The Role of Blockchain in RWA Tokenization

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction

✍️ The rise of DeFi is one of blockchain’s biggest success stories. Read our article on blockchain in decentralized finance to discover how traditional banking is being disrupted.

Real-world asset tokenization has emerged as a revolutionary innovation due to the rapid changes in the global financial ecosystem. Traditional assets suffered from low liquidity, high transaction costs, and complex legal processes; thus, real hurdles in their ownership and trading. The introduction of blockchain technology offers alternatives to digitization and fractionalization of the asset so as to allow for greater accessibility, transparency, and efficiency. By enforcing contracts on the blockchain, RWA tokenization services have enabled new prospects for investors and businesses with seamless ownership transfer, automated compliance, and enhanced security. This blog captures how RWA tokenization is being powered by blockchain technology alongside a few of its possible use cases and trends shaping its future.

Understanding RWA Tokenization

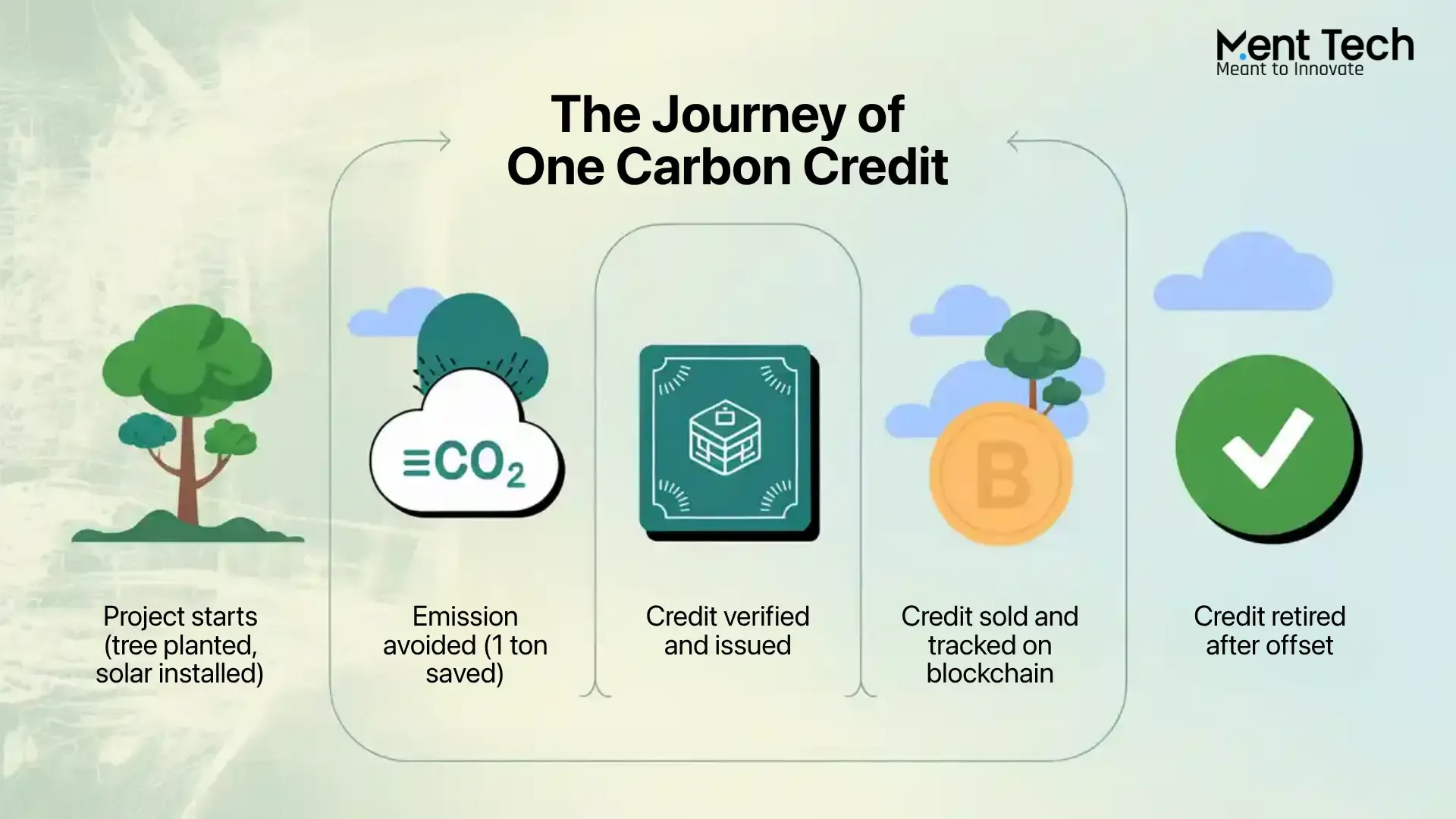

RWA tokenization is converting a physical or tangible asset into a digital token that exists on the blockchain. These tokens represent the ownership rights or value of real-world assets, allowing for trading and access of these assets on decentralized platforms. Anything from real property to precious metals, stocks, and bonds to fine art can be tokenized. This allows investors to buy fractional shares rather than ownership of an entire asset, democratizing the investment opportunity, providing liquidity, and adding ease to asset management.

For example, a high-value real estate property could be broken down into multiple digital tokens, allowing investors to purchase and trade fractional portions of the asset rather than needing large amounts of capital. Similarly, tokenized stocks or bonds allow marketing to investment worldwide without intermediaries. The blockchain digitization of ownership ensures a secure, transparent, and immutable record of transactions while eliminating inefficiencies associated with traditional asset markets.

The Implementation of RWA Tokenization Based on a Blockchain

The characteristic qualities of decentralization, transparency, and security afforded by blockchain serve the foundation of RWA tokenization. Certain unique characteristics improve asset tokenization, such as decentralized nature, smart contracts, and platforms dedicated to tokenized assets.

An Examination of the Blockchain and Its Standards

Real-world assets are stored securely within the blockchain through cryptographic means and strong decentralized consensus. Different blockchain standards provide different approaches for tokenized securities, complying with rules and regulations; for example, Ethereum's standards ERC-1400 and ERC-3643 allow the issuer to enforce ownership rights, authorize automated transaction processing, and manage investor identities in a seamless approach.

At the same time, some newer blockchain networks-such as Solana, Binance Smart Chain, and Avalanche-are becoming the accepted choice for tokenization due to their scalability, lower cost of transactions, and faster settlement times. In practical terms, different considerations apply to the choice of blockchain: asset type, regulatory requirements, and platform capabilities.

Smart Contracts: Pillar of the RWA Tokenization Process

Smart contracts enable tokenization by automating transactions, enforcing compliance, and providing transparency. Such contracts, which are self-executing, simply execute an agreement between two or several parties, based on pr-edefined rules. Hence, practically speaking, there is no need for intermediaries, and administrative costs get considerably reduced.

For instance, real estate tokenization enables a smart contract to execute the transfer of ownership, execute rental agreements and distribute dividends without any manual involvement. Similarly, in commodities tokenization, smart contracts ensure that gold-backed tokens maintain a one-to-one peg with respect to physical gold stored in vaults.

Enabling Platforms for RWA Tokenization

Several blockchain platforms have specialized in RWA tokenization and provide end-to-end solutions for asset issuers and investors. Polymath, Securitize, and Tokeny provide a regulatory-compliant framework for issuing and managing tokenized security solutions. These platforms seamlessly facilitate the tokenization of an asset through integrating identity verification, compliance automation, and secondary market trading. While traditional institutions are doing their own research, they are also implementing tokenization solutions through their blockchain efforts. Major banks and asset managers use blockchain technology to digitize financial assets, thereby benefiting from quicker settlement options and improved liquidity for capital markets.

Potential Use Cases of RWA Tokenization

The reach of RWA tokenization extends throughout many sectors and has the potential to alter the paradigm of asset ownership, trading, and management.

Real Estate: Tokenized real estate gives investors fractional ownership in properties, thereby democratizing access to high-value assets. Tokens can be traded on secondary markets for liquidity.

Precious metals and their commodities: tokenizing gold and silver and other commodities enables investors to buy and sell digital assets against these physical reserves, eliminating the cumbersome and expensive task of storing the asset while keeping it secure.

Stocks and bonds: Traditional equities and fixed-income securities can be tokenized to allow for global trading with minimal settlement time. Tokenized stocks will trade 24-7, as opposed to traditional markets that set hours for trading.

Fine art and collectibles: Tokenization in art allows fractional ownership of rare paintings and collectibles, thus giving access to high-value assets. Reliability and authenticity are ensured due to the blockchain documentation of the tokenized art.

Trends Shaping the Future of RWA Tokenization

From blockchain technology and around the following times, some trends emerged to promote the growth and adoption of RWA tokenization.

Integration with DeFi allows RWA tokenization to create newer opportunities for finance. Tokenized assets can serve as collateral for lending and borrowing in a way that provides liquidity to investors without having to sell their holdings. DeFi protocols automate transactions and yield generation on tokenized assets.

Another trend determining tokenization's future are regulatory advancements. Governments and financial regulators are developing frameworks to ensure compliance, investor protection, and market transparency for tokenized assets. With enhanced regulatory clarity, institutional adoption of tokenization should advance much faster, lending even more credibility to the sector.

Blockchain-based tokenization infrastructure, which includes interoperable networks and cross-chain solutions, is aiding in boosting RWA trading efficiency. Interoperability allows tokenized assets to be swapped cross-ledger within different blockchain ecosystems with improved ease of liquidity and accessibility for investors.

Conclusion

Blockchain technology has placed itself on the center stage of revolutionizing the tokenization of real-world assets by providing a secure, transparent, and efficient environment for the digitalization of ownership. Through its decentralized networks, smart contracts, and specific platforms, blockchain promotes the trading and management of tokenized assets. The maturation phase of the industry will, therefore, see RWA tokenization expand with the influence of regulatory developments, the role of DeFi integration, and institutional adoption.

Commercial players and investors wishing to give tokenized RWAs a try will improve asset liquidity, enhance financial accessibility, and partake in the digital finance of the future. With the new decentralized asset ecosystem being orchestrated by blockchain, traditional asset markets are to witness a complete reconstruction of global investment strategies.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.