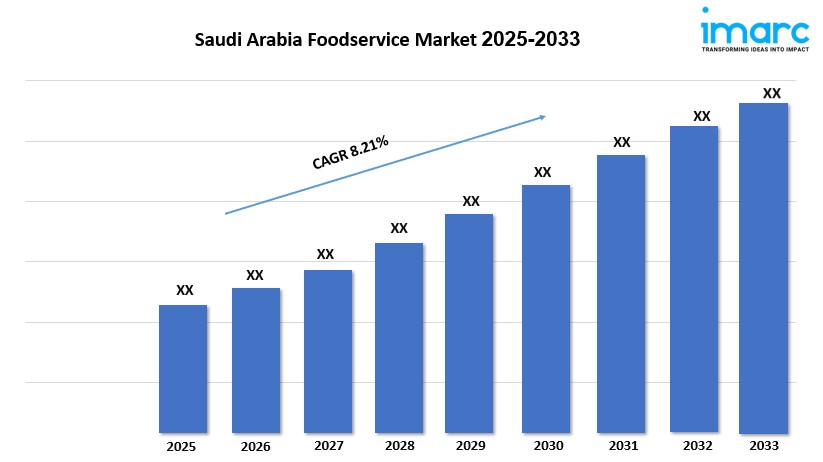

Saudi Arabia Foodservice Market Size, End-User Insights and Forecast 2025–2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Saudi Arabia Foodservice Market Overview

Market Size in 2024 : USD 28,669 Million

Market Size in 2033: USD 58,310 Million

Market Growth Rate 2025-2033: 8.21%

According to IMARC Group's latest research publication,"Saudi Arabia Foodservice Market Size, Share, Trends and Forecast by Foodservice Type, Outlet, Location, and Region, 2025-2033", The Saudi Arabia foodservice market size was valued at USD 28,669 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 58,310 Million by 2033, exhibiting a CAGR of 8.21% from 2025-2033.

Growth Factors in the Saudi Arabia Foodservice Market

- Rising Tourism and Cultural Events

Saudi Arabia’s ambitious Vision 2030 initiative has significantly boosted tourism, driving growth in the foodservice market. The influx of both domestic and international visitors, particularly to cities like Riyadh and Jeddah, has increased demand for diverse dining experiences. For example, events like Riyadh Season and Jeddah Season have attracted millions, with pop-up restaurants such as Zuma and Scalini catering to tourists seeking local and international cuisines. With this surge in culinary demand, the saudi arabia foodservice market size 2024 reflects significant expansion opportunities. Religious tourism, especially during Hajj and Umrah, further fuels demand for full-service restaurants, as pilgrims explore Middle Eastern and Asian flavors, creating opportunities for foodservice providers to expand their presence in high-traffic areas.

- Urbanization and Changing Lifestyles

Rapid urbanization and evolving lifestyles, particularly among Saudi Arabia’s youthful population, are key growth drivers. With over half of the population under 30, there’s a strong preference for convenience and dining out. The rise of dual-income households and working women has reduced home cooking, boosting demand for quick-service restaurants (QSRs) like Al Baik and international chains like McDonald’s. Urban centers like Riyadh and Dhahran see increased footfall in casual dining spots, as busy professionals seek fast, accessible meals. This shift has encouraged foodservice operators to open new outlets in densely populated areas, catering to modern, fast-paced lifestyles.

- Government Support and Economic Diversification

The Saudi government’s Vision 2030 plan, aimed at diversifying the economy, has created a favorable environment for the foodservice industry. Initiatives like reduced licensing costs for restaurants and financial aid for small businesses have lowered entry barriers for new players. The development of tourism projects, such as the Red Sea Project, has spurred demand for foodservice outlets in emerging destinations. For instance, the government’s investment in entertainment districts has led to the rise of food trucks and pop-up dining during events like Winter at Tantora, enabling businesses to tap into new markets and contribute to economic growth.

Key Trends in the Saudi Arabia Foodservice Market

- Growth of Online Food Delivery and Cloud Kitchens

The surge in smartphone penetration and digital adoption has transformed the foodservice landscape, with online food delivery platforms like Jahez and HungerStation gaining massive popularity. These platforms cater to busy consumers seeking convenience, especially in urban areas. Cloud kitchens, which focus solely on delivery, have emerged as a cost-effective model, reducing overhead costs for operators. For example, many cloud kitchens partner with delivery apps to offer diverse menus, from fast food to healthy options, appealing to millennials and professionals. This trend reflects a shift toward tech-enabled convenience, reshaping how food is accessed in Saudi Arabia.

- Demand for Health-Conscious and Sustainable Dining

Health and wellness trends are gaining traction, driven by a growing awareness of nutrition and sustainability. Consumers, particularly younger demographics, are seeking organic, plant-based, and low-calorie options. Restaurants like The Warehouse in Jeddah have introduced healthier menus, incorporating local ingredients to align with cultural preferences. The Saudi Green Initiative has also encouraged sustainable practices, with brands like Napco National offering compostable packaging for foodservice clients. This shift is evident in the rise of juice bars and cafes offering smoothies and organic snacks, catering to health-conscious consumers while addressing environmental concerns.

- Rise of Experiential and Fusion Dining

Saudi Arabia’s foodservice market is witnessing a surge in experiential dining, blending traditional Saudi flavors with international influences. Restaurants like Zuma and Catch have opened pop-up branches during cultural festivals, offering innovative menus that attract younger consumers. Fusion cuisine, combining Middle Eastern ingredients with global styles, is gaining popularity, especially among the 37% of the population under 25. For instance, local chefs like Nehal Felemban are opening restaurants that merge Saudi culinary traditions with modern techniques, creating unique dining experiences. This trend is fueled by a desire for novelty and social media-driven dining, particularly in vibrant cities like Riyadh.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-foodservice-market/requestsample

Saudi Arabia Foodservice Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Foodservice Type:

- Cafes and Bars

- By Cuisine

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- By Cuisine

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- By Cuisine

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- By Cuisine

Analysis by Outlet:

- Chained Outlets

- Independent Outlets

Analysis by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The major market players are indulging in expansion, innovation, and digitization, aligned with the Saudi Vision 2030. The FFCC states that the Saudi Vision 2030 aims to diversify the food service market by raising the number of cafes per million from its current count of 258 to 1,000 per million. International food chains are increasing their footprint and utilizing the new urban population with increasing disposable income.

Future Outlook

The Saudi Arabia poultry market is poised for sustained growth, driven by population growth, technological advancements, and government support under Vision 2030. As consumer preferences shift toward healthier, convenient, and sustainably produced poultry, companies will likely invest in organic and antibiotic-free products to meet demand. Strategic partnerships, like the 2023 joint venture between Tanmiah Food Company and Ukraine’s MHP SE, signal opportunities for export growth, positioning Saudi Arabia as a regional poultry hub. However, challenges such as feed price volatility and import competition will require ongoing innovation and regulatory support to ensure long-term resilience and market expansion.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.