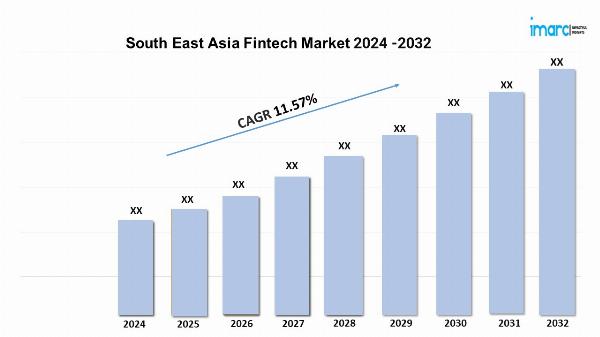

South East Asia Fintech Market | Expected to Grow at a CAGR of 11.57% during 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Fintech Market - South East Asia

Market Statistics

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 11.57% (2024-2032)

The South East Asia fintech market is experiencing significant growth, driven by rapid digital transformation, increasing internet penetration, and a growing demand for innovative financial services. Additionally, the expanding availability of various fintech solutions through mobile and online platforms is further propelling market demand. According to the latest South East Asia fintech market report by IMARC Group, the market is projected to grow at a CAGR of 11.57% from 2024 to 2032.

South East Asia Fintech Industry and Drivers:

The market is primarily driven by the increasing penetration of smartphones and internet connectivity. In line with this, the widespread adoption of digital payment solutions is also providing an impetus to the market. Moreover, the considerable rise in financial inclusion initiatives is acting as a significant growth-inducing factor for the market. In addition to this, the expanding demand for seamless and secure transaction services is resulting in a higher investment in fintech solutions.

Besides this, the growing interest in blockchain and cryptocurrency due to the rising awareness of decentralized finance is creating lucrative opportunities in the market. Also, the increasing influence of regulatory support and favorable policies is impacting the market positively. The market is further driven by the implementation of advanced technologies such as AI and machine learning that enhance financial services.

Download sample copy of the report: https://www.imarcgroup.com/south-east-asia-fintech-market/requestsample

South East Asia Fintech Industry Scope and Growth Analysis:

The scope of the global market is expanding as financial institutions increasingly adopt digital transformation strategies. The growing emphasis on customer-centric and innovative financial services, as per market analysis, is providing numerous opportunities for market participants. Additionally, the rising trend of cross-border payments and remittances is a key factor enhancing the market scope. In parallel, the integration of open banking and API-based services is opening new avenues for market growth. Moreover, the increasing focus on cybersecurity and fraud prevention is fostering the development of robust fintech solutions. The market is further shaped by the demand for personalized financial products that cater to diverse customer needs.

Furthermore, the expanding landscape of digital identity verification and KYC solutions is contributing to the broadening of market horizons. The growing importance of financial literacy and education, coupled with continuous innovation in mobile banking and payment platforms, is also augmenting market scope. As per market analysis, strategic partnerships and collaborations among fintech firms and traditional financial institutions are facilitating market expansion.

South East Asia Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=20370&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.