Springlear Residence: An Upcoming Condominium Development in Singapore

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

1. Overview & Strategic Context

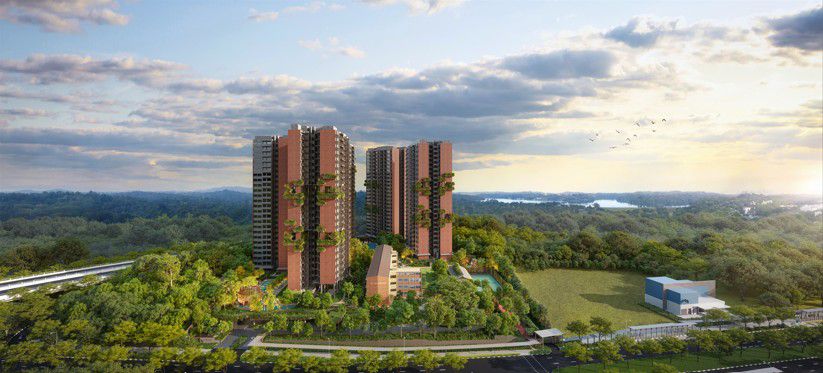

Springleaf Residence is a landmark 99-year leasehold condominium development located in District 26 (Upper Thomson/Springleaf), a traditionally landed enclave in the northern OCR (Outside Central Region) of Singapore. It will be the first high-rise condo in the area, developed by GuocoLand and Hong Leong Holdings after winning the URA Parcel B tender in April 2024 at about S$905 psf per plot ratio—a relatively low land cost compared to nearby sites.

Built on a sprawling 32,000+ sqm (approximately 344,000 sq ft) land parcel, Springleaf Residence will comprise 941 residential units across five 25-storey towers, plus a conserved low-rise block (former Upper Thomson Secondary School) integrated into the scheme.

2. Location & Connectivity

• Just ~110 200 metres (about a 2-minute sheltered walk) from Springleaf MRT Station (TEL), offering outstanding access to public transport. This proximity makes it one of the most accessible condo launches in the northern OCR (New Launches Condo).

• For motorists, convenient access to the North South Corridor and Seletar Expressway (SLE) enhances connectivity island-wide (New Launches Condo).

• The future Bright Hill station (CRL interchange) is within a short ride, boosting cross-island access by the early 2030s (99.co).

3. Development Layout & Design

• With a low site coverage of ~23%, the project emphasises spaciousness and greenery, allowing abundant landscaping and communal spaces (New Launches Condo).

• The preserved conserved block adds heritage character—a rare feature in new launches. Some residential units incorporate this conserved structure, offering a unique living ambience (New Launches Condo).

• The absence of PPVC (prefab) construction means purchasers can enjoy more flexibility in future renovations like hacking internal walls (New Launches Condo).

4. Unit Mix & Pricing

Springleaf Residence offers a broad mix suitable for different buyer types:

Unit Type Unit Share (~) Indicative Pricing Range

- 1 Bedroom ~15% From ~S$800K–S$875K

- 2 Bedroom ~15% Mid S$800Ks to ~S$1.18 M

- 3 Bedroom ~35% ~S$1.5M–S$1.8M (mid ≈ S$1.77M)

- 4 Bedroom ~25% Around ~S$2.7–2.8 M

- 5 Bedroom ~10% ~S$2.0M+

Average pricing is expected to be about S$2,200 psf, with a breakeven land cost around S$1,600 psf and typical developer margins factored in (New Launches Condo).

The 1 bed units (~S$873K) undercut both resale and other nearby OCR new launches by S$100K–300K, making it one of the most affordable MRT linked entries in D26. 2 beds (~S$1.18M) also offer unmatched entry pricing for HDB upgraders and first timers near MRT yielding full condo facilities. 3 beds are priced comparably or slightly below legacy freehold projects like Thomson Grove, yet offer modern layouts and full new launch facilities (Insights by PropertyLimBrothers). 4 beds maintain the advantage over older large units in freehold estates in terms of quantum.

5. Facilities & Liveability

The development’s vast land and design enable a comprehensive suite of lifestyle amenities:

• Outdoor tennis courts, fully equipped gyms, indoor running track, swimming pools, kids’ playgrounds, and lush landscaping gardens.

• Its proximity to the Springleaf Forest, Upper Seletar Reservoir Parks, and the surrounding greenery ensures most units have unblocked panoramic green views (New Launches Condo, 99.co).

• The overall landscape encourages a tranquil, nature immersive lifestyle that’s rare within MRT adjacent developments.

6. Competitive Positioning & Value Proposition

• Springleaf Residence is uniquely positioned as the first high rise condo in an enclave filled with landed homes, offering rare density plus direct MRT linkage.

• Its land cost advantage (~S$905 psf ppr) gives it pricing coachability compared to recent OCR launches like Lentor, Bayshore, and Norwood, where launch prices ranged from ~S$2,200–2,300 psf (New Launches Condo).

• The combination of modern layouts, eco-sensitive design, and reputable developers contributes to its MOAT (competitive moat) strength—suitable for owner-occupiers, long-term own-stay upgraders, especially those in nature-focused lifestyles .

7. Considerations / Limitations

• The 99-year leasehold tenure — while common for new OCR launches — remains a viable alternative to older freehold developments, but may dissuade some buyers.

• School proximity is not a strong point: there are no primary or secondary schools immediately nearby, raising concerns for families with young children applying via P1 balloting. Most schools are reachable via MRT commutes (99.co).

8. Market Outlook & Investment Potential

SG Home Investment highlights that the relatively low land cost (~S$905 psf ppr) combined with a strategic site and developer credibility provides a compelling upside opportunity—especially before surrounding area intensifies in developmen.

Longer term, plans for Springleaf include carefully balanced development around the forested areas, with buffer zones to preserve ecology—making the locale a potential "mini Bukit Timah of the north" in a decade—green, tranquil, and exclusive.

9. Final Verdict

Springleaf Residence emerges as a strong proposition, especially for:

• Nature-oriented own-stay buyers who value MRT access yet prefer serenity over urban density.

• HDB upgraders seeking affordable 2 or 3 bedder entry next to MRT under the ~S$1.2M mark.

• Long-term owner-occupiers are more than short-horizon investors, due to limited school access and leasehold tenure.

Its price quantum for 1 to 3 bedder layouts offers significant savings over older resale or new freehold projects, while delivering a modern, well-amenitised living environment within a unique enclave. SG Home Investment’s analysis emphasises that Springleaf Residence’s affordability gap, connectivity, and developer branding combine to create a compelling early bull case—particularly for buyers willing to ride the precinct’s evolution over the next decade.

In summary, Springleaf Residence offers exceptional value-for-money among D26 launches in 2025. It blends access, greenery, scale, and developer competence into a package tailored to serious own stay-upgraders, small families, and investors eyeing long-term capital growth as the Springleaf precinct gradually evolves.

For more property reviews, please visit SG Home Investment.

Please contact Lance Kuan to receive the latest information and pricing updates.

Please contact Lance Kuan to receive the latest information and pricing updates.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.