Saudi Arabia Video Surveillance Systems Market Share, Scope, Growth And Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Saudi Arabia Video Surveillance Systems Market Overview

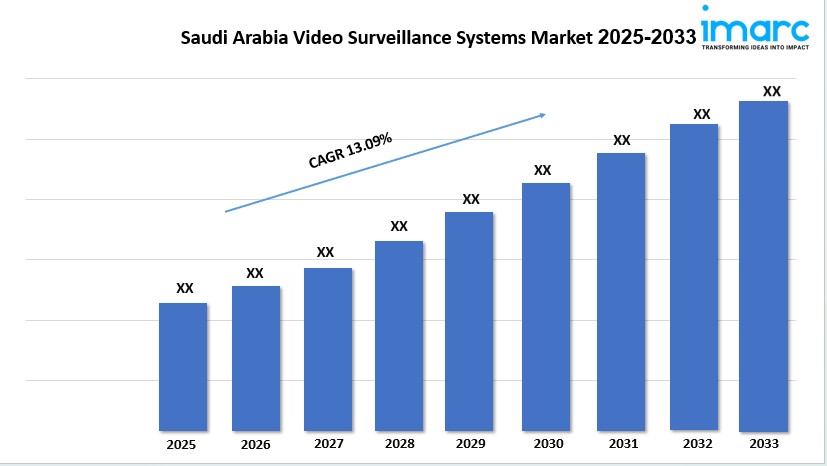

Market Size in 2024 : USD 690.5 Million

Market Size in 2033: USD 2,089.2 Million

Market Growth Rate 2025-2033: 13.09%

According to IMARC Group's latest research publication,"Saudi Arabia Video Surveillance Systems Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2023", The Saudi Arabia video surveillance systems market size reached USD 690.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,089.2 Million by 2033, exhibiting a growth rate (CAGR) of 13.09% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-video-surveillance-systems-market/requestsample

Growth Factors in the Saudi Arabia Video Surveillance Systems Market

- Government Initiatives and Vision 2030

Saudi Arabia’s Vision 2030, a transformative national plan to diversify the economy, significantly drives the video surveillance market. The government’s focus on smart city development, such as Neom and the Riyadh Metro, necessitates advanced surveillance systems to ensure public safety and infrastructure security. For instance, the Riyadh Metro project integrates high-definition cameras for real-time monitoring to manage crowds and prevent incidents. Additionally, regulations mandating CCTV installation in public spaces like hotels and stadiums, as enforced by the Ministry of Interior, boost demand. These initiatives create a robust framework for surveillance technology adoption across various sectors.

- Rising Security Concerns and Crime Prevention

Heightened security concerns across public and private sectors propel the demand for video surveillance systems. Increasing incidents of theft and vandalism, particularly in urban areas like Riyadh and Jeddah, encourage businesses and residents to invest in monitoring solutions. For example, retail chains in Jeddah’s shopping malls deploy AI-powered cameras with facial recognition to deter shoplifting. The government’s emphasis on maintaining Saudi Arabia’s reputation as a safe destination, evidenced by its high ranking in the 2023 Safety Index, further fuels investments in surveillance to protect critical infrastructure, such as oil facilities and transportation hubs, enhancing market growth.

- Infrastructure Development and Urbanization

Rapid urbanization and infrastructure projects across Saudi Arabia create significant opportunities for the video surveillance market. Mega-projects like AMAALA and Al-Qiddiya entertainment city require comprehensive security systems to safeguard assets and visitors. The construction of new commercial buildings, hotels, and educational institutions, particularly in Riyadh, necessitates surveillance to monitor high-footfall areas. For instance, the Mall of Saudi integrates IP-based cameras for seamless security management. As the country attracts foreign investment and tourism, the need for advanced surveillance to ensure safety in these developments drives market expansion, aligning with economic diversification goals.

Key Trends in the Saudi Arabia Video Surveillance Systems Market

- Integration of Artificial Intelligence and Analytics

The adoption of artificial intelligence (AI) in video surveillance systems is transforming the market by enabling advanced functionalities. AI-powered cameras offer features like facial recognition, object detection, and behavior analysis, enhancing threat detection. For example, banks in Riyadh use AI analytics to identify suspicious activities in real time, improving security protocols. This trend aligns with global advancements, as companies like Hikvision and Dahua introduce AI-enabled solutions tailored for Saudi Arabia’s needs. The integration of AI not only improves efficiency but also reduces reliance on manual monitoring, making surveillance systems more proactive and intelligent.

- Shift to IP-Based and Wireless Cameras

The market is witnessing a shift from analog to IP-based and wireless cameras due to their superior connectivity and flexibility. IP cameras, integrated with IoT, allow remote access and cloud storage, making them ideal for smart infrastructure projects like Neom Business City. Wireless cameras, in particular, are gaining traction for their ease of installation and affordability. For instance, small businesses in Dammam use wireless systems to monitor premises via smartphones, reducing operational costs. This trend reflects consumer preference for scalable, high-resolution solutions that support real-time data transmission, driving market innovation and adoption.

- Growth in Cloud-Based Surveillance Solutions

Cloud-based video surveillance, or Video Surveillance as a Service (VSaaS), is emerging as a key trend due to its scalability and cost-effectiveness. Businesses, especially in hospitality and healthcare, leverage cloud solutions for remote monitoring and data storage. For example, Eagle Eye Networks’ new data center in Riyadh, opened in 2024, supports AI-enhanced cloud surveillance, ensuring compliance with local data privacy regulations. This trend caters to the growing demand for flexible security systems that can be accessed across multiple devices, enhancing operational efficiency and supporting Saudi Arabia’s digital transformation initiatives.

Saudi Arabia Video Surveillance Systems Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Saudi Arabia Video Surveillance Systems market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

Component Insights:

- Hardware

- Software

- Services

Application Insights:

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

Customer Type Insights:

- B2B

- B2C

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Future Outlook

The Saudi Arabia video surveillance systems market is poised for robust growth, driven by ongoing smart city projects, technological advancements, and increasing security needs. As Vision 2030 progresses, investments in infrastructure like the Red Sea Project and Neom will demand cutting-edge surveillance solutions integrated with AI and IoT. The market will likely see greater adoption of cloud-based and wireless systems, catering to diverse sectors from retail to transportation. However, challenges like high initial costs and data privacy concerns may require innovative financing models and stricter regulations. With key players like Hikvision and Honeywell expanding their presence, the market is set to evolve into a cornerstone of Saudi Arabia’s safety and digital ecosystem.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.