Additionally, interest rates and economic policies impacting industrial activity and exports play an essential role in shaping PVC market trends.

Polyvinyl Chloride Prices Analysis

In North America, PVC prices rose during the first quarter of 2024. This increase was largely driven by growing demand from the construction sector and limited tank supplies, which were further strained by logistical issues stemming from the Baltimore bridge collapse. This incident disrupted PVC transportation, compounding the effects of adverse weather. Although contractionary interest rates were designed to temper industrial growth, the PVC market remained resilient. In January, PVC export values dropped by 5.2%, indicating higher inventory levels, yet prices surged by 7% from the previous quarter, reflecting strong market conditions despite the challenges.

In the Asia-Pacific region, PVC prices declined, primarily due to weak demand in sectors such as Chinese construction and a market oversupply. Even though crude oil prices were elevated, which typically drives PVC costs higher, ample supplies softened the price impact. Market confidence was shaky, leading to fluctuating prices. Producers in countries like Vietnam and China offered discounts to stimulate sales, demonstrating the broader market struggles. In contrast, Japan saw a 3.7% price increase due to supply constraints, illustrating regional differences within the APAC PVC market.

In Europe, PVC prices rose due to moderate demand and a shortage of supply. Logistical disruptions and geopolitical tensions, such as unrest in the Red Sea, coupled with OPEC+ production cuts that drove up crude oil prices, contributed to higher PVC costs. A narrow gap between supply and demand, especially in Germany, kept prices elevated. Rising input costs and logistical issues during the Easter holidays further strained the supply chain, keeping prices high despite a flat demand backdrop.

In the Middle East and Africa, particularly in Saudi Arabia, PVC prices increased due to strong demand from the construction sector and limited stock availability. Stable ethylene prices supported this upward trend, while seasonal factors and a positive year-over-year price change reinforced market strength. Improved business conditions in the region's construction sector further fueled demand, helping sustain higher price levels throughout the quarter.

In South America, PVC prices trended upward, influenced by limited supply and moderate demand growth. Supply chain disruptions, particularly those linked to the Baltimore bridge collapse, affected regional logistics and tightened available stock. Weather-related issues and strategic price adjustments by traders to protect margins also impacted the market. However, a slight uptick in downstream demand toward the end of the quarter helped support rising prices, suggesting a cautiously optimistic market outlook despite external challenges.

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

https://www.imarcgroup.com/polyvinyl-chloride-pricing-report

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.