Saudi Arabia Poultry Market Size, Demand Drivers and Strategic Outlook 2025–2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Saudi Arabia Poultry Market Overview

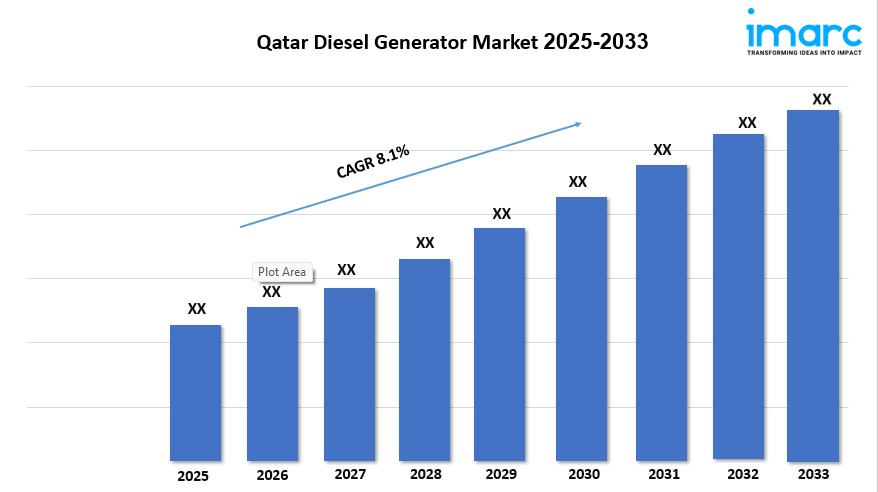

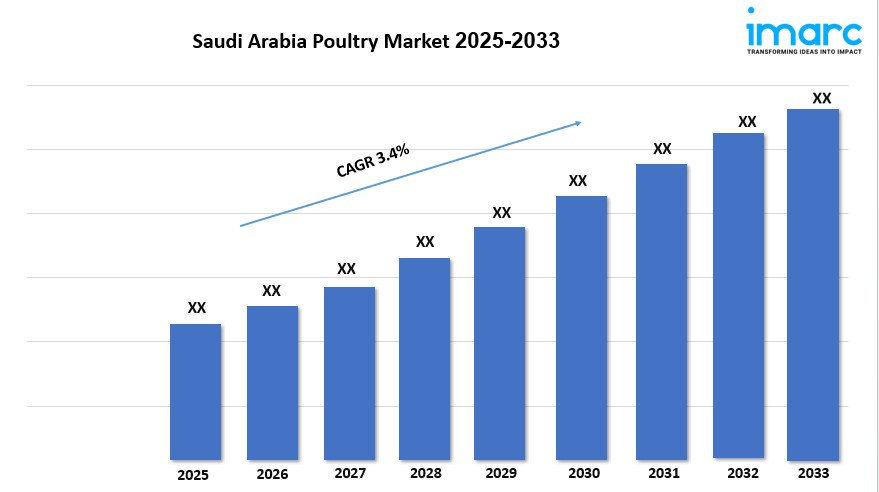

Market Size in 2024 : USD 19.0 Billion

Market Size in 2033: USD 26.6 Billion

Market Growth Rate 2025-2033: 3.4%

According to IMARC Group's latest research publication,"Saudi Arabia Poultry Market Report by Product Type (Broiler, Eggs, and Others), Nature (Organic, Conventional), Distribution Channel (On-Trade, Off-Trade), and Region 2025-2033", The Saudi Arabia poultry market size reached a value of USD 19.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.6 Billion by 2033, exhibiting a CAGR of 3.4% during 2025-2033.

Growth Factors in the Saudi Arabia Poultry Market

- Rising Population and Protein Demand

The growing population in Saudi Arabia, coupled with a strong cultural preference for poultry, significantly drives the poultry market. Chicken, valued for its affordability and versatility, is a staple in Saudi diets, especially as consumers increasingly seek protein-rich foods. Urbanization and rising incomes further amplify demand, as families incorporate poultry into daily meals. For instance, major cities like Riyadh and Jeddah see high consumption due to dense populations and busy lifestyles. This demographic shift pushes companies like Al-Watania Poultry to expand production facilities to meet the growing need for fresh and processed poultry products, ensuring a steady supply for households and restaurants.

- Government Support for Food Security

Saudi Arabia’s Vision 2030 initiative emphasizes food security, reducing reliance on imports by boosting domestic poultry production. The government provides subsidies for feed, interest-free loans, and incentives for modern farming equipment, enabling companies to scale operations. For example, in 2022, Almarai announced a significant expansion plan to double its poultry output, supported by government-backed financial incentives. These efforts encourage local producers to invest in advanced infrastructure, such as automated hatcheries, to enhance efficiency. By fostering self-sufficiency, these policies strengthen the poultry sector, making it a cornerstone of the nation’s agricultural economy and a key market driver.

- Increasing Disposable Incomes

Higher disposable incomes among Saudi consumers are fueling demand for premium and value-added poultry products. As the working population grows, particularly among women, there’s a shift toward convenient, high-quality options like marinated or ready-to-cook poultry. Companies like Tanmiah Food Company have capitalized on this by offering halal-certified, pre-seasoned products that cater to busy urban households. This trend is evident in the rising popularity of branded poultry items in supermarkets like Lulu Hypermarket, where consumers seek both quality and convenience. The financial ability to purchase premium products drives market growth and encourages innovation among producers.

Key Trends in the Saudi Arabia Poultry Market

- Technological Integration in Poultry Farming

The adoption of advanced technologies is transforming Saudi Arabia’s poultry industry. Precision farming, using IoT devices and data analytics, optimizes feed consumption, monitors flock health, and controls environmental factors like temperature. For instance, Golden Chicken Farms partnered with Petersime in 2023 to implement advanced incubators, increasing broiler hatchery capacity. These innovations improve productivity and reduce costs, allowing producers to meet rising demand efficiently. Automation also enhances biosecurity, minimizing disease risks, which is critical given past challenges like avian influenza. This trend aligns with global smart agriculture movements, making Saudi poultry farming more sustainable and competitive.

- Growing Demand for Processed Poultry

Urbanization and changing lifestyles are driving demand for processed and ready-to-eat poultry products. Busy consumers, especially in cities like Dammam, prefer convenient options like nuggets, sausages, and pre-marinated meats. Al Kabeer Group, for example, has expanded its range of halal-certified processed products, including samosas and kebabs, to cater to this trend. The rise of foodservice outlets, such as quick-service restaurants, further boosts demand, as they rely on processed poultry for consistent supply. This shift reflects a broader preference for time-saving meal solutions, pushing producers to innovate and diversify their product portfolios to capture market share.

- Rise of E-Commerce and Digital Marketing

The growth of e-commerce is reshaping poultry distribution in Saudi Arabia. Online platforms enable consumers to order fresh and frozen poultry conveniently, with retailers like Panda Retail leveraging digital channels to reach urban customers. Social media campaigns and digital marketing also help brands like Americana Group build consumer trust and highlight product quality, such as halal certifications. This trend is particularly appealing to younger, tech-savvy consumers who value accessibility and transparency. By integrating e-commerce, producers streamline supply chains and tap into growing online retail markets, enhancing market reach and driving sales in a competitive landscape.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-poultry-market/requestsample

Saudi Arabia Poultry Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

- Broiler

- Eggs

- Others

Breakup by Nature:

- Organic

- Conventional

Breakup by Distribution Channel:

- On-Trade

- Off-Trade

Breakup by Region:

- Western Region

- Northern and Central Region

- Eastern Region

- Southern Region

Competitive Landscape:

- Al Kabeer Group Me

- Almarai Company

- Almunajem Foods Co.

- Al-Wadi Poultry Company

- Al-Watania Poultry

- Arabian Agricultural Services Company (ARASCO)

- Balady Poultry Trading Company

- BRF Global

- Cherkizovo Group

- Saudi Radwa Food Co. Ltd.

Future Outlook

The Saudi Arabia poultry market is poised for sustained growth, driven by population growth, technological advancements, and government support under Vision 2030. As consumer preferences shift toward healthier, convenient, and sustainably produced poultry, companies will likely invest in organic and antibiotic-free products to meet demand. Strategic partnerships, like the 2023 joint venture between Tanmiah Food Company and Ukraine’s MHP SE, signal opportunities for export growth, positioning Saudi Arabia as a regional poultry hub. However, challenges such as feed price volatility and import competition will require ongoing innovation and regulatory support to ensure long-term resilience and market expansion.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.