Safeguarding the Financial Sector Through Compliance Technology

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction

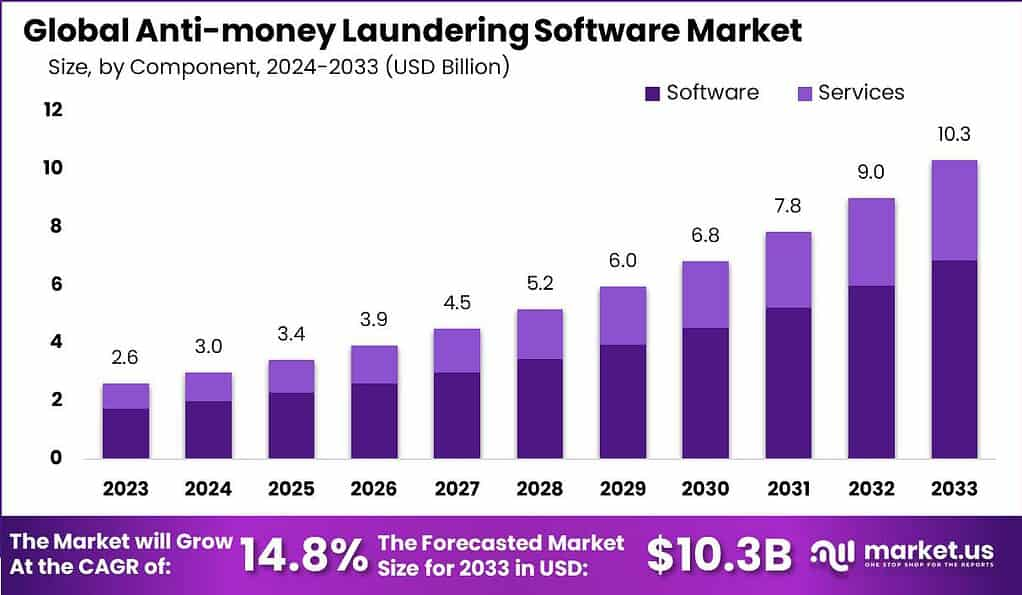

The global Anti-Money Laundering (AML) Software Market has achieved substantial growth, reaching a size of USD 2.6 billion in 2023. This surge is driven by increasingly stringent regulatory frameworks, a spike in financial fraud cases, and the ongoing digitization of banking and financial services. Looking forward, the market is poised for remarkable expansion, projected to attain USD 10.3 billion by 2033. This reflects a robust CAGR of 14.8% between 2024 and 2033. Financial institutions are investing in AML solutions to ensure compliance, improve risk management, and prevent illicit financial activity.

Key Takeaways

Market size in 2023: USD 2.6 billion

Forecasted market size by 2033: USD 10.3 billion

CAGR: 14.8% (2024–2033)

Growing regulatory pressures propel adoption

AI enhances transaction monitoring accuracy

Cloud deployment gaining popularity among SMEs

Crypto-related AML solutions in demand

Banking sector dominates AML adoption

North America is the leading regional market

Real-time monitoring and data integration are major trends

Component Analysis

The AML software market is primarily segmented into software and services. The software component leads the market due to its comprehensive functionalities such as customer identity verification, transaction monitoring, and case management. Demand for services including consulting, support, and integration is also rising, especially as companies seek expert assistance to meet evolving compliance mandates. Managed services are growing fast, offering scalability and operational efficiency to enterprises navigating increasingly complex regulatory environments.

Product Type Analysis

AML software products span several functionalities, including transaction monitoring, currency transaction reporting, customer identity management, and compliance management. Among these, transaction monitoring holds the lion’s share, driven by its capability to detect suspicious activities in real time. Currency transaction reporting remains essential for ensuring threshold-based compliance. Meanwhile, customer identity management and compliance management are gaining prominence with the advent of digital onboarding and evolving Know Your Customer (KYC) regulations.

Deployment Mode Analysis

Deployment modes for AML software are broadly divided into on-premises and cloud-based. While on-premises systems offer greater control and data security, especially favored by large institutions, cloud-based AML solutions are witnessing rapid adoption due to their flexibility, cost-efficiency, and quick deployment. The shift toward digital banking and remote operations post-COVID-19 has further accelerated the preference for cloud platforms. Cloud-based solutions are particularly attractive for SMEs and fintech firms looking for real-time, scalable solutions.

Market Segmentation

By Component:

Software

Services (Consulting, Integration, Training, Managed Services)

By Product Type:

Transaction Monitoring

Currency Transaction Reporting

Customer Identity Management

Compliance Management

Others

By Deployment Mode:

On-Premises

Cloud-Based

By Organization Size:

Large Enterprises

Small & Medium Enterprises (SMEs)

By End-Use Industry:

Banking & Financial Services

Insurance

Government

Healthcare

Gaming & Gambling

Others

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Restraints

Despite significant market opportunities, several restraints challenge AML software adoption. High costs of initial setup and maintenance, especially for small to mid-sized firms, remain a critical barrier. Integration difficulties with legacy banking systems slow down implementation. Furthermore, the evolving nature of financial crimes requires frequent system updates and skilled personnel, which many organizations lack. Data privacy concerns and diverse regulatory landscapes across regions further complicate cross-border deployment, making standardization a challenge.

SWOT Analysis

Strengths:

Strong regulatory push worldwide

Increasing digitization of financial operations

Integration with advanced analytics and AI

Weaknesses:

High implementation costs

Complexity of integrating with legacy systems

Lack of skilled AML professionals

Opportunities:

Expanding fintech ecosystem

Growing demand in developing markets

Rising need for crypto transaction monitoring

Threats:

Rapidly evolving financial fraud techniques

Regional compliance variations

Growing competition from open-source alternatives

Trends and Developments

AI and machine learning transforming predictive risk analysis

Surge in demand for cloud-native and API-enabled platforms

Integration of biometrics for enhanced identity verification

Greater emphasis on real-time behavioral analytics

AML tools expanding into crypto and DeFi space

Increased investment from RegTech startups

Automation of compliance workflows for audit readiness

Development of privacy-preserving data models in AML tech

Conclusion

The Anti-Money Laundering Software Market is positioned for strong and sustained growth, driven by technological advancement and global compliance requirements. As organizations prioritize proactive risk management, AML tools will become increasingly essential to preserving financial system integrity.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.