Conversion-Focused Landing Pages – More Leads, Less Bounce!

Conversion-Focused Landing Pages – More Leads, Less Bounce!

Trade Finance Market Size, Growth, Demand, Key Players & Forecast Analysis 2024-2032

Written by Business News » Updated on: June 17th, 2025 163 views

Summary:

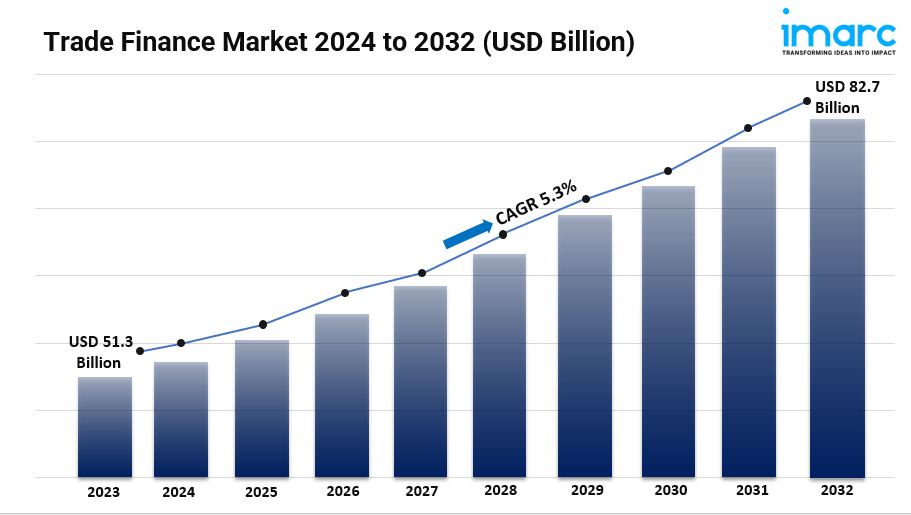

- The global trade finance market size reached USD 51.3 Billion in 2023.

- The market is expected to reach USD 82.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

- North America leads the market, accounting for the largest trade finance market share due to its well-established trade infrastructure.

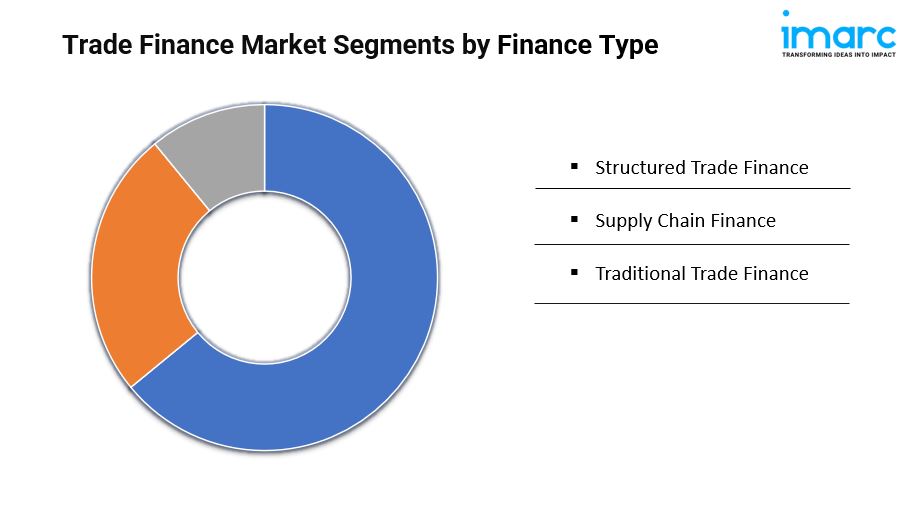

- Supply chain finance accounts for the majority of the market share in the finance type segment due to its ability to optimize cash flow.

- Letters of credit holds the largest share in the trade finance industry as they provide a secure payment method.

- Banks remain a dominant segment in the market as they are traditionally trusted institutions with established infrastructure.

- Large enterprises represent the leading application segment because they engage in high-value international trade transactions.

- The rapid globalization of trade activities is a primary driver of the trade finance market.

- Ongoing digitalization and fintech innovations are further reshaping the trade finance market.

Request to Get the Sample Report: https://www.imarcgroup.com/trade-finance-market/requestsample

Industry Trends and Drivers:

Globalization of Trade:

The trade finance market is significantly influenced by the ongoing globalization of trade. As nations become more integrated into global supply chains, the volume of international trade is expanding, creating a growing need for financial solutions to facilitate cross-border transactions. Trade finance instruments, such as letters of credit, guarantees, and trade credit insurance, provide the necessary financial backing for companies engaging in international trade, mitigating the risks associated with delays, non-payment, or fluctuating exchange rates.

Businesses, particularly small and medium-sized enterprises (SMEs), often face barriers such as lack of trust between trading partners, especially in unfamiliar markets. Trade finance helps address these challenges by offering secure payment mechanisms and risk mitigation tools, enabling companies to engage confidently in global markets.

Digitalization and Fintech Innovations:

Digitalization is revolutionizing the trade finance market by streamlining traditional processes and introducing greater transparency, security, and efficiency. Financial technology (fintech) innovations, including blockchain, artificial intelligence (AI), and automated platforms, are simplifying documentation, reducing manual interventions, and cutting down on transaction time and costs.

Blockchain, in particular, is gaining traction for its ability to secure transaction data and reduce fraud through immutable ledgers, while AI is being used to analyze trade patterns, credit risk, and market trends more effectively. These technologies are also enhancing trade finance by automating paperwork, making compliance and regulatory checks more seamless and reducing human error. This is especially important for SMEs, which often struggle with the complexity and cost of traditional trade finance processes.

Emerging Market Expansion:

Emerging markets are playing a pivotal role in the expansion of the trade finance market. Countries are experiencing rapid industrialization and trade growth, which is fueling the demand for sophisticated financial solutions. As these economies develop, they are becoming major players in global supply chains, both as exporters and importers of goods. However, businesses in these regions often face challenges such as lack of access to credit, political instability, and volatile currencies, which can make international trade riskier.

Trade finance services, including credit lines, factoring, and export credit insurance, provide the necessary support to mitigate these risks and ensure smooth transactions. By offering risk mitigation tools, trade finance enables companies in emerging markets to engage in international trade more confidently, promoting economic growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Trade Finance Market Report Segmentation:

Breakup By Finance Type:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Supply chain finance account for the majority of shares due to its ability to optimize cash flow and reduce financial risks across the entire supply chain.

Breakup By Offering:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Letter of credit dominates the market as they provide a secure payment method that mitigates the risks of non-payment and non-delivery in international trade.

Breakup By Service Provider:

- Banks

- Trade Finance Houses

Banks represents the majority of shares because they are traditionally trusted institutions with established infrastructure to facilitate trade finance solutions.

Breakup By End-User:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Large enterprises hold the majority of shares as they engage in high-value international trade transactions requiring sophisticated financial instruments.

Breakup By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America holds the leading position owing to its well-established trade infrastructure and a high volume of cross-border transactions.

Top Trade Finance Market Leaders: The trade finance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Asian Development Bank

- Banco Santander SA

- Bank of America Corp.

- BNP Paribas SA

- Citigroup Inc.

- Crédit Agricole Group

- Euler Hermes

- Goldman Sachs Group Inc.

- HSBC Holdings Plc

- JPMorgan Chase & Co.

- Mitsubishi Ufj Financial Group Inc.

- Morgan Stanley

- Royal Bank of Scotland

- Standard Chartered Bank

- Wells Fargo & Co.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.