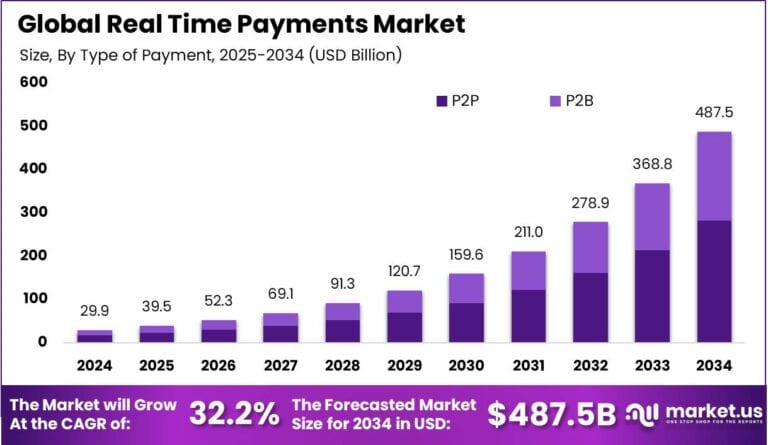

Real Time Payments Market size is at a CAGR of 32.20%

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The Global Real Time Payments Market size is expected to be worth around USD 487.5 Billion By 2034, from USD 29.9 Billion in 2024, growing at a CAGR of 32.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the real-time payments market with over 38% market share and USD 11.3 billion in revenue. China’s market was valued at USD 3.7 billion, reflecting rapid advancements in digital payment infrastructure, with a CAGR of 28.3%.

The Real-Time Payments (RTP) market refers to a financial ecosystem that enables instant or near-instant transfer of funds between banks and financial institutions. These transactions are processed in real time, twenty-four hours a day, seven days a week, with immediate confirmation to both sender and receiver. This market is growing rapidly across the globe as consumers, businesses, and governments increasingly expect faster, more transparent payment solutions. The surge in demand is supported by innovations in payment infrastructure, rising smartphone penetration, and a growing need for efficient cash flow management. RTP platforms are being adopted across industries such as retail, e-commerce, healthcare, and public services due to their speed, reliability, and improved user experience.

Top driving factors behind the expansion of the real-time payments market include the growing adoption of digital banking, customer demand for faster and safer transactions, and a shift toward contactless payments post-pandemic. Governments and regulatory bodies are also pushing for improved financial inclusion and greater payment efficiency, which further accelerates market development. Another major force is the demand from small and medium-sized enterprises, who benefit significantly from real-time fund availability and reduced dependency on credit lines.

Demand analysis shows a steady climb in RTP usage in both developed and emerging economies. In regions like Asia-Pacific and North America, transaction volumes are increasing at a remarkable pace, driven by a tech-savvy population and proactive regulatory policies. Consumers now expect faster settlements not only for peer-to-peer transfers but also for bill payments, salaries, and even loan disbursements. This growing demand is encouraging banks and fintech firms to invest heavily in RTP infrastructure.

The rising adoption of technologies such as cloud computing, open APIs, artificial intelligence, and machine learning is reshaping the RTP landscape. These technologies support real-time fraud detection, predictive analytics, and better customer personalization. They also make integration with legacy systems more feasible, allowing traditional banks to participate in the real-time revolution without overhauling their entire infrastructure.

The key reasons organizations are adopting real-time payments include improved liquidity, better customer retention, lower operational costs, and competitive advantage. Businesses can settle invoices instantly, reduce processing fees, and maintain more accurate cash flow forecasting. This results in smoother operations and stronger relationships with suppliers and customers alike.

Investment opportunities in the RTP market are broad and promising. Venture capital and private equity firms are increasingly funding startups that offer innovative RTP solutions. Established financial institutions are partnering with tech providers to launch real-time services. Payment infrastructure upgrades, mobile banking platforms, and cross-border real-time networks present particularly lucrative areas for strategic investment.

From a business benefits standpoint, real-time payments enhance transaction transparency, speed, and accuracy. They reduce the risk of fraud and errors while enabling better data tracking for compliance and reporting. Companies gain operational agility, and customers enjoy an improved payment experience—two critical aspects in today’s highly competitive financial landscape.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.