Real Estate Portfolio Management in the Age of AI: Risks, Rewards & Real-Time Insights

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

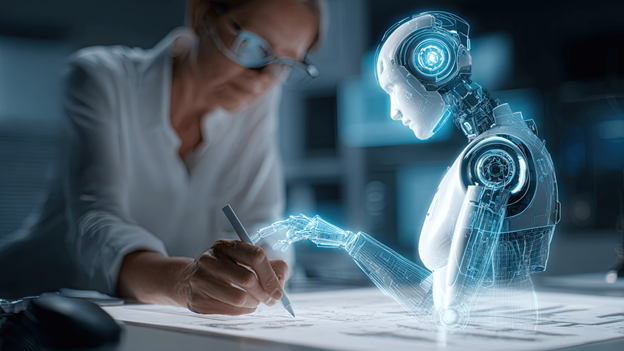

Artificial Intelligence (AI) is no longer just a buzzword in the real estate sector; it’s becoming a fundamental tool in how property portfolios are managed, optimized, and scaled. From streamlining routine tasks to delivering predictive insights, AI is reshaping the way investors, asset managers, and developers make decisions.

As real estate markets grow increasingly complex and data-driven, AI offers a powerful edge: the ability to process massive datasets, uncover hidden patterns, and provide real-time visibility into portfolio performance. But with innovation comes risk. Data privacy, algorithmic bias, and system overreliance are just a few of the challenges that industry professionals must navigate.

This blog explores how real estate AI portfolio management transformation, the tangible rewards it offers, and the risks that demand thoughtful governance and human oversight.

The Rewards of AI in Real Estate Portfolio Management

1. Operational Efficiency & Cost Reduction

AI tools streamline traditionally time-consuming tasks like tenant screening, lease processing, rent collection, and maintenance tracking. This automation cuts labor hours and reduces administrative costs, enabling leaner and faster operations across both residential and commercial portfolios.

2. Smarter, Data-Driven Decisions

AI-powered analytics platforms offer detailed dashboards showing real-time portfolio metrics—rental income, asset utilization, and expenditure trends. Investors can react swiftly to underperforming assets or market shifts, refining their strategies with high precision.

3. Predictive Insights for Future Growth

AI algorithms can analyze historical market data, economic indicators, and neighborhood trends to forecast rental yields, property appreciation, or market saturation. This allows portfolio managers to identify growth zones and prepare for downturns in advance.

4. Greater Accuracy in Property Valuation

AI-based Automated Valuation Models (AVMs) enhance the precision of pricing, underwriting, and investment assessments. This reduces human error and speeds up decision-making, key factors in high-stakes real estate investments.

5. Personalized Client Experiences

From tailored property suggestions to dynamic pricing models, AI can adapt to a client’s changing needs and behaviors, offering a more engaging and value-driven experience for investors and tenants alike.

6. Enhanced Risk Assessment

AI systems evaluate factors like environmental risks, crime statistics, and economic volatility to help investors assess potential vulnerabilities in their portfolios, supporting more informed and risk-conscious investment strategies.

The Risks of Relying on AI in Real Estate

Despite its advantages, AI implementation in real estate analytics comes with notable concerns:

Real-Time Insights: The Competitive Edge

One of the most significant contributions of AI to real estate portfolio management is real-time monitoring. With AI-driven dashboards, portfolio managers can track everything from occupancy rates to maintenance issues and revenue performance, on demand.

Moreover, market forecasting models use historical transaction data, economic trends, and even social media sentiment to predict property demand and price fluctuations. This allows managers to shift strategies quickly and stay ahead of the curve.

AI also enables advanced scenario planning, helping decision-makers simulate the impact of external shocks economic downturns, policy changes, or climate events on their portfolios. These simulations guide smarter allocation and hedging strategies.

Where AI Makes the Biggest Impact

Commercial Real Estate (CRE): In sectors like retail, logistics, and office spaces, AI automates staffing, lease management, and predictive maintenance, leading to significant cost savings and better cash flow management.

Residential Portfolios: AI enhances the speed and security of transactions with features like fraud detection, automated property valuation, and tenant background checks.

Sustainable and Responsible Investing: Emerging AI technologies, including generative AI, can now link environmental, social, and governance (ESG) data to real estate performance, helping investors align with ethical and sustainable goals.

Best Practices for Responsible AI Adoption

To harness AI’s full potential while minimizing its downsides, real estate professionals should:

Integrate AI with Human Oversight: Use AI as a decision support tool, not a decision-maker.

Prioritize Data Hygiene: Ensure datasets are accurate, unbiased, and regularly updated.

Ensure Transparency: Communicate clearly with clients about how AI is used in their investments.

Continuously Monitor and Evolve: Keep up with technological advancements and legal frameworks to remain compliant and competitive.

Meet Leni - Top AI Tool for Real Estate Portfolio Management & Analytics

Hey, I’m Leni

I know how overwhelming portfolio management can tracking rent flows, chasing market trends, spotting risks before they hit your NOI. That’s where I come in.

I’m your intelligent real estate assistant. I can help you:

Spot underperforming assets before they drag your returns down

Predict rental trends using historical data, sentiment shifts, and market momentum

Track your entire portfolio in real-time—maintenance costs, occupancy rates, lease expirations, the works

Run ‘what-if’ scenarios to plan for downturns or expansion

Evaluate risk zones across economic, demographic, and local data layers

And I’m not just throwing charts at you, I’ll flag what matters, when it matters.

Need to make a call on a new asset? Want to test your exposure in a cooling submarket? Ask me.

I’m not here to replace you. I’m here to make you sharper, faster, and 10x more prepared.

Try Me Now.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.