Transform Finance Operations with AP & AR Automation Services

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today’s fast-paced business environment, financial leaders are under pressure to improve accuracy, reduce costs, and deliver real-time insights. To meet these expectations, many organizations are turning to automation technologies that streamline their finance functions. Among the most transformative innovations are AP automation services and accounts payable automation services, which play a pivotal role in eliminating repetitive manual tasks and enhancing operational agility.

IBN Technologies, a global automation service provider, is at the forefront of this revolution. With decades of experience and a robust presence in the USA, UK, and India, IBN delivers intelligent accounts payable (AP) and accounts receivable (AR) automation solutions that enable businesses to reduce processing errors, accelerate workflows, and improve cash flow visibility across their finance operations.

Why AP Automation Services Are Essential Today

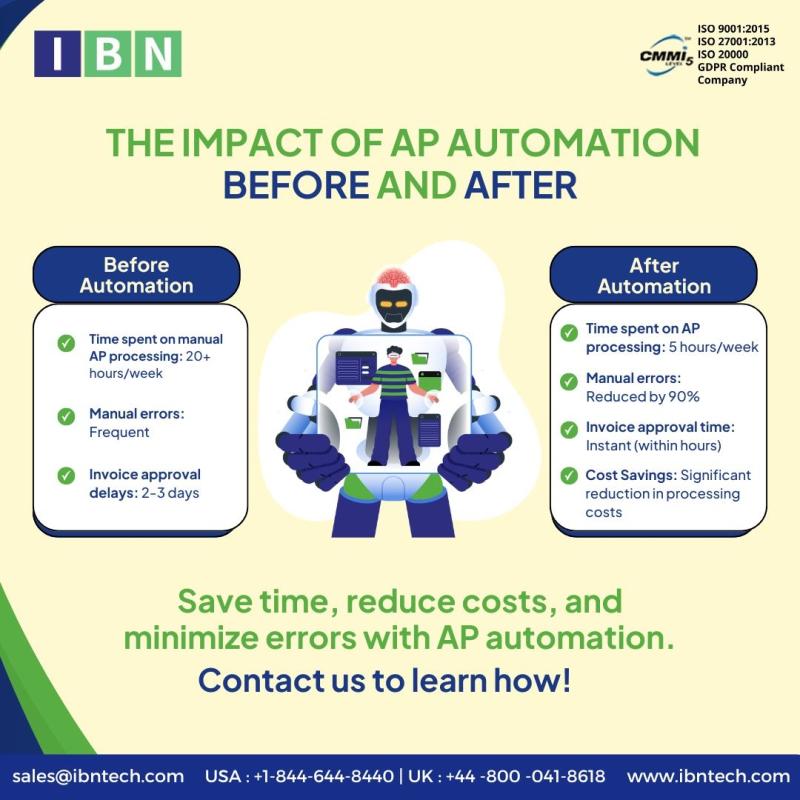

Manual processing of accounts payable not only consumes valuable resources but also introduces risks such as duplicate payments, missed deadlines, and inaccurate reporting. AP automation services address these challenges by digitizing the entire lifecycle of invoice processing, from capture to payment approval.

Key benefits of implementing AP automation include:

1. Faster invoice processing that reduces cycle times and improves vendor satisfaction.

2. Improved data accuracy by minimizing human intervention and reducing entry errors.

3. Greater visibility into accounts payable liabilities, supporting better cash flow planning.

4. Stronger supplier relationships due to timely and accurate payments.

As a reliable AP automation provider, IBN Technologies helps businesses in markets like the USA and UK streamline AP workflows using intelligent automation tools. These tools integrate seamlessly with existing ERP systems and empower finance teams to focus on value-added tasks instead of routine operations.

Key Features of Accounts Payable Automation Services

Accounts payable automation services extend beyond just digitization they introduce smart workflow automation, analytics, and rule-based processes to optimize finance departments. These services help standardize invoice formats, enforce business rules, and maintain a consistent process flow.

Notable features include:

1. Automated invoice capture and validation using OCR and AI for high accuracy.

2. Rule-based routing and approval workflows to ensure compliance and faster approvals.

3. Seamless ERP integration, enabling real-time syncing of financial data.

4. Real-time audit trails and compliance tracking to meet regulatory and internal control requirements.

These capabilities are particularly valuable for organizations in diverse geographic markets like India, the UK, and the US, where regulatory requirements and vendor expectations can vary significantly. IBN Technologies’ scalable automation solutions are tailored to meet these needs, delivering transparency, traceability, and control.

Accounts Receivable Automation: Accelerating Cash Flow

Effectively managing outgoing payments is essential; however, enhancing incoming payments via accounts receivable automation is just as important. AR automation simplifies and speeds up the collection process, reducing delays and freeing up working capital.

With IBN Technologies’ AR automation solutions, businesses can:

1. Send automated invoices and follow-up reminders to clients at optimal times.

2. Track payment statuses in real time, improving forecasting and decision-making.

3. Generate aging reports and insights that help identify collection trends and risks.

4. Integrate AR tools with CRM systems, ensuring sales and finance teams work in sync.

By automating both AP and AR functions, companies create an end-to-end financial ecosystem that ensures cash inflow and outflow are optimized for maximum efficiency.

Why Choose IBN Technologies?

IBN Technologies is a trusted name in financial process automation with over 20 years of experience serving global clients. With operations across the USA, UK, and India, IBN brings global insights and local expertise to every project.

What sets IBN apart?

1. Customizable automation frameworks that align with each client’s business structure.

2. Secure, cloud-based platforms that ensure data integrity and compliance.

3. 24/7 process monitoring and support, ensuring consistent performance.

4. Industry best practices, honed through experience across industries like banking, retail, healthcare, and manufacturing.

Whether your business needs a full-scale AP/AR transformation or a gradual automation rollout, IBN Technologies offers flexible engagement models to meet specific organizational goals without disrupting existing operations.

Conclusion

As businesses navigate increasingly complex financial landscapes, the need for intelligent automation has never been more urgent. Investing in accounts payable automation, accounts receivable automation, and comprehensive AP automation services offers a strategic advantage by boosting accuracy, reducing costs, and improving working capital. Partnering with a seasoned AP automation provider like IBN Technologies equips businesses in the USA, UK, and India with scalable, intelligent solutions that not only solve current challenges but also future-proof finance operations. Embrace automation today to drive sustainable financial performance tomorrow.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.