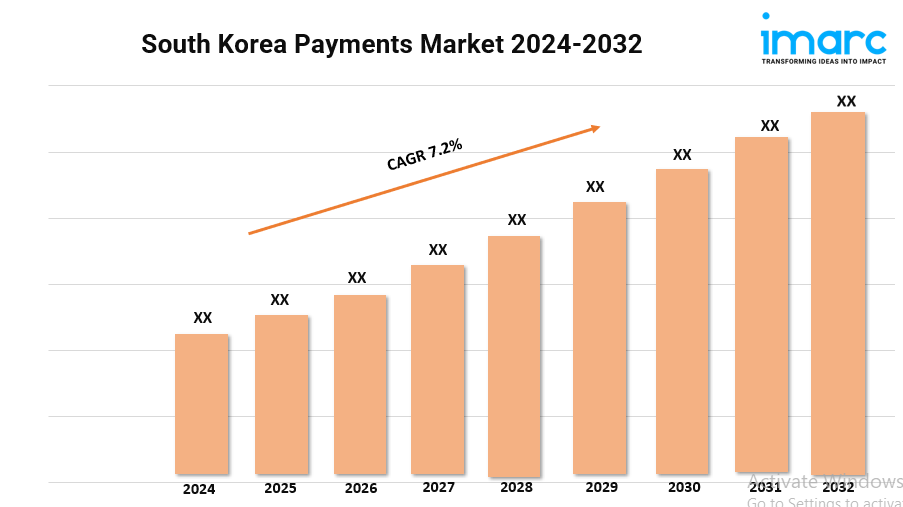

South Korea Payments Market 2024-2032: Size, Trends, Growth and Forecast

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

South Korea Payments Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 7.2% (2024-2032)

The proliferation of smartphones and widespread internet connectivity represents one of the key factors supporting the market growth in South Korea. According to the latest report by IMARC Group, the South Korea payments market size is projected to exhibit a growth rate (CAGR) of 7.2% during 2024-2032.

South Korea Payments Industry Trends and Drivers:

The proliferation of smartphones and widespread internet connectivity represents one of the key factors supporting the market growth in South Korea. Individuals are favoring mobile payments and digital wallets, which offer convenience, speed, and security. The advanced information technology (IT) infrastructure and high internet penetration rate provide a solid base for digital payment solutions to thrive. The widespread use of smartphones and high levels of digital literacy among individuals are also critical factors supporting the adoption of innovative payment methods.

Additionally, the rise of contactless payments is aligning with user preferences for quick and efficient transactions. The strong support for financial technology (fintech) innovation is fostering an ecosystem where new payment solutions are continuously developed and integrated, enhancing the overall user experience. Besides this, the growing popularity of online shopping is driving the demand for versatile payment methods that cater to a tech-savvy population.

The technological infrastructure supports seamless integration of payment systems across various digital platforms, providing users with multiple options for online transactions. The adoption of biometric authentication methods is enhancing security and user trust.Moreover, individuals are seeking quicker and easier payment methods, which is encouraging financial institutions and fintech companies to develop innovative digital solutions. The increasing trust in digital payment platforms, driven by enhanced security measures and user protection policies, is contributing to the market growth.

The convenience offered by mobile wallets and digital payment systems is appealing, encouraging higher adoption rates among individuals. Apart from this, the proactive stance of the governing body in promoting digital transformation within the financial sector, coupled with policies aimed at reducing cash usage, is accelerating the shift towards digital payments. Supportive regulations that encourage competition and innovation among fintech companies are fostering a vibrant market landscape.

These initiatives are facilitating the development and deployment of advanced payment technologies, making digital payments more accessible and appealing to a broader audience. Furthermore, financial institutions and fintech firms are investing heavily in research and development (R&D) to create secure, user-friendly payment solutions. This competition is leading to the introduction of new features and functionalities that enhance the overall payment experience for clients.

Download sample copy of the Report: https://www.imarcgroup.com/south-korea-payments-market/requestsample

South Korea Payments Industry Segmentation:

The report has segmented the market into the following categories:

Mode of Payment Insights:

- Point of Sale

- Card Payments

- Digital Wallet

- Cash

- Others

- Online Sale

- Card Payments

- Digital Wallet

- Others

End Use Industry Insights:

- Retail

- Entertainment

- Healthcare

- Hospitality

- Others

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- American Express Company

- Kakao Pay Corp.

- Mastercard Inc.

- Naver Corporation

- NHN PAYCO Corp.

- Rapyd Financial Network (2016) Ltd.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- Viva Republica Inc.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.