Saudi Arabia Fintech Market Research Report 2024-2032, Industry Growth, Share, Size and Forecast

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Saudi Arabia Fintech Market Overview

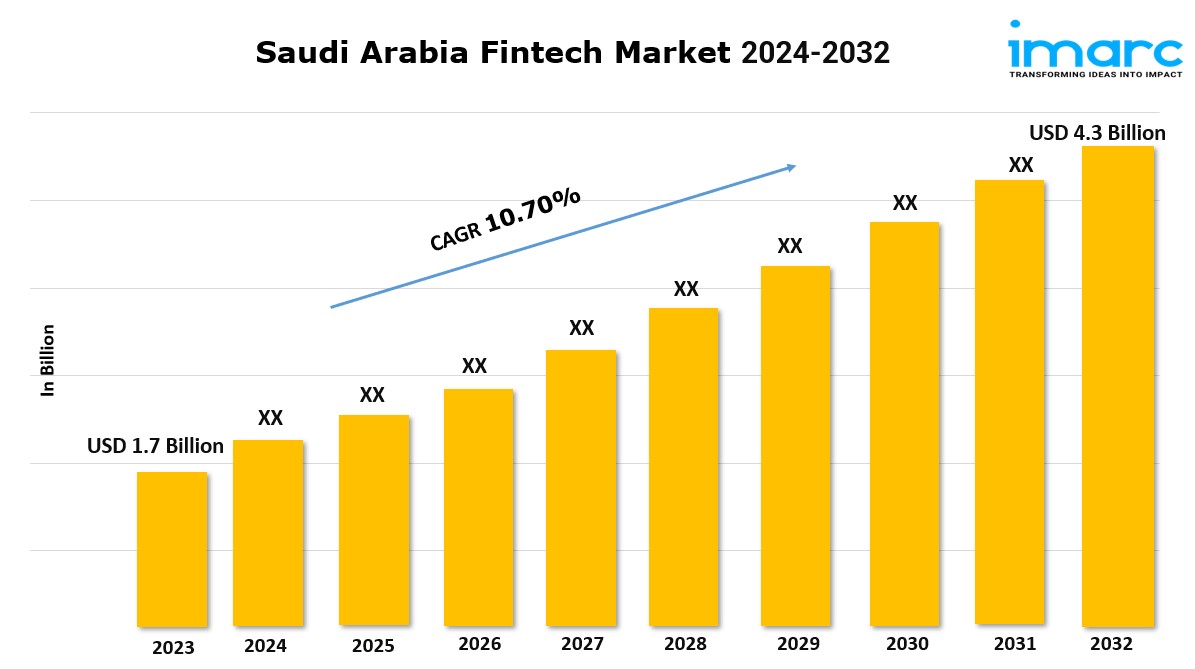

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

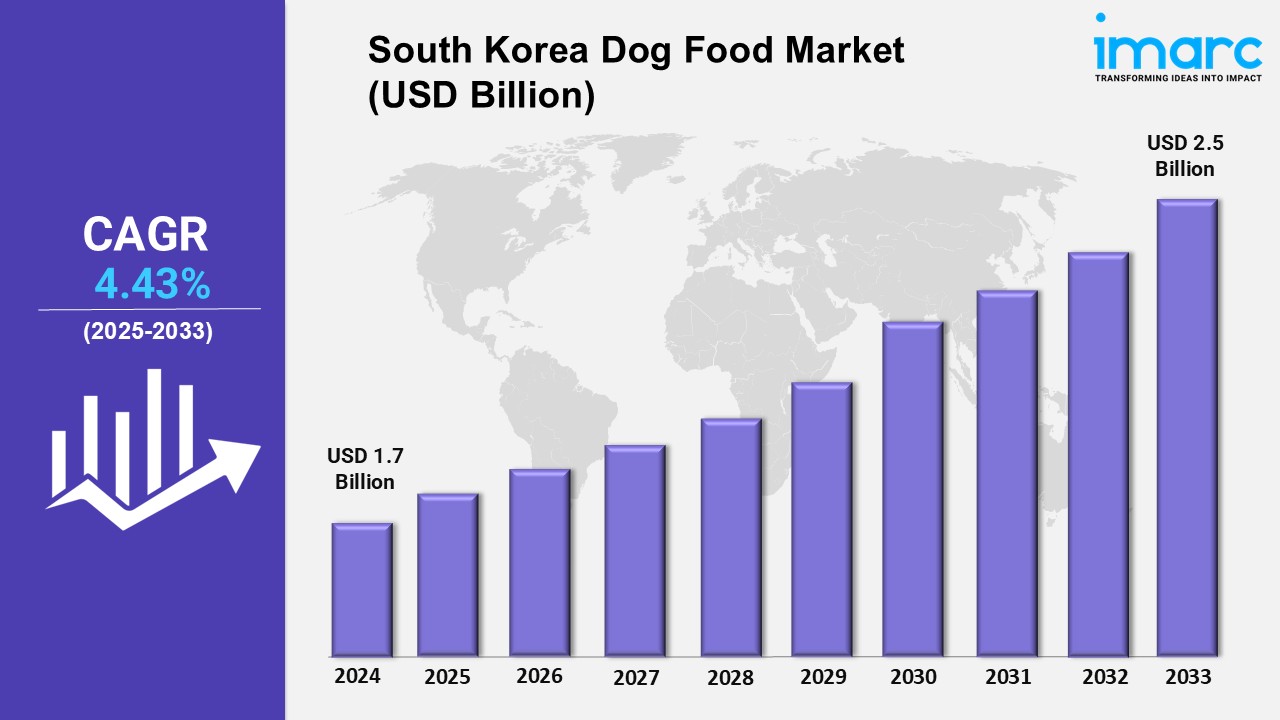

Market Size in 2023: USD 1.7 Billion

Market Forecast in 2032: USD 4.3 Billion

Market Growth Rate: 10.70% (2024-2032)

The Saudi Arabia fintech market size reached USD 1.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2032, exhibiting a growth rate (CAGR) of 10.70% during 2024-2032.

Request for a sample copy of this report: https://www.imarcgroup.com/saudi-arabia-fintech-market/requestsample

Saudi Arabia Fintech Market Trends:

The market in Saudi Arabia is primarily driven by the increasing adoption of digital payment systems in the country as the government promotes cashless transactions. Moreover, a strong emphasis on financial technology in the Kingdom's Vision 2030 initiative, aiming at diversifying the economy, is providing an impetus to the market. Additionally, rising mobile banking and the integration of AI in financial services are expanding the market reach.

Furthermore, the tech-savvy young population in the country is fueling the demand for digital financial solutions, which is also a significant growth-inducing factor for the market. Some of the other factors, such as strategic collaborations, increased foreign investments, and growing consumer trust in digital financial products, are facilitating the market.

Saudi Arabia Fintech Market Scope & Growth Analysis:

The scope of the market in Saudi Arabia is significantly expanding due to the increasing integration of blockchain technology and open banking platforms, which offer enhanced transparency and efficiency. In addition to this, the strategic focus on digitizing financial services by the government is enhancing the market scope. Besides this, supportive regulations from the Saudi Central Bank (SAMA) encourage fintech startups and innovations, broadening market scope.

Moreover, developing innovations in Islamic fintech services that are catering to Sharia-compliant financial products is extending market capabilities. Furthermore, increasing cross-border transactions and collaborations with global fintech players is further broadening the scope of the market, providing opportunities for new entrants. As per the market analysis, the market is witnessing robust growth as fintech adoption is spreading across various industries like insurance and real estate, and the demand for specialized fintech services is continuously growing.

Saudi Arabia Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Service Proposition Insights:

- Money Transfer and Payments

- Savings and Investments

- Digital Lending and Lending Marketplaces

- Online Insurance and Insurance Marketplaces

- Others

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=13887&flag=E

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.