Saudi Arabia E-Commerce Market Size, Industry Trends, Share, Demand & Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

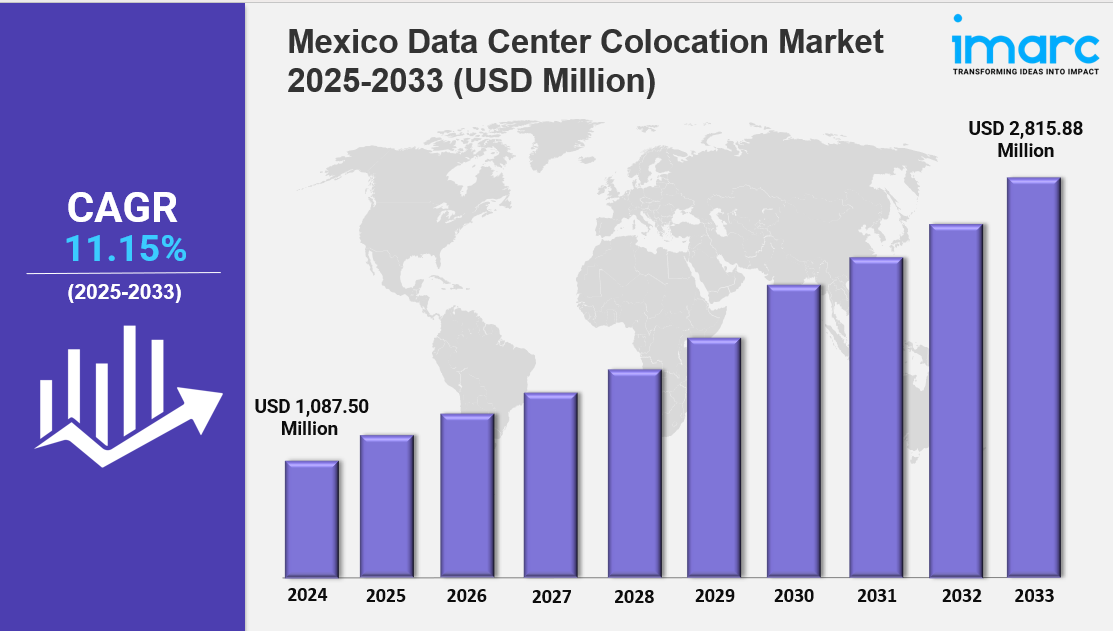

Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. The market is growing rapidly due to increasing internet penetration, digital payment adoption, and shifting consumer preferences. Government initiatives, technological advancements, and expanding product categories are key factors driving industry expansion.

Key Market Highlights:

✔️ Rapid market growth driven by increasing internet penetration and digital payment adoption

✔️ Rising demand for fashion, electronics, and grocery shopping through online platforms

✔️ Expanding government initiatives supporting digital economy and logistics infrastructure development

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-e-commerce-market/requestsample

Saudi Arabia E-Commerce Market Trends and Driver:

The Saudi Arabian e-commerce market is experiencing a major digital transformation, driven by government initiatives and a tech-savvy population. As part of the Vision 2030 strategy, the country is actively diversifying its economy and reducing its dependence on oil by fostering digital innovation. This has led to a surge in internet usage and smartphone adoption, creating a thriving environment for e-commerce. By 2024, over 90% of the population is expected to be online, making digital shopping more accessible than ever.

The growing reliance on e-commerce is fueled by convenience, a wider range of product choices, and competitive pricing. Social media platforms also play a crucial role in this shift, with consumers increasingly using them for product discovery, reviews, and recommendations. Influencer marketing and targeted advertising are further driving online sales, making platforms like Instagram, TikTok, and Snapchat key players in the e-commerce landscape.

The Saudi e-commerce market has expanded significantly, reflecting a shift in consumer preferences from traditional retail to online shopping. Factors such as easy home delivery, better deals, and a broader selection of products have contributed to this rapid growth. The COVID-19 pandemic accelerated the transition, reinforcing online shopping as a preferred choice for many consumers. By 2024, a substantial share of the country’s retail sales is expected to occur online, indicating a long-term change in shopping habits.

As the market matures, competition is intensifying. Both local and international brands are working hard to capture market share, with Saudi consumers placing a greater emphasis on product quality, brand reputation, and customer service. This shift is benefiting domestic brands while allowing global companies to expand their presence. To stand out, retailers are investing in personalized shopping experiences, loyalty programs, and advanced logistics solutions to enhance customer satisfaction and retention.

Efficient logistics and seamless payment solutions are crucial to sustaining the growth of e-commerce in Saudi Arabia. The increasing demand for fast and reliable delivery has led companies to invest in advanced logistics technologies, including automated warehouses and last-mile delivery services. These improvements are optimizing supply chain operations and ensuring quicker delivery times.

In parallel, digital payment methods are gaining widespread acceptance. Consumers are increasingly opting for mobile wallets, online banking, and contactless payments, shifting away from traditional cash transactions. By 2024, cashless payments are expected to dominate as more shoppers embrace secure and convenient digital payment solutions. This transition enhances trust in e-commerce platforms, encourages higher spending, and drives repeat purchases.

The Saudi Arabian e-commerce sector is on a trajectory of continued expansion, propelled by evolving technology and shifting consumer behaviors. As more people integrate online shopping into their daily lives, e-commerce is expected to command a larger share of the retail industry. Social commerce is also on the rise, with platforms like Instagram and TikTok streamlining the shopping experience and making direct purchases easier than ever.

Government backing through Vision 2030 further strengthens the sector, fostering innovation and creating a digital-first economy. Consumers are demanding a wider variety of products, from electronics and fashion to groceries and beauty products, prompting retailers to expand their offerings. To meet rising expectations, businesses are enhancing personalized recommendations, customer service, and fast-tracked delivery options. Additionally, flexible payment solutions like buy-now-pay-later (BNPL) are making online shopping more accessible and attractive.

Overall, the Saudi Arabian e-commerce market is dynamic and rapidly evolving. With continuous advancements in technology, shifting consumer preferences, and strong government support, the sector is set for sustained growth and innovation, reshaping the retail landscape in the years ahead.

Saudi Arabia E-Commerce Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- B2C E-commerce

- B2B E-commerce

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.