Saudi Arabia Fintech Market Report 2025-2035, Industry Growth Opportunity, and Forecast

Saudi Arabia Fintech Market Overview

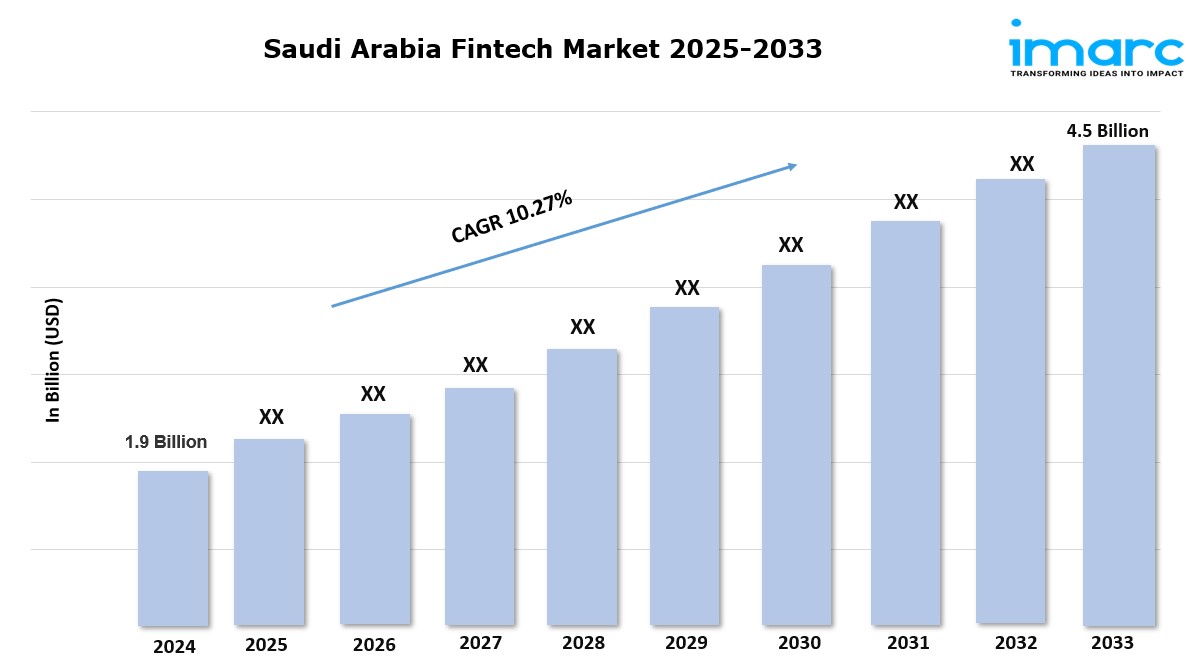

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 1.9 Billion

Market Forecast in 2033: USD 4.5 Billion

Market Growth Rate: 10.27% (2025-2033)

The Saudi Arabia fintech market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 10.27% during 2025-2033.

Saudi Arabia Fintech Market Trends:

The market in Saudi Arabia is primarily driven by the increasing adoption of digital payments among a tech-savvy population. In line with this, the expanding presence of mobile banking applications is significantly improving consumer convenience, supporting the market’s growth. Moreover, the rising government support for fintech initiatives is fostering a favorable environment, further augmenting the sector’s potential.

Additionally, the introduction of regulatory sandboxes by the Saudi Central Bank is encouraging innovation by allowing fintech firms to experiment with new products safely, thereby fostering market growth. Furthermore, the increasing penetration of internet services is enabling broader access to digital financial services, thus expanding market participation. Besides, the influx of foreign investment is empowering local fintech firms with capital, fueling sector growth. Apart from this, the gradual shift in consumer preferences toward cashless transactions is setting the stage for sustained market expansion.

Saudi Arabia Fintech Market Scope & Growth Analysis:

The market scope is broadening significantly due to its unique demographic makeup, which includes a youthful, digitally engaged population. Alongside this, the strategic alliances between local banks and global fintech companies are enhancing cross-border financial service integration, thereby bolstering the market’s scope. Furthermore, regulatory advancements, particularly the Saudi Central Bank’s pro-innovation stance, are actively shaping a secure framework for fintech expansion.

Besides, advancements in AI and blockchain technology are providing new avenues for financial services, adding complexity and depth to the fintech landscape. As per market analysis, the proliferation of digital payment solutions tailored to local preferences is enabling the sector to reach previously untapped consumer segments. Besides, the increase in fintech accelerators and incubators is creating a nurturing ecosystem for emerging fintech startups, positioning the Saudi Arabia market as a competitive fintech hub.

Request for a sample copy of this report: https://www.imarcgroup.com/saudi-arabia-fintech-market/requestsample

Saudi Arabia Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Service Proposition Insights:

- Money Transfer and Payments

- Savings and Investments

- Digital Lending and Lending Marketplaces

- Online Insurance and Insurance Marketplaces

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.