The Importance of Regular Check-ups and Screenings for Women's Health Insurance Planning

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Maintaining good health is crucial, especially for women who often juggle multiple responsibilities. Regular check-ups and screenings play a pivotal role in ensuring overall well-being. They also significantly impact health insurance planning, helping to choose the best health insurance plan that caters to individual needs.

✍️ Learn how tax deductions work with insurance premiums. Our detailed post on health insurance tax benefits shows how you can save money while staying protected.

In this article, we will explore the importance of regular health check-ups and screenings, and how they influence health insurance planning, particularly focusing on the best health insurance plans and health insurance plans for family.

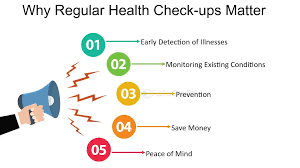

Benefits of Regular Check-ups

Regular health check-ups offer numerous benefits, including:

Early Detection of Diseases

Many diseases, including cancer, cardiovascular issues, and diabetes, can be detected early through regular screenings. Early detection often results in more effective treatment and a higher chance of recovery. For example, breast cancer detected at an early stage through mammograms can significantly increase the survival rate.

Better Management of Chronic Conditions

Conditions such as hypertension and diabetes can be better managed with regular monitoring. Regular visits to the healthcare provider allow for timely adjustments in treatment plans, which can prevent complications and improve quality of life.

Reduced Healthcare Costs

Early detection and management of health issues can lead to significant savings on medical expenses. Preventive care is generally less expensive than emergency care, and catching a condition early can prevent the need for more costly treatments down the line.

Enhanced Quality of Life

Regular check-ups ensure that any potential health problems are addressed promptly, improving overall quality of life. When women are proactive about their health, they are more likely to maintain their physical and mental well-being, enabling them to fulfil their daily responsibilities more effectively.

Finding the Best Health Insurance Plan for Women

Choosing the right health insurance plan involves taking several important factors into account. Consider the following tips to guide you during health insurance planning:

Coverage for Women's Health Issues

Ensure the health insurance plan covers essential screenings like mammograms, Pap smears, and bone density tests. Women’s health needs change over time, so it’s important that the health insurance plan offers coverage for a broad range of services that address these evolving needs.

Maternity and Newborn Care

If you are planning to start a family, check if the plan includes maternity and newborn care. Comprehensive maternity coverage should cover prenatal visits, delivery, and postnatal care, ensuring that both mother and baby receive the necessary medical attention.

Preventive Services

Look for plans that offer comprehensive preventive services without additional costs. Preventive services may include vaccinations, annual physicals, and wellness check-ups, which can help in detecting and preventing illnesses early.

Affordability

Balance the premium costs with the coverage benefits to find a plan that offers good value for money. Consider not only the monthly premiums but also other costs like deductibles, co-pays, and out-of-pocket maximums.

Flexibility

Opt for a plan that allows you to customise coverage based on your specific health needs. Some health insurance plans offer riders or add-ons that can be tailored to cover specific conditions or treatments, providing more personalised coverage.

Health Insurance Plans for Family

When planning health insurance for your family, it's crucial to ensure that all members are adequately covered. Here are some tips:

Comprehensive Family Coverage

Choose health insurance plans for family that provide coverage for all members, including children and elderly parents. Family health insurance plans should cater to the diverse health needs of all family members, from paediatric to geriatric care.

Regular Pediatric Check-ups

Ensure the plan covers regular paediatric check-ups and vaccinations for children. Preventive care for children, such as routine check-ups and immunizations, is vital for their healthy growth and development.

Chronic Illness Management

Look for plans that offer support for managing chronic illnesses prevalent in your family. Chronic diseases often require ongoing care and management, which can be costly without adequate insurance coverage.

Mental Health Services

Opt for plans that provide mental health services, which are essential for overall family well-being. Mental health is as important as physical health, and comprehensive coverage should include access to counselling and psychiatric services.

Maximising Health Insurance Benefits through Regular Screenings

Maximising the benefits of your health insurance plan involves utilising regular screenings and preventive services. Here’s how:

Stay Informed

Keep yourself updated on the screenings and preventive services covered by your health insurance plan. Understanding what your plan covers helps ensure that you take full advantage of the benefits available to you.

Schedule Regular Appointments

Make it a habit to schedule regular check-ups and screenings for yourself and your family. Regular appointments help in maintaining a routine of preventive care and catching potential health issues early.

Utilise Wellness Programs

Participate in wellness programs offered by your insurer to maintain good health and prevent illnesses. Wellness programs can provide valuable resources and support to help you and your family stay healthy.

Keep Records

Maintain detailed records of all medical visits and screenings to ensure you can track your health and claim benefits when needed. Having organised records can simplify the process of filing claims and managing your health history.

Review Your Plan Annually

Regularly review your health insurance plan to ensure it continues to meet your needs as your health and family circumstances change. Life changes, such as having a baby or dealing with a new health condition, may require adjustments to your coverage.

Conclusion

Regular check-ups and screenings are vital for maintaining good health and optimising your health insurance planning. By choosing the best health insurance plan and ensuring comprehensive coverage for your family, you can safeguard against unforeseen medical expenses and enhance your overall well-being.

To explore the best health insurance options, visit Niva Bupa's Health Insurance page for comprehensive and customizable plans that cater to your unique needs. Integrating regular check-ups and screenings into your routine can lead to a healthier life and make the most of your health insurance plan.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.