The Future of Payments: E-Money Blockchain Explained

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In an age where technology is reshaping every facet of our lives, the world of finance is no exception. As digital transactions become the norm, the concepts of e-money and blockchain technology are emerging as pivotal players in the future of payments. This article will delve into the synergy between e-money and blockchain, exploring how this combination is revolutionizing the financial landscape.

✍️ Energy concerns are a major criticism of blockchain. In our blockchain energy impact guide, we explore solutions like Proof-of-Stake to reduce consumption.

Understanding E-Money

E-money, or electronic money, refers to a digital representation of fiat currency. It allows users to conduct transactions electronically, facilitating the transfer of value without the need for physical cash. E-money can be stored on various platforms, such as mobile wallets, prepaid cards, and bank accounts.

Key Features of E-Money:

1. Convenience: E-money enables quick and easy transactions, making it ideal for both consumers and businesses.

2. Accessibility: With the proliferation of smartphones and internet access, e-money can be accessed by a wider audience, including unbanked populations.

3. Speed: Transactions can be completed almost instantaneously, enhancing user experience and operational efficiency.

The Role of Blockchain Technology

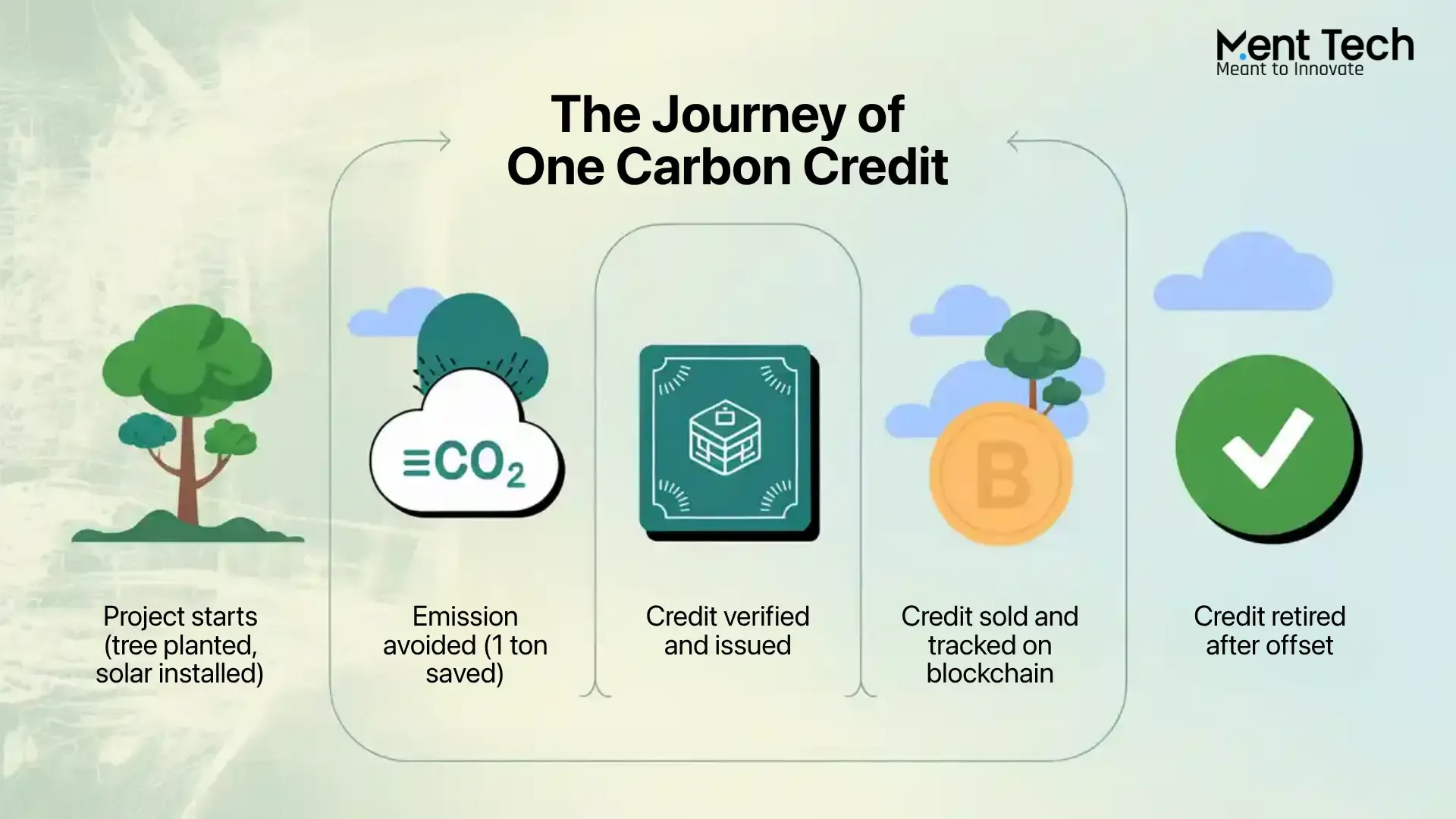

Blockchain technology serves as a decentralized ledger that records transactions across multiple computers. This means that once a transaction is recorded, it cannot be altered retroactively, ensuring transparency and security.

Key Features of Blockchain:

1. Security: Transactions are encrypted and stored in a way that makes them nearly impossible to tamper with, significantly reducing the risk of fraud.

2. Transparency: All transactions are visible to authorized users, fostering trust among participants.

3. Decentralization: By eliminating the need for a central authority, blockchain allows for peer-to-peer transactions, reducing costs and increasing efficiency.

The Intersection of E-Money and Blockchain

The combination of e-money and blockchain is a game-changer in the payments ecosystem. Here’s how they complement each other:

1. Enhanced Security and Fraud Prevention

Blockchain's immutable nature ensures that all e-money transactions are secure and tamper-proof. This significantly reduces the risk of fraud, making e-money a safer option for users.

2. Lower Transaction Costs

Traditional payment methods often involve intermediaries, leading to increased costs and longer processing times. By leveraging blockchain, e-money can facilitate direct peer-to-peer transactions, reducing the need for intermediaries and lowering fees.

3. Increased Efficiency

Blockchain enables faster transaction processing, allowing for real-time settlements. This efficiency is particularly beneficial for businesses that rely on quick payment processing.

4. Financial Inclusion

The integration of blockchain with e-money has the potential to bridge the gap for unbanked populations. By utilizing mobile devices and blockchain-based platforms, individuals without access to traditional banking systems can participate in the digital economy.

Real-World Applications

Several innovative platforms are already harnessing the power of e-money and blockchain to reshape the payment landscape:

1. Cryptocurrencies

Digital currencies like Bitcoin and Ethereum are prime examples of e-money that utilize blockchain technology. They allow users to make peer-to-peer transactions without the need for banks, offering a decentralized alternative to traditional currencies.

2. Stablecoins

Stablecoins are digital currencies pegged to a stable asset, such as the US dollar. They combine the benefits of cryptocurrencies with the stability of fiat currencies, making them a viable option for everyday transactions. Many stablecoins, like Tether (USDT) and USD Coin (USDC), leverage blockchain technology to facilitate secure and quick transactions.

3. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring the potential of CBDCs, which are digital currencies issued and regulated by central banks. CBDCs aim to provide the benefits of e-money while maintaining the stability of government-backed currencies. Many CBDCs are designed to be built on blockchain technology, ensuring security and transparency.

Challenges Ahead

Despite the promising future of e-money and blockchain, several challenges remain:

1. Regulatory Uncertainty

The evolving nature of e-money and blockchain has led to a patchwork of regulations across different jurisdictions. Governments must develop clear guidelines to foster innovation while ensuring consumer protection and financial stability.

2. Technical Hurdles

While blockchain technology is gaining traction, scalability remains a significant challenge. Many blockchain networks struggle to handle a high volume of transactions efficiently, leading to delays and increased costs.

3. Public Awareness and Adoption

For e-money and blockchain to become mainstream, consumers and businesses must understand and trust these technologies. Educational initiatives will play a crucial role in promoting acceptance and usage.

Conclusion

The future of payments lies at the intersection of e-money and blockchain technology. Together, they offer a powerful solution that enhances security, reduces costs, and promotes financial inclusion. As these technologies continue to evolve, they will undoubtedly shape the way we transact, paving the way for a more efficient and accessible financial system. Embracing this revolution will be essential for businesses and consumers alike as they navigate the digital economy of tomorrow.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.