Price of Lithium Fluoride, Growth, Monitor, Price Trend and Demand

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

- United States: 57510 USD/MT

The price difference between the first and second halves of the quarter was -3%. Currently, the latest price of lithium fluoride CIF in the US is 57,510 USD/MT. The latest report by IMARC Group, titled "Lithium Fluoride Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data" delivers a comprehensive analysis of Lithium Fluoride prices on a global and regional scale, highlighting the pivotal factors contributing to price changes. This detailed examination includes spot price evaluations at key ports and an analysis of pricing structures, such as Ex Works, FOB, and CIF, across North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Lithium Fluoride Prices December 2023:

- United States: 57510 USD/MT

- South Korea: 54515 USD/MT

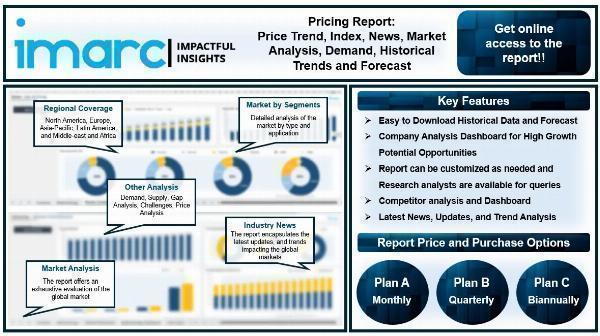

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting Lithium Fluoride price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/lithium-fluoride-pricing-report/requestsample

Lithium Fluoride Price Trend- Q4 2023

The Lithium Fluoride market is primarily driven by its diverse applications across various industries, coupled with the growing demand for lithium-ion batteries and pharmaceuticals. As a highly versatile compound, Lithium Fluoride finds extensive use in the manufacturing of specialty glasses and ceramics, where its unique properties enhance the optical and mechanical characteristics of the final products. Additionally, lithium fluoride's role in nuclear reactors as a coolant and neutron absorber contributes to its market growth, especially in the energy sector. The burgeoning demand for rechargeable lithium-ion batteries, driven by the increasing adoption of electric vehicles and renewable energy storage solutions, serves as a significant catalyst for the Lithium Fluoride market. As a key component in the electrolyte formulation of these batteries, Lithium Fluoride plays a crucial role in enhancing battery performance and longevity. Moreover, the reliance of the pharmaceutical industry on Lithium Fluoride for the synthesis of various pharmaceutical compounds further propels market expansion. Lithium fluoride's applications in dental care products, such as toothpaste and mouthwash, also contribute to its steady market growth.

Lithium Fluoride Market Analysis

The global lithium fluoride market size reached US$ 623.7 Million in 2023. By 2032, IMARC Group expects the market to reach US$ 1644 Million, at a projected CAGR of 11.40% during 2023-2032. In the fourth quarter of 2023, the Lithium Fluoride market in North America exhibited stability, characterized by a moderate supply and a bearish market atmosphere. Demand from the lithium hexafluorophosphate market in the cathode active material (CAM) manufacturing sector was subdued, with purchases primarily stimulated by immediate demand. Market sentiments overall found equilibrium, and procurement activities from Asian market participants remained steady. Additionally, in the Asia-Pacific (APAC) region, the Lithium Fluoride market demonstrated stability throughout the fourth quarter of 2023, characterized by abundant supply and relatively subdued to moderate demand. Within the Indian domestic market, sentiments surrounding Lithium Fluoride remained steady, accompanied by a slight uptick in prices. Meanwhile, in China, the market exhibited bullish tendencies, supported by a moderate supply and a slight uptick in demand from the downstream automotive industry. Additionally, there was a marginal increase in prices attributed to heightened cost support from the upstream anhydrous hydrofluoric acid market. Looking ahead, market fundamentals in the Chinese domestic market are expected to stabilize, with procurement rates remaining subdued due to ample material availability.

In the fourth quarter of 2023, the Lithium Fluoride market in Europe experienced a varied pricing trajectory. Initially, prices were affected by weak demand from downstream sectors, resulting in low import prices and limited inquiries. In Belgium specifically, the price of Lithium Fluoride consistently declined, primarily due to a significant decrease in demand from battery manufacturing, particularly in the lithium hexafluorophosphate industry, along with subdued consumer interest. The overall downtrend in Lithium Fluoride pricing was prolonged by deteriorating business sentiments across Europe, exacerbated by a sluggish business environment as reflected in the HCOB Eurozone Manufacturing PMI. Additionally, the European chemicals market witnessed a decline driven by both low demand and rising energy costs. Throughout the fourth quarter, battery manufacturers showed reluctance to expand their orders, further contributing to the subdued market conditions.

Browse Full Report: https://www.imarcgroup.com/lithium-fluoride-pricing-report

Key Points Covered in the Lithium Fluoride Pricing Report:

The report delivers the following key findings, alongside a comprehensive breakdown of prices by region:

- Lithium Fluoride Prices

- Lithium Fluoride Price Trend

- Lithium Fluoride Demand & Supply

- Lithium Fluoride Market Analysis

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Lithium Fluoride Price Analysis

- Lithium Fluoride Industry Drivers, Restraints, and Opportunities

- Lithium Fluoride News and Recent developments

- Global Event Analysis

- List of Key Players

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Browse More Pricing Reports by IMARC Group:

- Price of Potassium Benzoate

- Price of Selenium

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.