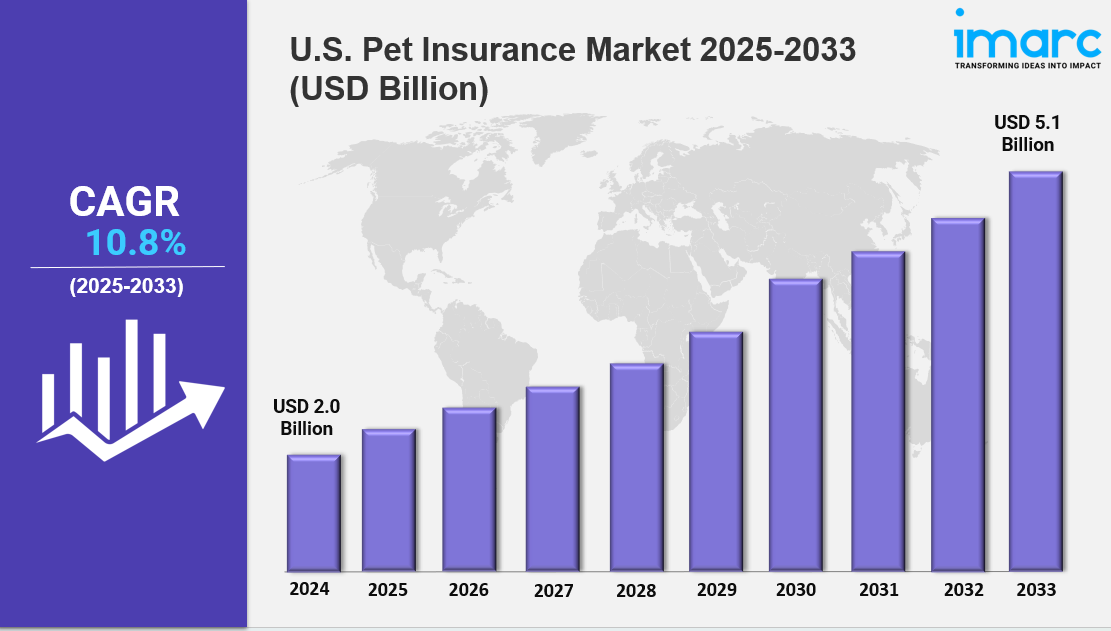

U.S. Pet Insurance Market Size, Share, Trends, and Growth Opportunities 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

The U.S. pet insurance market size was valued at USD 2.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.1 Billion by 2033, exhibiting a CAGR of 10.8% from 2025-2033. The market is growing due to rising veterinary costs, increased pet ownership, and the humanization of pets. Growth is driven by customizable plans, digital enrollment platforms, and wellness integrations, making the industry more accessible and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising pet ownership and increasing veterinary care costs

✔️ Growing awareness of pet health and wellness boosting insurance adoption

✔️ Expanding offerings with customizable, multi-pet, and wellness coverage plans from insurers

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-pet-insurance-market/requestsample

U.S. Pet Insurance Market Trends and Drivers:

The U.S. Pet Insurance Market is growing steadily as more pet owners seek comprehensive coverage that goes beyond emergency care. In 2024, the shift from basic accident-only plans to more inclusive policies—covering chronic conditions like arthritis, diabetes, and cancer—marked a major change in consumer behavior. Many pet insurance plans now include benefits for rehab, behavioral therapy, and even alternative treatments like acupuncture. As a result, average premiums rose to about $780 a year for dogs and $384 for cats. Innovations like genetic testing, offered by insurers such as Nationwide and Trupanion, have become a popular add-on, with nearly 30% of new customers opting in—driving up both early diagnoses and overall U.S. Pet Insurance Market Demand.

Employer-sponsored pet insurance is also becoming more common. By 2024, nearly two-thirds of Fortune 500 companies had added pet coverage to their employee benefits packages. Major employers like Amazon and Starbucks reported high participation, with some seeing enrollment rates close to 90%. Meanwhile, rising vet bills—up nearly 20% in just one year—have led insurers to adopt flexible pricing models. Companies like Lemonade now adjust premiums based on local veterinary rates, helping them stay competitive and meet changing U.S. Pet Insurance Market Trends.

Technology is playing a big role in how the market is evolving. Wearable pet devices are gaining traction, allowing providers to offer discounts to owners of active, healthier pets. Brands like Healthy Paws and FitBark are tapping into this data to encourage wellness. Others, like Petplan, are linking directly to vet health records to offer customized plans. Mobile apps now handle over 70% of all claims, cutting reimbursement wait times from weeks to just a few days. Some insurers are even testing blockchain to speed up the process and lower admin costs.

Privacy concerns over genetic data made headlines in 2024, prompting insurers to tighten their data security practices. Companies like Embark Veterinary responded by implementing encryption and stronger controls. Regulators also stepped in—more than 30 states adopted a standardized policy format to make pet insurance terms clearer and easier for consumers to understand. These actions have helped boost consumer confidence and added stability to the U.S. Pet Insurance Market.

Looking ahead, the U.S. Pet Insurance Market Size is projected to surpass $24 billion by 2028. Big retail players are jumping in—Walmart partnered with Spot to offer insurance options directly during vet visits and adoption events, bringing in thousands of new policyholders. Gen Z is driving much of the growth, now accounting for over half of new signups, particularly drawn to low-cost, app-based options like Pets Best’s $9.99 accident-only plans.

Rural adoption is rising too. A Farm Bureau initiative bundling pet insurance with farm policies led to a 60% boost in coverage across underserved communities. Market consolidation is reshaping the competitive landscape—Allstate’s $2.7 billion acquisition of Fetch created the largest digital pet insurance platform in the U.S. And with climate-related risks growing, some insurers are introducing coverage for issues like heatstroke and wildfire evacuations, particularly in southern and western states.

With new products, better technology, and wider employer involvement, the U.S. Pet Insurance Market Growth is expected to continue its upward trajectory. Flexible pricing and more diverse policy options are helping pet insurance reach a broader range of households, setting the stage for even stronger momentum in 2025 and beyond.

U.S. Pet Insurance Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

- Base Year: 2024

- Historical Year: 2019-2024

- Forecast Year: 2025-2033

Analysis by Policy:

- Illnesses and Accidents

- Chronic Conditions

- Others

Analysis by Animal:

- Dog

- Cat

- Others

Analysis by Provider:

- Public

- Private

Regional Analysis:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.