The Asia Pacific Fish Processing Market Growth, Top Players and Trends

The Asia Pacific Fish Processing Market has witnessed robust expansion, reaching a valuation of USD 162.15 billion. This growth stems from rapid urbanization, increasing seafood consumption, and evolving consumer preferences across major countries like China, Japan, and India. With governments actively supporting aquaculture infrastructure and exports, processed fish products are becoming vital to both domestic consumption and global trade.

Explore the in-depth industry analysis Asia Pacific Fish Processing Market Report.

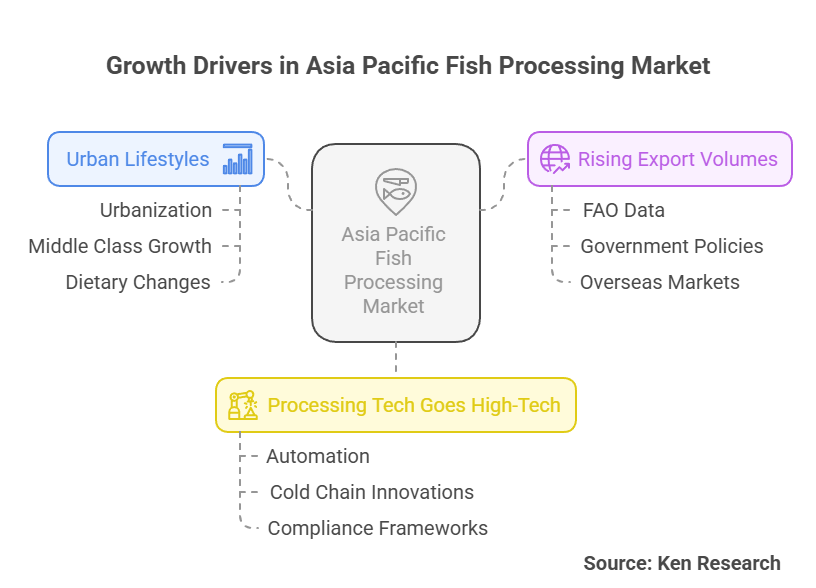

Growth Driven in Asia Pacific Fish Processing Market

- Urban Lifestyles Drive Demand for Processed Seafood: With urbanization in Asia hitting 56.9% in 2024, a growing middle class and changing dietary habits have increased demand for ready-to-eat and frozen fish products. Countries like Japan and South Korea are seeing seafood emerge as a primary protein source. Frozen fish, thanks to its extended shelf life and high nutritional value, now dominates retail shelves and export consignments alike.

- Rising Export Volumes Fuel Expansion: Asia Pacific contributes nearly 60% of global seafood exports, totaling over 36 million metric tons in 2024, according to the FAO. Countries like India, Vietnam, and Thailand benefit from favorable government policies, such as export subsidies, modernized ports, and reduced customs red tape, giving regional processors access to lucrative overseas markets.

- Processing Tech Goes High-Tech: Advanced automation in filleting and freezing, combined with cold chain innovations, has transformed the fish processing landscape. Companies are investing in cutting-edge machinery that reduces waste and improves food safety. The use of Hazard Analysis and Critical Control Points (HACCP) and other compliance frameworks ensures that quality standards remain globally competitive.

Top Players in APAC Fish Processing Industry

The Asia Pacific fish processing market is marked by the dominance of a few global and regional powerhouses:

- Thai Union Group: A global seafood leader, known for its strategic investments in automation and sustainability.

- Maruha Nichiro Corporation: Japan-based giant with a focus on high-quality processed seafood and R&D innovation.

- Nippon Suisan Kaisha Ltd. (Nissui): Strong export network and diversified product portfolio tailored to consumer trends.

- CP Foods (Charoen Pokphand Foods): Active across aquaculture, farming, and processing, with a robust footprint in Southeast Asia.

These companies leverage integrated supply chains, advanced processing facilities, and sustainability practices to maintain their competitive edge.

Emerging Trends Reshaping the Industry

- Sustainability in Seafood Sourcing: Consumer demand for eco-certified products is on the rise. Brands are responding by adopting sustainable fishing practices and traceability solutions. Certifications like MSC (Marine Stewardship Council) are becoming essential for market entry, particularly in export-driven segments.

- Rise of Value-Added Seafood Products: Pre-marinated fillets, smoked cuts, and ready-to-serve fish snacks are gaining momentum. Consumers in urban hubs prefer convenience without compromising quality, opening up opportunities for innovative product development.

- Technological Innovation in Processing: Automation in filleting, freezing, and skinning processes is reducing waste and improving consistency. AI and IoT integration in processing lines are enhancing quality checks, boosting productivity, and aligning with hygiene regulations like Japan’s HACCP protocols.

- Growth of Aquaculture as a Supply Backbone: Southeast Asia is investing heavily in aquaculture. Countries like India and Vietnam are scaling production with modern hatcheries and feed innovations, ensuring consistent supply to meet rising demand for processed fish.

Conclusion

As the Asia Pacific fish processing industry continues to modernize, it is riding a wave of export growth, technological innovation, and changing consumer behavior. Key players are tapping into premiumization trends and expanding aquaculture operations to meet demand sustainably. With governments backing the industry through policy, infrastructure, and compliance frameworks, the sector is poised for long-term resilience and profitability.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.