Repo Rate History in India (2015-2025): What Every Borrower Should Know

Strong8k brings an ultra-HD IPTV experience to your living room and your pocket.

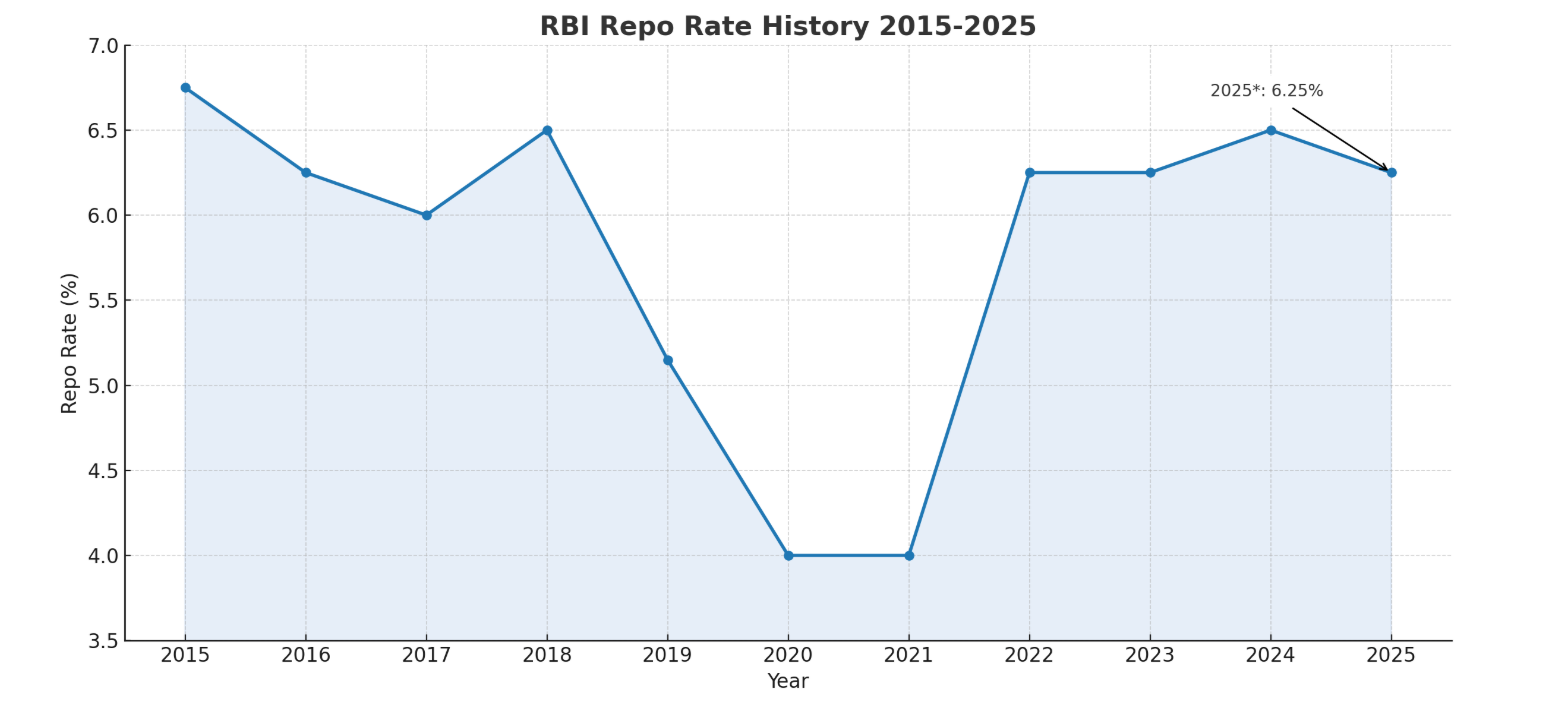

The repo rate, also known as the repurchase rate/ Policy rate, is a crucial tool used by the Central Bank (RBI) to manage inflation, balance the economy and control the money supply to influence the cost of borrowing in the country. For borrowers, the repo rate is a key determinant of interest rates on loans, including home loans, car loans, and personal loans. Recently, RBI Governor Sanjay Malhotra announced a bold move, reducing the repo rate to 6%, signaling a shift toward easing borrowing conditions and supporting economic momentum. This blog delves into the history of the repo rate in India from 2015 to 2025 and discusses how these changes have impacted borrowers, especially those with floating-rate loans.

Understanding the Repo Rate and Its Impact

Before we dive into the specifics of the repo rate history, it’s essential to understand its role in the economy. The repo rate is the rate at which the RBI lends money to commercial banks. When the RBI raises the repo rate, it increases borrowing costs for banks, which often results in higher interest rates on loans for consumers. On the other hand, when the RBI cuts the repo rate, borrowing becomes cheaper, potentially lowering the interest rates on loans and making it easier for consumers to borrow money.

As such, the repo rate is a powerful tool to control inflation and stimulate or slow down economic growth. The adjustments made by the RBI over the years have directly influenced the cost of credit in the economy and affected the financial planning of millions of borrowers.

Repo Rate History in India (2015-2025): What Every Borrower Should Know

What Does This Mean for Borrowers?

Over the past decade, repo rate changes have significantly impacted borrowing costs in India. For borrowers with floating-rate loans, it’s essential to understand how these changes affect their EMIs. When the RBI cuts the repo rate, it typically leads to lower EMIs, making loans more affordable. On the other hand, rate hikes mean higher EMIs, which could strain borrowers’ finances.

The repo rate is also crucial for individuals considering taking out loans. In periods of low rates, borrowing is cheaper, making it a good time to lock in a home loan or personal loan. Conversely, during high rates, borrowers may want to consider getting in a fixed-rate loan or delaying their decision to borrow.

Conclusion

The repo rate in India has experienced significant fluctuations from 2015 to 2025, with cuts aimed at boosting economic growth and hikes introduced to control inflation. For borrowers, these changes have profoundly impacted the cost of loans, influencing decisions related to home loans, auto loans, and personal loans. By staying informed about the repo rate and its movements, borrowers can make more strategic decisions, minimise costs, and plan their finances better. Understanding the repo rate history empowers borrowers to anticipate changes in interest rates, making it easier to manage loan repayments and optimize borrowing costs.

Explore More Articles for Valuable Insights:

RBI Governor Sanjay Malhotra Unveils Bold Move – Repo Rate Drops to 6%

Fixed Vs Floating Home Loan Interest Rate – Which is Better for you?

RBI likely to slash down rates by 25 bps to 6% on April 9, says experts

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.