Qatar E-Commerce Market Report 2025 Edition: Industry Market Size, Share, Growth and Competitor Analysis

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

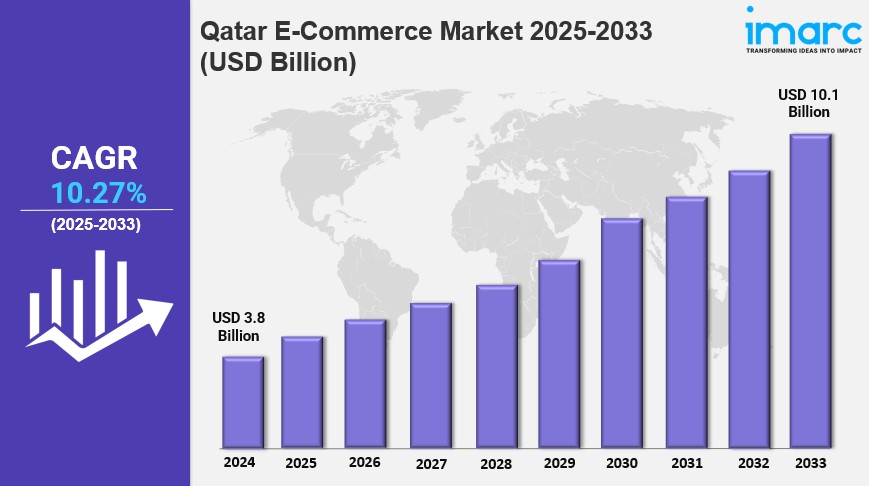

The Qatar e-commerce market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.1 Billion by 2033, exhibiting a growth rate (CAGR) of 10.27% during 2025-2033. The market is expanding rapidly, driven by growing internet penetration, digital payment adoption, and shifting consumer preferences. Key trends include a surge in mobile commerce, increasing demand for international brands, and the rise of quick commerce for faster deliveries.

Key Market Highlights:

✔️ Strong growth driven by rising digital adoption and evolving consumer behavior

✔️ Increasing preference for mobile commerce and seamless online shopping experiences

✔️ Growing demand for international brands and luxury products

✔️ Expansion of quick commerce for faster and more convenient deliveries

✔️ Advancements in AI-driven personalization and secure digital payments

✔️ Strengthening logistics networks to enhance last-mile delivery efficiency

Qatar E-Commerce Market Trends and Drivers:

The Qatar e-commerce market is experiencing a significant transformation, particularly with a shift towards hyperlocal models that cater to the rising demand for instant gratification and convenience. This evolution is marked by the proliferation of on-demand delivery services, especially in sectors such as food, groceries, and pharmaceuticals. Companies are leveraging advanced logistics and real-time tracking to ensure rapid delivery within specific geographic areas, addressing the urgent needs of urban consumers. The preference for localized services is bolstered by high mobile penetration rates and the increasing use of smartphone applications. This trend transcends mere speed; it emphasizes building trust and loyalty through consistent, reliable, and personalized service within communities. Local businesses are adapting by integrating their operations with these platforms, allowing them to expand their reach without the need for extensive physical infrastructure. Moreover, the adoption of digital payment solutions, including mobile wallets and contactless payments, has streamlined transactions, making hyperlocal e-commerce even more seamless.

The competitive landscape in this sector is fierce, with companies striving to optimize delivery routes, enhance customer experiences through personalized recommendations, and offer attractive pricing. This hyperlocal trend is also fostering the growth of specialized niche markets, such as artisan food delivery and local craft marketplaces, contributing to a vibrant and diverse e-commerce ecosystem. The emphasis on localized services reflects a cultural inclination to support local businesses and strengthen community ties, which is a vital aspect of Qatar's unique market dynamics. Additionally, high-speed internet connectivity facilitates smooth online transactions and real-time communication between customers and service providers, fostering a culture of immediacy where consumers expect and receive goods and services within remarkably short timeframes.

Furthermore, the Qatar e-commerce market is witnessing a notable increase in cross-border transactions, driven by high disposable incomes and a strong appetite for international brands. Consumers are increasingly turning to global e-commerce platforms to access a wider range of products, particularly in categories like fashion, electronics, and luxury goods. This trend is supported by Qatar's robust logistics infrastructure, including efficient air cargo services and well-connected ports, which enable seamless international shipping. Additionally, government initiatives aimed at streamlining customs procedures and reducing trade barriers have further facilitated the growth of cross-border e-commerce. International brands are recognizing the potential of the Qatari market and are actively establishing their online presence through localized websites and partnerships with local distributors. Integrating multilingual customer support and localized payment options is essential for attracting and retaining Qatari consumers.

A key driver of cross-border e-commerce is the demand for authentic and exclusive products, with consumers seeking unique items that are not readily available in the local market. The rise of social commerce—where consumers discover and purchase products through social media platforms—is significantly promoting cross-border transactions. Influencer marketing and targeted advertising campaigns effectively reach Qatari consumers and drive sales for international brands. Increased familiarity with international shipping and return policies has boosted consumer confidence in cross-border e-commerce. Additionally, the growing population of expatriates in Qatar is fueling demand for products from their home countries, further driving cross-border transactions. The use of advanced analytics and AI-powered personalization tools is helping e-commerce platforms better understand consumer preferences and tailor their offerings, enhancing the growth of cross-border activities.

The Qatar e-commerce market is also rapidly transitioning towards digital payment solutions, propelled by the government's push for a cashless society and the increasing adoption of mobile technologies. This trend is characterized by the widespread use of mobile wallets, contactless payments, and online payment gateways. The preference for digital payments is amplified by the convenience and security they provide compared to traditional cash transactions. E-commerce platforms are investing heavily in robust security measures, including encryption technologies and fraud detection systems, to safeguard consumer data and build trust. The Central Bank of Qatar plays a crucial role in regulating and promoting the adoption of digital payment solutions, ensuring a secure and efficient payment ecosystem.

Moreover, the integration of biometric authentication methods, such as fingerprint and facial recognition, is enhancing the security of online transactions. The rise of fintech startups is driving innovation and diversification in digital payment options in Qatar. QR code payments and other mobile payment technologies are becoming increasingly common in both online and offline retail environments. Emphasizing data privacy and security is essential for building consumer confidence in digital payment solutions. Government initiatives aimed at promoting financial literacy and digital inclusion are also contributing to the widespread adoption of digital payments. The increasing integration of e-commerce platforms with banking systems and mobile network operators is streamlining the payment process and enhancing the overall customer experience. This dynamic is further supported by a growing number of young, tech-savvy consumers who are comfortable using digital payment technologies.

Qatar E-Commerce Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

Breakup by Transaction:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

Breakup by Region:

- Ad Dawhah

- Al Rayyan

- Al Wakrah

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.