Saudi Arabia Poultry Market Size, Opportunities, Risks and Forecast 2025–2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Saudi Arabia Poultry Market Overview

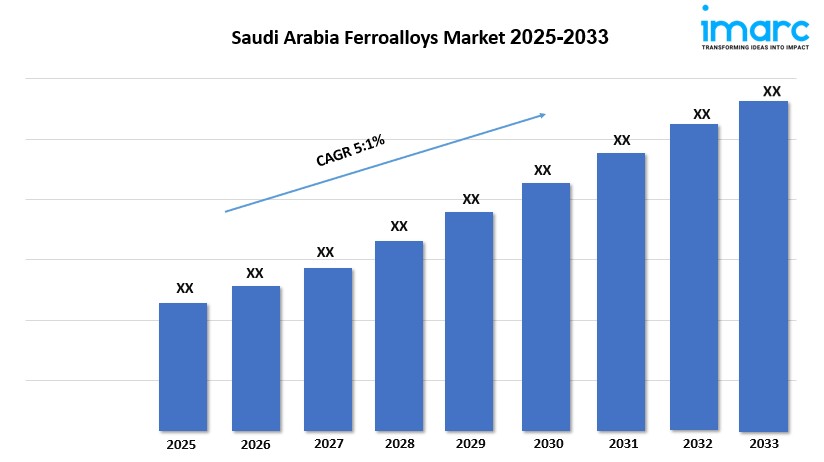

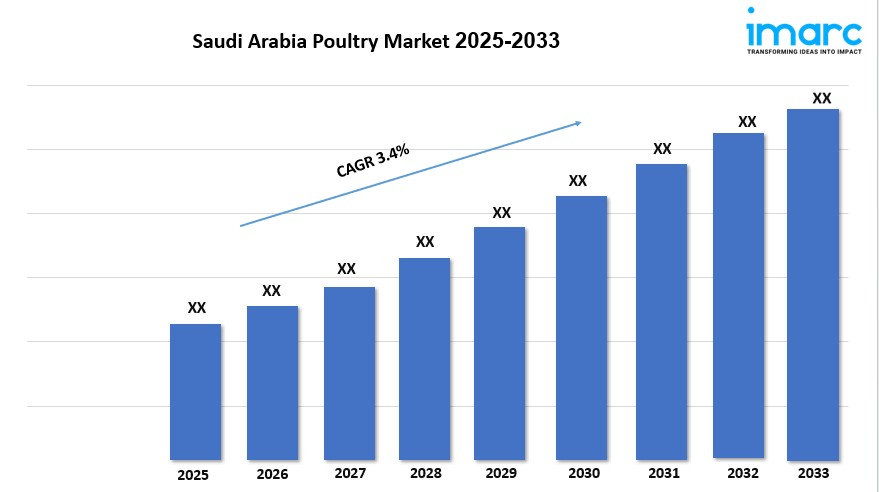

Market Size in 2024 : USD 19.0 Billion

Market Size in 2033: USD 26.6 Billion

Market Growth Rate 2025-2033: 3.4%

According to IMARC Group's latest research publication,"Saudi Arabia Poultry Market Report by Product Type (Broiler, Eggs, and Others), Nature (Organic, Conventional), Distribution Channel (On-Trade, Off-Trade), and Region 2025-2033", The Saudi Arabia poultry market size reached a value of USD 19.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.6 Billion by 2033, exhibiting a CAGR of 3.4% during 2025-2033.

Growth Factors in the Saudi Arabia Poultry Market

- Rising Population and Protein Demand

Saudi Arabia's increasing population size is behind new poultry entries, making poultry market entry a high priority as the job and education markets grow. The continued increase in living standards raises the demand for affordable, bulk, and accessible protein sources to maintain healthy family diets. Chicken remains a mainstay of protein in Saudi diets, largely due to its flexibility, versatility in preparation, and nutritional value—making it the protein of choice for most families. The Saudi Arabian poultry market is also experiencing a boost from a wave of new expatriates seeking jobs and from tourism growth (e.g., Riyadh Season), suggesting rising poultry demand in restaurants and hotels. For example, Al-Watania Poultry has increased production in recent months to meet and fulfill demand for an ever-expanding supply mix of processed and fresh poultry products across the hospitality sector.

- Government Support for Food Security

The Saudi government’s Vision 2030 initiative makes excellent strides for the poultry industry to increase food security and reduce dependency on imports. Subsidies for feed, interest-free loans, and rebates on poultry equipment will drive down production costs and enable local farmers to expand the origin of their production. A glaring example includes Tanmiah Food Company which partnered with a Ukrainian producer, MHP SE in 2022, to enhance an existing poultry agreement designed to grow domestic production through technology and expertise. This is all in line with the government’s aspirations to reduce poultry importation by achieving 80% self-sufficiency by 2025. With this effort, it is clear that the conditions for technical market-business growth and sustainability are present.

- Increasing Disposable Income and Urbanization

Increased disposable incomes and urbanization in places like Riyadh and Jeddah has increased demand for quality and convenient poultry products. With more women entering the workforce, consumers are looking for ready-to-eat options or ready-to-cook products like marinated chicken or chicken nuggets. Companies like Almarai have taken notice of the trend by providing halal, pre-packaged and pre-seasoned products perfect for busy urban households. Similarly, not only do modern retail outlets like Lulu Hypermarket introduce more branded poultry products to urban consumers, but they also provide the convenience of easily accessible products.

Key Trends in the Saudi Arabia Poultry Market

- Technological Integration in Poultry Farming

The rapidly changing poultry sector in Saudi Arabia, driven largely by the introduction of cutting-edge technologies, such as precision farming and Internet of Things devices, will have a lasting impact on the industry. These technologies will greatly enhance operational efficiencies and the welfare of poultry by facilitating real-time awareness of flock health, feed intake/expenditure and environmental conditions. Golden Chicken Farms engaged Petersime to explore X-Streamer incubator solutions in 2023, boosting their broiler hatchery capacity to 50 million birds annually. Fully automated feeding systems and advances in climatic technology are directly reducing labor costs associated with running the business and ensuring they meet sustainability goals and continue to supply increasing demand for quality poultry in a reliable and efficient manner.

- Growing Demand for Processed Poultry Products

Saudi consumers are increasingly opening up to convenient and/or processed poultry items including nuggets, sausages, and cooked meals due to their busy lifestyles and changing dietary habits. Major players, Al Kabeer Group and Almarai, are already providing a range of convenient poultry options with halal certification, including samosas and burger patties from Al Kabeer Group, to urban households, as well as the foodservice market. The rise of quick-service restaurants (QSR) and e-commerce approaches (for example, online meat delivery services) are also facilitating this trend by providing access to high-quality and convenient poultry products to consumers, with increasing access to convenience convenient options that aligned with their sped-up lifestyles.

- Focus on Sustainability and Animal Welfare

Animal welfare and sustainability are becoming increasingly important to Saudi Arabia's poultry sector due to environmental concerns and local laws. Many livestock and poultry farms are taking actions to reduce their impact on the environment and adopt waste management strategies. In examples of such efforts, poultry waste is transformed into organic fertilizers that can be recycled, and more efficient livestock waste storage and treatment methods will reduce the farms' carbon footprints. Additionally, welfare-friendly conditions will involve better biosecurity, better ventilation of poultry, and reduced reliance on antibiotics, as farmers will prioritize reducing sick animals or animal endangerment. In 2024, producers such as Al-Watania Poultry implemented cage-free egg production systems to meet economic demand concerning customer preferences for eggs produced under humane conditions. Such efforts are witnessed in the gradual uptake of more sustainable and responsible farming practices in Saudi Arabia's poultry sector.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-poultry-market/requestsample

Saudi Arabia Poultry Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product Type:

- Broiler

- Eggs

- Others

Breakup by Nature:

- Organic

- Conventional

Breakup by Distribution Channel:

- On-Trade

- Off-Trade

Breakup by Region:

- Western Region

- Northern and Central Region

- Eastern Region

- Southern Region

Competitive Landscape:

- Al Kabeer Group Me

- Almarai Company

- Almunajem Foods Co.

- Al-Wadi Poultry Company

- Al-Watania Poultry

- Arabian Agricultural Services Company (ARASCO)

- Balady Poultry Trading Company

- BRF Global

- Cherkizovo Group

- Saudi Radwa Food Co. Ltd.

Future Outlook

Due to a combination of population growth, government assistance, and changing consumer preferences, the Saudi Arabian poultry market is expected to continue expanding. Investments in cutting-edge agricultural technologies and global alliances like those with Tyson Foods and BRF will increase production capacity and quality as Vision 2030 strives for increased self-sufficiency. Poultry products will become more widely available due to the growing popularity of e-commerce and contemporary retail channels, and there will be room for innovation due to the demand for organic and halal-certified products. The industry's emphasis on sustainability, technology, and high-quality products positions it for a resilient and prosperous future despite obstacles like disease outbreaks and feed price fluctuations.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.