Top Risks in Investment Portfolio Management and How Software Mitigates Them

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today’s fast-paced and volatile financial markets, managing an investment portfolio is more complex than ever. Gone are the days when spreadsheets and instinct could guide asset allocation and risk decisions. Today, portfolio managers must navigate a landscape filled with economic uncertainty, regulatory pressure, and data overload.

In this article, we’ll explore the top risks in investment portfolio management and how modern portfolio management software plays a critical role in mitigating those risks, empowering firms to make faster, smarter, and more secure decisions.

Understanding the Core Risks in Investment Portfolio Management

Whether you're a wealth manager, institutional investor, or fund administrator, you're bound to face a variety of risks. Let’s break them down.

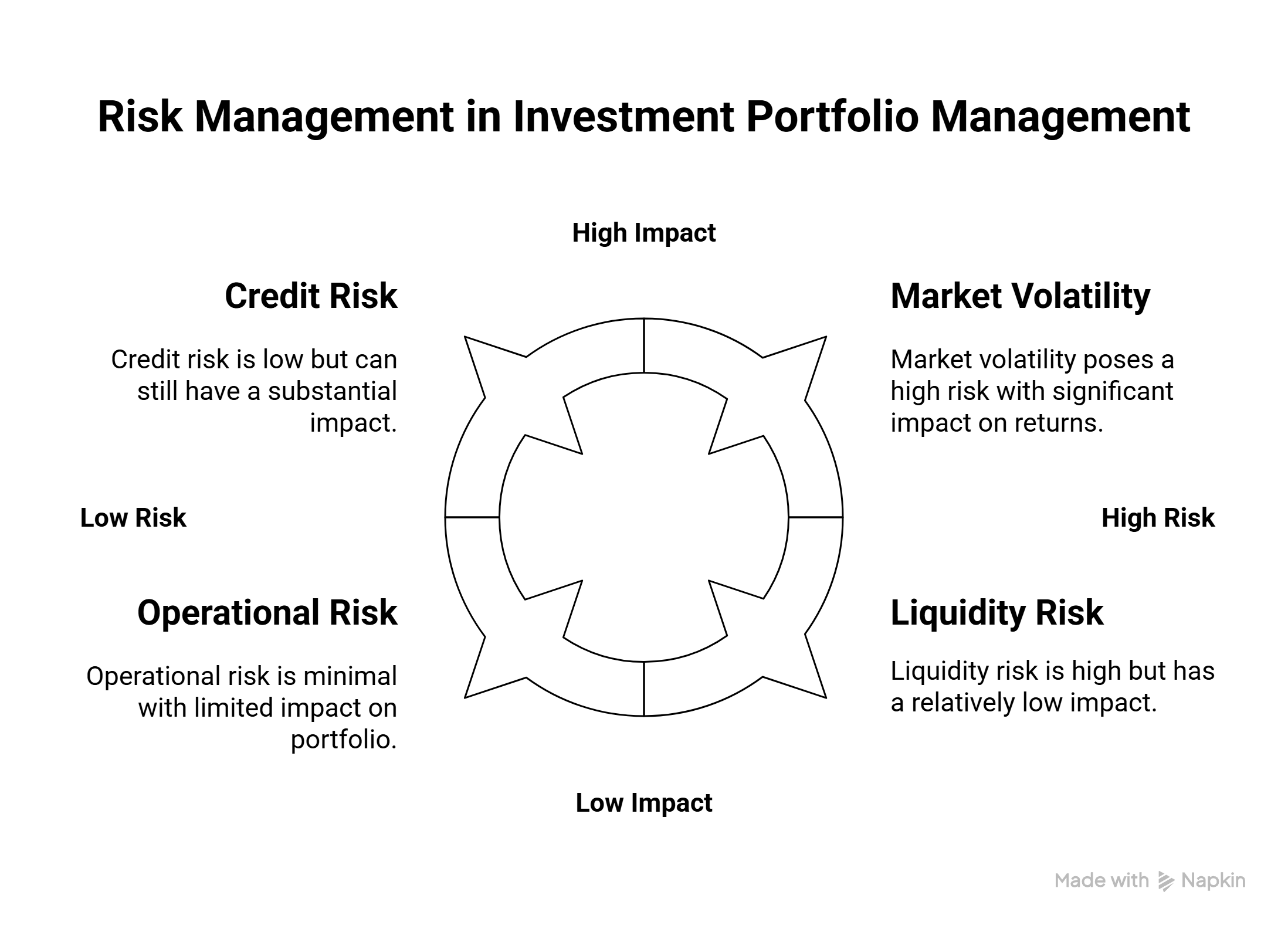

1. Market Risk

This is the most well-known form of risk, stemming from volatility in equity prices, interest rates, currency fluctuations, and other macroeconomic factors. A sudden geopolitical event or shift in central bank policy can drastically affect portfolio returns.

Software mitigation:

- Real-time market feeds and dashboards

- Predictive analytics and trend forecasting

- Automated risk alerts when asset values fluctuate beyond thresholds

2. Liquidity Risk

Liquidity risk occurs when assets can't be sold quickly without incurring a significant loss. This often affects private equity, real estate investments, or complex derivatives.

Software mitigation:

- Liquidity scoring models built into portfolio tools

- Scenario analysis for asset exit strategies

-

Visibility into market depth and trade execution timelines

3. Concentration Risk

Portfolios overly weighted in one sector, geography, or asset class are vulnerable. Diversification is the classic remedy, but it is easier said than done without the right tools.

Software mitigation:

- Automated portfolio rebalancing

- Exposure heat maps across all asset categories

- Portfolio simulation tools for diversification optimization

4. Operational Risk

This includes internal failures like manual data entry errors, system outages, or lack of audit trails. As portfolios grow, so does the room for human error.

Software mitigation:

- Centralized, cloud-based data management

- Workflow automation and process logging

- Role-based permissions and version control

5. Compliance Risk

Regulatory environments are growing more complex, especially for cross-border investments. Missing a reporting deadline or misclassifying an asset can result in fines or worse.

Software mitigation:

- Built-in compliance checks for regional and global regulations

- Automatic generation of reports in required formats

- Custom alerts for policy breaches or deadlines

6. Behavioral Risk

Even experienced managers fall prey to emotional decisions, fear-driven selling, confirmation bias, or overconfidence. These decisions can erode returns over time.

Software mitigation:

- Data-driven decision models powered by AI

- Backtesting strategies against historical data

- Automated investment rules to remove personal bias

The Power of Software in Modern Portfolio Risk Management

The role of technology in financial services has shifted from supportive to mission-critical. Portfolio management software doesn't just help track assets actively protects portfolios from common risks.

Key Benefits Include:

- 🔍 Real-Time Insights: See what’s happening across all accounts and asset classes instantly

- 📊 Data-Driven Decisions: AI and analytics replace gut-feel with hard evidence

- 🔄 Process Automation: Reduce human error, free up analyst time

- ✅ Audit & Compliance-Ready: Be prepared for regulatory checks with full transparency

- 🧠 Scalability: Manage thousands of accounts or billions in assets with ease

Final Thoughts

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.