UAE Residential Real Estate Market Share, Trends, Size, Growth, Analysis, Report 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

UAE Residential Real Estate Market Overview:

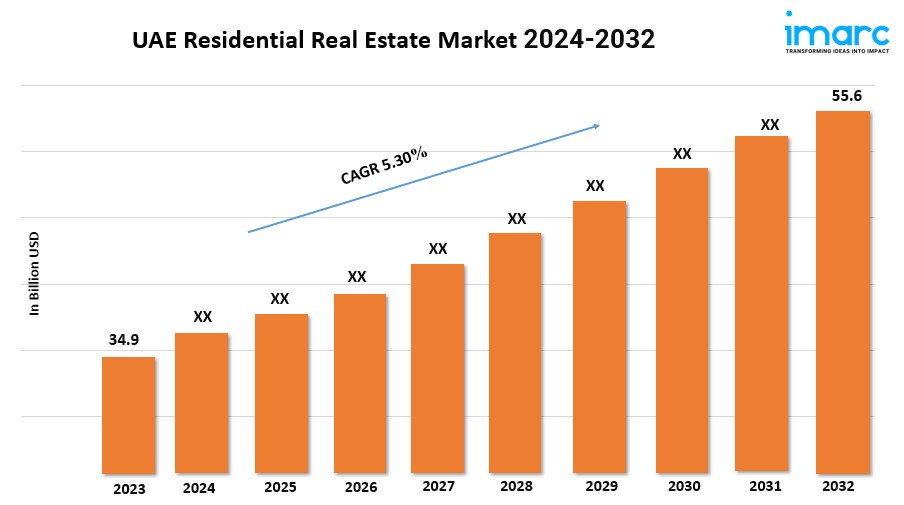

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 34.9 Billion

Market Size in 2032: USD 55.6 Billion

Market Growth Rate (CAGR) 2024-2032: 5.30%

According to IMARC Group's report titled "UAE Residential Real Estate Market Report and Forecast 2024-2032," the market reached USD 34.9 billion in 2023. Looking forward, IMARC Group expects the market to reach USD 55.6 billion by 2032, exhibiting a growth rate (CAGR) of 5.30% during 2024-2032.

UAE Residential Real Estate Market Trends and Drivers:

The UAE residential property market is booming, largely due to high urban population growth and a major focus by the government towards infrastructure investment. The residential property market has expanded, considering the settlement of foreign people and the expansion of industries within major metropolitan areas, such as Abu-Dhabi and Dubai. Foreigners have also been able to invest in the real estate market as a result of the long-term residency visas aimed at investors and the Golden Visa program initiated by the government. In addition, the influx of tourists coupled with economic diversification activities, especially into the tech and finance sectors, is increasing the demand for housing, particularly in the cities/semi-urban regions.

A developing trend in the UAE residential real estate market is the increasing inclination towards sustainable and smart houses as a result of increased energy efficiency and the environment. These trends have influenced developers to include green building designs, smart technology features and unique designs that suit green buyers and those who are looking for modern homes. In addition, social changes brought about newly adopted changes in work patterns due to the pandemics, such as the mode of working from home have increased the need for bigger homes or outdoor space properties. The high end housing market and affordable market are also expanding and therefore the future of the UAE residential real estate market is set to continue performing well due to increasing creativity and positive policies.

UAE Residential Real Estate Industry Segmentation:

Our comprehensive UAE residential property market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

Type Insights:

- Condominiums and Apartments

- Villas and Landed Houses

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.