Transforming Real Estate with Blockchain: Top Tokenization Companies to Watch

Introduction

As for the real estate industry, one of the old-guard traditional investments, at the moment of writing this blog it is under a radical tech revolution posted by blockchain technology and tokens. Core to real estate tokenization is the transfer of ownership rights concerning a specific real estate asset or a pool of assets, to a digital token issued on a blockchain that collectively allows for partial ownership of said asset(s). This, in itself, is the transformation and revolutionizing way in the whole real estate transaction and investment scenario, with improved transparency, ease of accessibility, and, above all, better efficiency.

✍️ For entrepreneurs and developers, blockchain is a goldmine of opportunities. Explore our blockchain business guide to see how you can leverage it for innovation.

Leading the revolution are the real estate tokenization firms, the first of their kind which intend to change the ways of property ownership through implementing blockchain technology. This bridges traditional real estate markets and the new world of decentralized finance. Through smart contracts, DeFi provides global exposure to previously unreachable properties, lower transaction costs, and safe ownership records.

Benefits of Real Estate Tokenization Companies

Through a slew of benefits offered to investors, property owners, and the broader industry, real estate tokenization companies are pointing the way in the property market. Chief among most benefits is access higher as tokenization does fractional ownership, meaning several investors can fund their money into expensive properties with relatively little capital. It democratizes real estate investment by bringing in a broader range of investors. Transparency and security are elevated as transactions are recorded on immutable leases, thus reducing the chances of fraud and increasing trust.

The traditional real estate market would dampen the market's liquidity. Tokenizing allows the buying and selling of digital tokens on exchanges. In addition, these firms utilize smart contracts to pull off an easier real estate transaction with fewer intermediaries in the way. Connecting the nontraditional with the unique makes the tokenization companies a major player in guiding the reinvention of property investments.

Top 7 Tokenization Companies to Watch Out for in 2025

In-vein with their proclivity toward the adoption of blockchain technology, the sphere of real estate will enter the year 2025 with a few companies at the helm of this wave of tokenization. The following are some of the more notable ones.

BlockchainX

BlockchainX is a high-profile digital tokenization service provider for real estate, with end-to-end solutions from compliant and secure smart contracts. Their open and scalable tokenization platform accommodates various asset classes: residential, commercial, and luxury real estate. BlockchainX is chosen because it guarantees legal compliance and market gains in real estate tokenization.

Brickken

A Barcelona startup Brickken is focused on real-world asset tokenization, such as real estate. Managed a seed round with ~$2.5M in January 2025, at a valuation in the range of $22.5 million. The funds are targeted to develop its presence in the European market and expand to North America and Asia. Since March 2023, Brickken has built over $250 million in tokenized assets.

OpenBrick

Barcelona startup Brickken specializes in the tokenization of real-world assets. A seed round in January 2025 raised $2.5 million, valuing the company at about $22.5 million. The funds are targeted to develop its presence in the European market and expand to North America and Asia. Since March 2023, Brickken has built over $250 million in tokenized assets.

Mantra

Blockchain-based MANTRA, an asset platform, partnered with DAMAC Group, a Dubai developer, in January 2025, to tokenize one billion dollars worth of assets in the Middle East. The collaboration is aimed at turning ownership rights into digital tokens and enhancing offerings by realizing Middle Eastern assets on the MANTRA chain. Instead, early this year.

RealT

RealT is a U.S. platform that enacts investors' purchase of fractional shares of income-generating residential or commercial properties. The investors will receive rental income in digital currencies, thus giving global access to real estate funds with minimal capital investment.

Propy

Propy provided blockchain-based solutions to speed up transactions in the real estate industry, establishing a compliant and transparent platform for tokenizing real estate assets. Their solutions enable processes to be automated from listing to final settlement aligned with a range of local and international regulations simplifying transactions and providing higher efficiency.

SolidBlock

SolidBlock converts real estate assets into tradable digital securities secured by physical assets. This way, property owners and developers can raise funds, while offering increased liquidity over traditionally illiquid assets. SolidBlock specializes in structuring and launching tokenized assets in enormous commercial and luxurious real estate projects.

Role of Blockchain in Real Estate Tokenization Companies

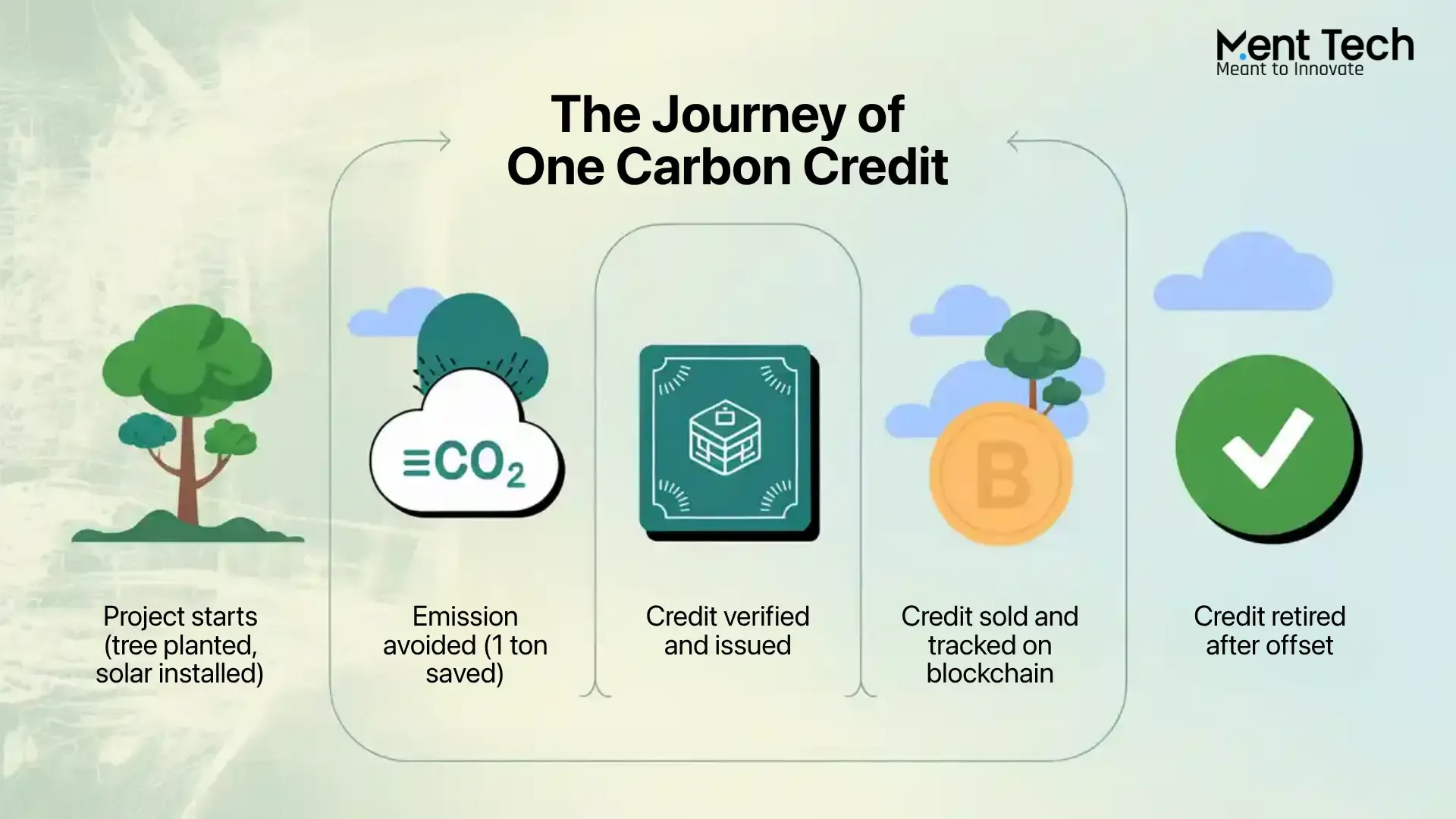

Blockchain technology has chosen to furnish the technological backbone of real estate tokenization companies, ensuring security, transparency, and efficient property transactions. Fundamentally, blockchains secure ownership records and transaction details in an unalterable manner, cutting back on any chance of fraud and disputes.

Smart contracts (a core function of blockchain) take off from here by administrating processes related to payment distribution, property transfers, and compliance checks, which prevent most intermediaries and cause the end transaction costs to be substantially diminished. Also, blockchain enables fractional ownership wherein investors can buy smaller stakes in high-value properties giving them access to increased participation in real estate.

The decentralized feature of blockchain also allows cross-border flows of investments, allowing for the real estate market to be globally accessible along the lines of information transfer without the strains of traditional international transactions. This enables real estate tokenization companies that leverage blockchain technology to change the property buying and managing landscape in a more interoperable, efficient way of running the real estate ecosystem.

Investment Opportunities in Real Estate Tokenization Companies

Thanks to the real estate tokenization companies, investors both private and institutional can now access the market via fractional ownership. As such, small investors can acquire smaller shares of properties, making for an easier entry into what has been thus far a highly capital-intensive market. Such a new era in real property investment permits an extensive spread of diversified portfolios by investment spread from one location to another extending between different types of properties.

With such an emergence, liquidity is further enhanced by trading these assets within secondary markets, which traditional property markets do not have. Additionally, companies are increasingly trying to create more types of token assets, and as time goes on, they will develop into shares of regulated security tokens, making them compliant with the standards, regulations, or whatever other acts may exist in their investor hinterland.

This potentially means a more secure environment for the investment. However, the reduced charges associated with both initial and ongoing costs as well as greater trading flexibility are good signs. Therefore, from the investment perspective, it creates an ideal opportunity for low-cost capital access and more flexible trading. Nevertheless, barriers include regulation, uncertainty, and the volatility of investment markets.

Real Estate Tokenization Companies in Future Technology

Real estate tokenization companies seem to assume a highly influential role in the future of technology and investments. By applying blockchain technology, such companies are reaching out to change the ordinarily illiquid and involved real estate into an approachable, transparent, and efficient sphere. In turn, tokenization enables properties to be tokenized as digital tokens so fraction ownership can happen broadening the circle of investors that can access real state markets with lower capital requirements to a diverse group of investors.

As mentioned, these companies will more likely incorporate further advancements such as artificial intelligence and smart contracts to streamline property transactions, and other opportunities to do due diligence for assets management. Lastly, amidst the off growth of DeFi, real estate tokenization companies will most likely edge the way in linking real-world assets to digital finance platforms, thereby making way for global investment and innovation opportunities in prop-tech.

Conclusion

To conclude, real estate tokenization companies not only change our perspective on property ownership but are also actually changing the dynamic of the entire investment landscape. Blockchain technology is used to offer greater real estate market liquidity, equity, and transparency that investors at every level can tap into by owning fractional stakes in high-valued assets.

While hurdles like regulation and market penetration, the result of where democratization in real estate investment, and beyond that it's getting transformed is truly mind-blowing. These companies will, no doubt, innovate and solve problems which ensures they play a huge role in shaping property investment tomorrow by making it inclusive, sleek &digitally integrated.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.