The Smart Business Owner’s Guide to CPA Outsourcing Services

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Why Outsourcing Your Accounting Makes Financial Sense

Every successful business reaches a critical juncture—when managing finances in-house becomes more costly than beneficial. Whether you're a startup, a growing mid-sized company, or an established enterprise, CPA outsourcing services offer a smarter way to handle accounting while freeing you to focus on what truly matters—growing your business.

This guide explores the benefits, key services, and how to choose the right provider—so you can make an informed decision for your company’s financial future.

The Top Benefits of CPA Outsourcing

1. Significant Cost Savings

Hiring a full-time, in-house CPA can cost between 70,000to150,000 per year (plus benefits, payroll taxes, and software expenses). Outsourcing allows you to:

✔ Pay only for the services you need

✔ Avoid employee-related expenses (health insurance, retirement plans, etc.)

✔ Access high-level expertise without the full-time price tag

2. Expertise You Can Rely On

Tax laws, compliance requirements, and financial regulations change frequently. A professional CPA outsourcing firm stays updated on:

✔ Federal, state, and local tax codes

✔ Industry-specific accounting standards

✔ Best practices for financial reporting and audits

3. Scalability for Business Growth

Whether you're experiencing seasonal spikes or rapid expansion, outsourced accounting grows with you. Need more support during tax season? No problem. Scaling back in slower months? Easily adjusted.

4. Advanced Technology & Security

Top-tier outsourcing firms use:

✔ Cloud-based accounting software (QuickBooks Online, Xero)

✔ Secure, encrypted data storage

✔ Automated workflows to reduce human error

5. More Time to Focus on Your Business

Instead of struggling with spreadsheets or tax filings, you can invest your energy in strategy, sales, and customer satisfaction.

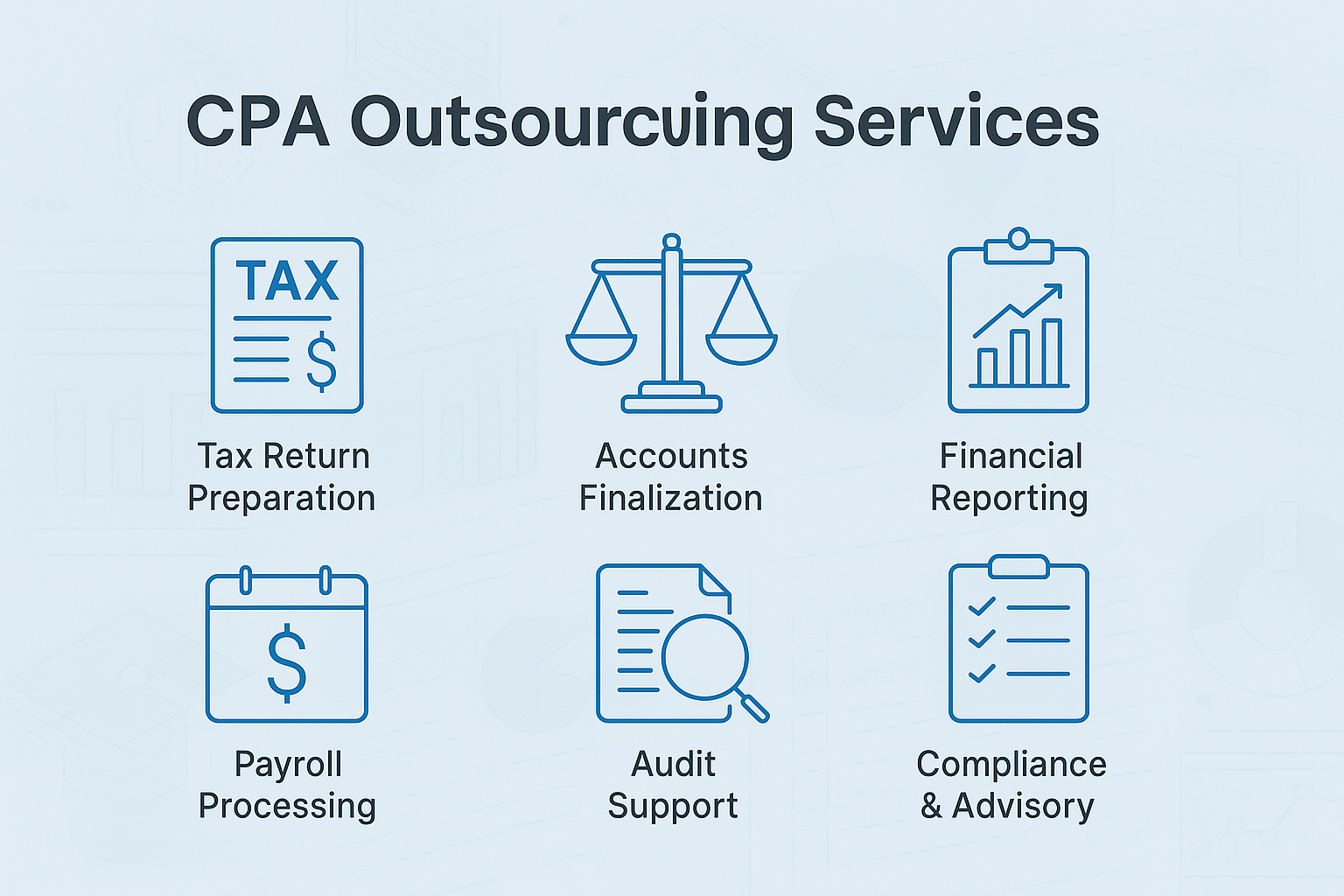

Key CPA Outsourcing Services for Businesses

1. Tax Preparation & Planning

✔ Federal and state tax filing

✔ Tax strategy to maximize deductions

✔ IRS audit support

2. Bookkeeping & Financial Reporting

✔ Daily transaction tracking

✔ Monthly financial statements

✔ Cash flow analysis

3. Payroll Processing

✔ Employee payroll & tax withholdings

✔ Contractor payments (1099s)

✔ Compliance with labor laws

4. CFO & Advisory Services

✔ Financial forecasting

✔ Budgeting & cost control

✔ Business growth strategy

How to Choose the Right CPA Outsourcing Provider

Not all accounting firms are the same. Here’s what to look for:

✅ Industry Experience – Do they understand your business niche?

✅ Transparent Pricing – Avoid hidden fees with clear, flat-rate pricing.

✅ Technology & Security – Cloud-based tools and data protection are a must.

✅ Client Reviews & References – Check testimonials and case studies.

✅ Communication Style – Will they be responsive to your needs?

Common Myths About CPA Outsourcing

❌ Myth: "Only big companies need outsourced accounting."

✅ Truth: Small and mid-sized businesses benefit the most—saving time and money while improving accuracy.

❌ Myth: "I’ll lose control over my finances."

✅ Truth: You maintain full visibility—outsourcing simply handles the heavy lifting.

❌ Myth: "It’s too expensive."

✅ Truth: It’s often cheaper than hiring in-house staff when you factor in salaries, benefits, and software costs.

Is CPA Outsourcing Right for Your Business?

Ask yourself:

✔ Are you spending too much time on accounting instead of growth?

✔ Are you confident you’re maximizing tax savings?

✔ Could your business benefit from professional financial insights?

If you answered yes, outsourcing could be your competitive advantage.

Next Steps:

Identify your biggest accounting pain points (taxes, payroll, reporting).

Research 2-3 reputable CPA outsourcing firms.

Schedule consultations to compare services and pricing.

Final Thought:

Outsourcing your accounting isn’t about giving up control—it’s about gaining expertise, efficiency, and peace of mind. The right CPA partner doesn’t just crunch numbers—they help you build a stronger financial future.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.