Purchase Invoice Discounting: A Smart Way to Improve Cash Flow

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

For businesses like yours, managing cash flow and cash flow activities is an essential part of life that underlies sustainability and growth. Purchase Invoice Discounting is one such financial instrument that acts on companies to increase liquidity. Be it an MSME or large enterprise, invoice discounting solutions let you tap into quick funds, ensuring liquidity in your supply chain.

What is purchase invoice discounting?

Purchase Invoice Discounting is a financing solution that enables businesses to release cash that is locked in unpaid invoices. When a business buys goods or services on credit, its supplier may require immediate cash to cover his operational expenses. Rather than waiting for buyers to pay invoices, suppliers can discount these invoices with a financier to receive upfront cash.

Invoice discounting does not need collateral rather than traditional loans, which is why it is a preferred choice of funding options for businesses.

How Does Invoice Discounting Work?

As for how the invoice discounting process works:

- A company makes sales of goods or services on credit and prepares an invoice.

- A person or a business approaches a financier or platform (like Vayana) for invoice discounting.

- Typically, the financier advances up to 80-90% of the invoice value.

- As soon as the buyer pays the invoice, the financier receives the payment, deducts a small fee, and transfers the rest to the business.

This gives businesses access to capital quickly and helps to keep their working capital cycle smooth.

Benefits of Purchase Invoice Discounting

1. Improved Cash Flow

Businesses no longer have to bear extended credit terms laid upon them with purchase invoice discounting. This ensures greater liquidity and seamless functioning of financial activities.

2. Reduced Credit Risk

Businesses can mature with better cash flow using invoice discounting while you still have access to funds early. This is of great advantage to MSMEs who function mostly on a cash flow cycle.

3. No Collateral Required

In the case of invoice discounting, businesses do not have to offer collateral like they need for traditional business loans. It's an accessible and hassle-free financing option.

4. Scalable Financing

Even in the procedure of growth, your enterprise asks for funds. This allows you to unlock cash in line with your sales and invoices rather than in the same way as fixed-term loans with the provision of another loan—purchase invoice discounting offers growing funding as a scalable solution.

5. Strengthened Supplier Relationships

Furthermore, by paying suppliers on time, even with invoice discounting, businesses can negotiate good terms and discount offers with suppliers, leading to stronger long-term relationships.

Who Can Benefit from Purchase Invoice Discounting?

- MSMEs who are now not getting payments from their buyers.

- Suppliers handling big orders but in need of cash quickly.

- Businesses in industries like manufacturing, retail, and trade that have long payment cycles.

- Startups looking for non-dilutive financing solutions.

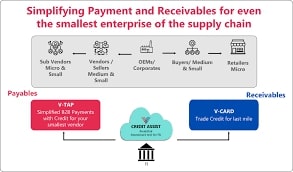

How Vayana Simplifies Invoice Discounting

Vayana, a leading trade finance platform, enables businesses to access seamless invoice discounting solutions. With a tech-driven approach, Vayana connects businesses with financiers, ensuring quick approvals and transparent processes. Their platform simplifies documentation and reduces the hassle associated with traditional financing options.

Final Thoughts

Cash flow is crucial for success in any contemporary market. With Purchase Invoice Discounting, businesses can access working capital easily and quickly, without the long wait that comes with credit periods. Trusted platforms like Vayana help businesses stay financially stable and focus on growth. If you are looking for a more intelligent strategy to monitor your finances, invoice discounting may be the appropriate answer for your organization.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.